Photo: Daily Messenger

Bangabandhu Sheikh Mujibur Rahman, before independence, had 40 shares in the Eastern Banking Corporation (now Uttara Bank). Later, the number of shares stood at 200. Now the number of shares stands at 1,47,000 after receiving the dividends.

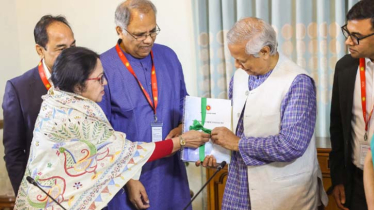

On Tuesday, the ownership of these shares was transferred to the successors of Bangabandhu Sheikh Mujibur Rahman, i.e. Prime Ministers Sheikh Hasina and her younger sister Sheikh Rehana.

According to the sources in Bangladesh Securities and Exchange Commission (BSEC), the BO accounts were opened in Uttara Bank Securities in the name of both the sisters. Now the shares have been deposited in those accounts.

In this regard, Professor Shibli Rubaiyat Ul Islam, Chairman of the BSEC told The Daily Messenger, “Forty shares of Uttara Bank of the father of the nation have been handed over to his worthy successors along with dividends. We are relieved of the liability by handing over the ownership of the shares.”

It has been known that PM Sheikh Hasina always keeps updated information about the capital market of Bangladesh. She also has precedents of giving various directions for the development of the capital market at different times.

The ruling Awami League government, led by Sheikh Hasina, has been working for the past decade and a half to raise the country's capital market to international standards. In the meantime, the BSEC, the capital market regulatory body, has organised various roadshows in different countries of the world.

Through this, investors from various countries including Europe, America, Middle East have started investing in the capital market of Bangladesh, according to BSEC sources. Besides, many more foreign investors are waiting to invest in the capital market. Their investment can be added to the capital market of the country at any time.

Earlier, in her speech as the chief guest at the Bangladesh Trade and Business Summit jointly organised by the BSEC and the Bangladesh Investment Development Authority (BIDA) at the Radisson Blu Hotel and Convention Center in Johannesburg, South Africa on August 23, PM Sheikh Hasina said the BSEC is promoting the capital market for necessary long-term financing.

Sheikh Hasina at that time said, “We have expanded our bond market for financial progress. Simultaneously, we launched Sukuk, Green Bond, ETF, Venture Capital, Private Equity and Impact Fund. Soon, we are going to include non-fundamental products in our capital market, which will help reduce investment risk through risk management.”

Messenger/Rony/Alamin