Photo : collected

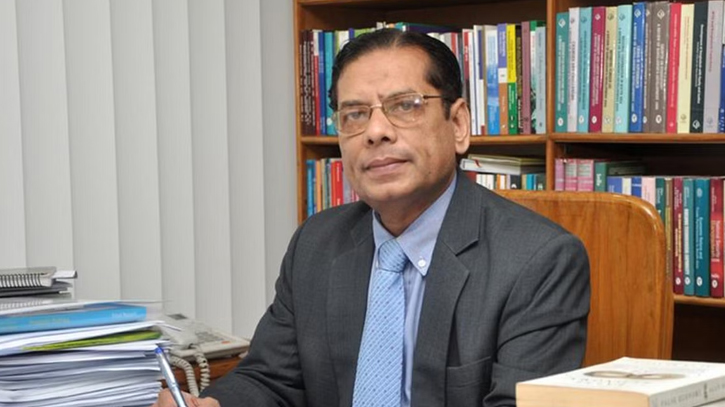

Distinguished fellow of the Centre for Policy Dialogue (CPD) Professor Dr. Mustafizur Rahman has said that the government and Anti-Corruption Commission (ACC) should investigate how the assets of MPs have increased manifold.

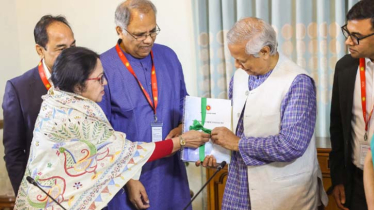

He said this at a view exchange meeting on the contemporary economic situation of Bangladesh organized by the Economic Reporters Forum (ERF) at Paltan in the capital Tuesday (26 December).

The CPD fellow said, I was surprised to see the rate of increase in wealth in the affidavits of the candidates in the 12th parliament elections. Where a plot of land costs Tk 1.0 crore; shown taka one lakh.

Even then, wealth increases hundreds of times, then what is the real picture? Seeing this, it is not clear how much wealth has actually increased, Prof Mustafiz raised question.

He said that in the affidavit of the candidates, the properties of many have increased hundreds of times. It is interesting to see how such a huge amount of wealth has grown in such a short time.

“Those properties have increased so much, the government and their party should ask to know the source of these properties. At the same time, the Anti-Corruption Commission (ACC) and the Bangladesh Financial Intelligence Unit (BFIU) should find the source of their assets,” said Prof Mustfiz.

He said that mismanagement of the banking sector, corruption, money laundering, everything is created by a 'dishonest cycle’.

He said that defaulted loans are increasing, and some banks have also fallen into disaster due to providing aggressive loans.

“It is Bangladesh Bank’s main responsibility to control this. They should be allowed to work independently either state or anyone can't interfere here, this must be ensured by the state,” he said.

“Now the issue of merger of financially weak banks has been mentioned many times before. For this, legal weaknesses and regulations need to be fixed. Because the banking sector is the blood of the economy. The problem of this sector falls on the whole economy,” he pointed out.

He said that a large amount of money has to be provisioned by the bank against default. This means that the money is not able to participate in the economy, it is lying in the bank.

“By this, the bank's ability to give loans is decreasing and the income is decreasing,” he added.

Dr. Mustafiz said that suppose banks are paying interest against a deposit of Tk100, but the bank is able to give a loan of Tk80 out of Tk100. That means the loan interest rate has to increase, this again affects investment.

Regarding US sanctions, he said, America imposes trade restrictions (sanctions) for their own benefit.

“If necessary, contracts with countries like Venezuela. Therefore, it should be emphasized that they do not get the opportunity to sanction without paying attention to whether they will sanction or not. We must ensure the wages and rights of our workers,” he suggested.

“The government has brought the garment industry to this level by providing various facilities. The world market of clothing is $700 billion. We have export potential. There is no other sector as big as this. Exports need to be diversified, go to new markets.”

There is still an opportunity to occupy a large part of this market, for that Bangladesh needs to modernize more.

He suggested emphasizing the export of the leather sector and pharmaceuticals. The global markets have a potential future for those products.

ERF’s general secretary Abul Kashem moderated the program while President Mohammad Refayet Ullah Mirdha presided over it.

Messenger/Disha