Photo : Collected

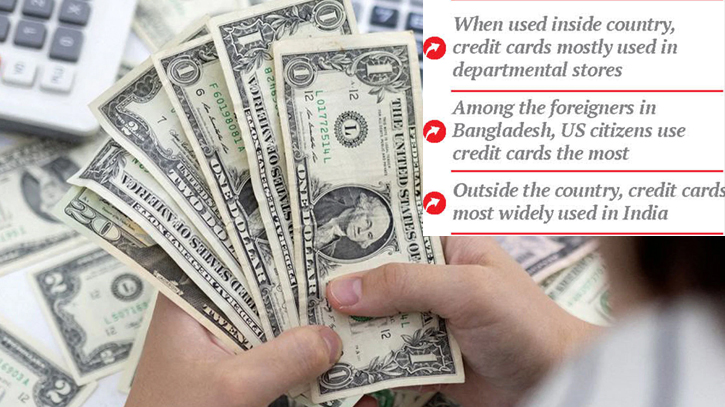

The utilisation of credit cards is steadily gaining popularity in the country, with a predominant trend being the payment of department store bills. According to the latest updated report from Bangladesh Bank, credit cards are not only widely used domestically but also find significant traction for purchases abroad, particularly in department stores.

The recent data from Bangladesh Bank indicates a decrease in the use of credit cards outside the country in November compared to the previous month of October. In November, transactions totaling Tk 487.40 crores were conducted using credit cards internationally, representing a 9.50 percent decrease from the previous month when expenditures on credit cards outside the country amounted to Tk 538.60 crore.

Simultaneously, it has been observed that Bangladeshis exhibit the highest usage of credit cards in India. In November, the credit card expenditures by Bangladeshis in India amounted to Tk 87.10 crore, constituting 17.87 percent of the total spending outside the country. However, when measured in taka, the spending propensity in India decreased compared to the preceding month of October. In October, Bangladeshis spent Tk 90.20 crore using credit cards in India.

The Statistics Department of Bangladesh Bank has gathered data from multiple commercial banks and financial institutions in the country, conducting an analysis of credit card transactions over a two-month period. This comprehensive review includes insights into the credit card usage patterns among both local and foreign nationals within the country.

As per the collected data, foreign nationals made purchases totaling Tk 193.80 crore using credit cards within the country in November. Among these transactions, credit cards belonging to US citizens were used the most, accounting for 24.74 percent of the total. The citizens of the United States spent Tk 48 crore during the specified month. Following closely, citizens of the United Kingdom ranked second, spending Tk 26.70 crore. Citizens of India secured the third position, with expenditures amounting to 19.10 crores.

An analysis of credit card usage reveals a predominant increase in transactions within department stores across the country. Nearly half of the total credit card transactions, accounting for 49.57 percent, occurred in departmental stores. Additional breakdowns of credit card usage include 13.12 percent for money withdrawals from outlets, 9.06 percent for utilities, 8.18 percent for cash withdrawals, 4.74 percent for clothing purchases, 5.15 percent for transactions in drugs and pharmacies, 3.33 percent for transportation, 2.11 percent for business services, and 3.20 percent for cash remittances.

Upon analysing the types of cards used in transactions, it is evident that a significant majority were conducted through Visa cards, constituting 72.69 percent of the total. Following closely is MasterCard, with transactions through this card amounting to 17.65 percent. The remaining 10.06 percent of transactions were carried out using other card types.

The analysis of cross-border transaction data for the country's credit card holders indicates that similar trends and needs are reflected both abroad and domestically. In November, approximately 28.08 percent of credit cards were utilised in department stores outside the country. Other sectors contributing to cross-border credit card transactions include 16.16 percent in money withdrawals, 11.50 percent in medicine and pharmacy purchases, 8.52 percent in clothing purchases, 7.46 percent in transportation, and 28.27 percent in various other sectors.

The analysis of country-wise data reveals that India has the highest percentage of credit cards used for transactions outside Bangladesh, accounting for 17.87 percent, equivalent to 87 crore taka. Other significant contributors to these cross-border transactions include the United States at 15.01 percent, the United Arab Emirates at 8.49 percent, Thailand at 8.28 percent, Singapore at 7.10 percent, Canada at 6.76 percent, the United Kingdom at 6.71 percent, Saudi Arabia at 4.82 percent, Malaysia at 3.62 percent, Australia at 2.51 percent, the Netherlands at 2.50 percent, Ireland at 2.46 percent, and a combined 13.86 percent from 162 other countries.

According to a managing director of a prominent private bank, there has been a recent surge in purchases from international e-commerce companies originating from the country. Speaking on the condition of anonymity, the managing director shared with The Daily Messenger, "Customers in the country are increasingly making purchases from renowned companies such as Amazon, Flipkart, eBay, and Alibaba. Bills from these organisations must be settled in dollars or euros, leading to a substantial amount of currency being sent abroad."

Experts are recommending heightened scrutiny and vigilance regarding the use of foreign currency. They emphasise the importance of being cautious and ensuring that foreign currency transactions are closely monitored to detect any potential misuse, particularly with regards to possible involvement in money laundering activities.

Zahid Hussain, the former chief economist of the World Bank's Dhaka office, has conveyed to The Daily Messenger, "Customers are acquiring credit cards through various channels, and banks are actively involved in providing them. Credit cards from various banks are readily accessible, leading customers to spend significantly abroad. This outflow of foreign currency is exacerbating the apparent dollar crisis. Moreover, individual customers are employing multiple bank cards. If the Central Bank does not maintain special vigilance over these matters, there is a high likelihood of increased susceptibility to money laundering."

Messenger/Disha