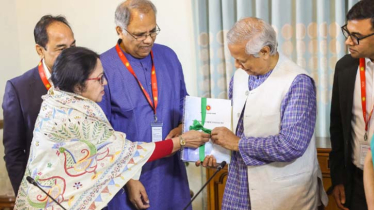

Photo: Courtesy

UCB Investment Limited (UCBIL), a subsidiary of United Commercial Bank PLC (UCB), has recently celebrated its fourth anniversary, reflecting on a journey marked by success and industry recognition. The celebration coincided with the company’s latest accolade: “Best Securities House” in Bangladesh for 2024, awarded by Euromoney, reinforcing UCBIL’s standing as a leader in Bangladesh's financial sector.

This prestigious award highlights UCBIL's prominence among merchant banks, stock brokerages, asset management firms, and other key capital market institutions in Bangladesh.

In addition to this recent award, UCBIL has won several accolades in the last four years, including recognition as the Best Investment Bank by both Euromoney and FinanceAsia in 2023 and 2024, and by Asiamoney in 2023. These awards cement UCBIL's position as a leader in investment banking in Bangladesh.

The fourth-anniversary celebrations took place at the UCB PLC’s headquarters on October 6, 2024. The event was attended by key figures, including Mohammad Mamdudur Rashid, Managing Director & CEO of UCB; Nabil Mustafizur Rahman, Additional Managing Director of UCB, and Tanzim Alamgir, Managing Director & CEO of UCB Investment Ltd., along with senior executives from both UCB, UCB Investment, UCB Stock Brokerage and UCB Asset Management.

Over the past four years, UCBIL has been committed to offering 360-degree investment banking services including bond issuances, IPOs, rights offerings, syndicated loan, corporate advisory and mergers and acquisitions. UCBIL's experienced team of professionals continues to deliver innovative and effective solutions to meet the needs of its clients.

As UCBIL celebrates this four-year milestone, it remains determined to pursue growth, expand its service offerings, and maintain its leadership position in the investment banking sector, while continuing its endeavours to support both the clients and the economy.

Messenger/Fameema