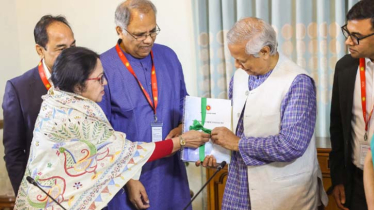

Photo: Collected

Indian power generation giant Adani falls in pressure from the global companies as Adani did not follow the conventional honest polity to have the jobs from international companies. Moreover, the company is alleged for applying tricky pros and cons in deals especially with weaker countries. Thus, a chance has been opened for Bangladesh to negate the deal which was criticized earlier.

Bangladesh has a deal with Adani for importing 1,600 MW of power that is alleged for high rate and capacity charge. Moreover, India's Adani Group owes Bangladesh more than $800 million in electricity supply. The Indian company has urged the current interim government to pay this amount quickly. However, it has also been stated that electricity supply from India will not be stopped due to the arrears.

S&P Global Ratings lowered its outlook on three Adani Group entities to 'negative' from 'stable' on Friday, citing risks to funding access following a U.S. indictment of the conglomerate's billionaire founder, Gautam Adani, on bribery charges, reports Reuters.

Adani and seven other people, including his nephew Sagar, were indicted on Thursday for fraud by U.S. prosecutors for their alleged roles in a $265 million scheme to bribe Indian officials to secure power-supply deals.

Adani Group has said the accusations levelled by U.S. federal prosecutors, as well as those by the U.S. Securities and Exchange Commission in a parallel civil case, are "baseless and denied" and that it will seek "all possible legal recourse." The U.S. indictment could affect investor confidence in other Adani Group entities, as the founder sits on the boards of other companies within the group, potentially impairing their access to funding and increasing funding costs, S&P said in a note.

Country’s Energy expert Prof Izaz Hossain told the Daily Messenger “As Adani is questioned for different issues, we currently can negotiate further about the deal with Bangladesh.”

Though he thinks the deal should not be cancelled, the government can negotiate about pros and cons which are much talked about among the experts. Economist Anu Muhammad thinks, as the deal was signed by the Awami Leage government to facilitate the Indian company leaving the interest of the country Bangladesh should scrap the agreement.

He said “The deal was signed in favour of India. This is not a win-win deal because of the lack of public interest in Bangladesh, now we can cancel the deal as Adani is under international pressure.”

A source in the Adani Group told the media that a request has been made to the interim government of Bangladesh to pay the arrears quickly. Bangladesh has been informed that the Adani Group is under pressure from donors to build the power plant. Adani's 1,600 MW Godda power plant built in Jharkhand has an agreement with the Bangladesh Power Development Board (BPDB). Adani Group has to pay Bangladesh $90 to $100 million every month for electricity supply.

All the electricity from the Godda power plant comes to Bangladesh. The power plant started generating electricity in June 2023 and they started supplying electricity to Bangladesh from that month. Gautam Adani had dismissed the allegations as baseless. This time too, the Adani group has made the same claim - they never break the rules in business.

However, the value of Gautam Adani's personal assets has decreased. Along with this, the bond issue of Adani Green Energy in the US market has been postponed. News Economic Times According to Forbes Magazine, Gautam Adani's asset value decreased by 12.4 billion or 1,240 crore dollars. However, later, as the share price increased slightly, the amount of decrease in asset value decreased slightly to 10.5 billion or 1,500 crore dollars.

At the time of writing, Gautam Adani was ranked 25th on Forbes magazine's list of the richest people. His net worth is $59.3 billion.

The seven people, including Gautam Adani, are accused of offering bribes worth around Rs 2,237 crore to Indian government officials to secure contracts for solar power projects. The allegations were made in a notice issued by the US Attorney's Office for the Eastern District of New York. The controversy has since erupted. It has also had a major impact on the Adani group's share price.

Gautam Adani's nephew Sagar Adani has also been named in the bribery case. The US administration has issued arrest warrants against Gautam and his nephew. The other accused include Adani Green Energy Limited CEO Vineet Jain, Ranjit Gupta, Rupesh Agarwal, Australian and French citizens Cyril Cabanes, Saurav Agarwal and Deepak Malhotra.

An Adani Group spokesperson told the media that the Adani Group will soon issue a statement on the allegations.

Messenger/Tareq