Photo: Messenger

Petrobangla, the state-owned company responsible for exploring gas and oil in the country and ensuring the supply of primary energy to power plants and industry, has decided to take a loan of $600 million to settle outstanding bills and import LNG.

Experts concerned over the costly liquefied natural gas (LNG) imports think that the high-cost LNG will exert more pressure on the entire economy if the government continues importing, while neglecting exploration.

Petrobangla, due to a dollar and financial crunch for importing a large amount of LNG, has had to borrow from lenders, including the Gas Development Fund (GDF) and LNG suppliers, an ongoing process.

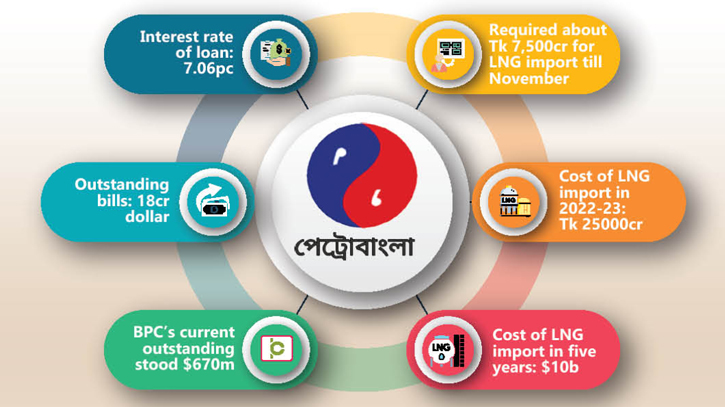

Petrobangla wants to secure a $500 million loan from ITFC with a 7.06 percent interest rate in a bid to pay current arrears and import LNG for the next six months.

Moreover, Petrobangla has decided to triple its LNG imports in the coming days – capping at 10.50 million tonnes per annum (MTPA) of LNG imports after 2026, and has signed an agreement for a $100 million loan from ITFC for these imports.

When asked, Zanendra Nath Sarker, the Chairman of Petrobangla, told The Daily Messenger, “As domestic gas is depleting rapidly, there is no option but to import LNG.”

He mentioned that Bangladesh signed a 15-year agreement with Qatar to import 1.8 million tonnes of LNG per year and another deal to import LNG from 0.25 to 1.5 million tonnes per annum from Oman over a 10-year period starting from 2026.

In addition, Petrobangla has $18 million in outstanding bills for purchasing oil and gas companies operating in the country, including the US-based giant Chevron’s $170 million.

Officials of Petrobangla said the cost of LNG imports in the 2022-23 financial year is Tk 25,000 crore.

LNG has been imported into the country since April 24, 2018, with 1,629 billion cubic feet of LNG imported in the last five years, spending more than $10 billion.

Energy expert and former member of Bangladesh Energy Regulatory Commission (BERC) Maqbul-E-Elahi Chowdhury told the Daily Messenger, “The Energy Division is spending a huge amount of money on importing LNG, which contributes little to the supply. A new and even more massive spending plan has been finalised. The energy sector is at financial risk. Again, for more than two decades, investment in local gas extraction and exploration was negligible.”

Experts believe that LNG imports are largely responsible for the ongoing crisis in gas supply management in the country. If this LNG dependence is not overcome, they fear that the danger level may increase in the coming days.

Already, the Energy Division requires about Tk 7,500 crore for the bills of LNG imports till November. The Ministry of Power, Energy, and Mineral Resources has already faced pressure with a Tk 30,000 crore outstanding subsidy, while the IMF has imposed a condition to withdraw subsidy support to the Power Division.

“Due to the global economic slowdown, the economy is already vulnerable. A huge amount of expensive LNG from an unstable market will create additional pressure on the economy of Bangladesh. The government should source primary energy from renewable and local gas fields. As local gas is depleting, the risk for the economy is getting higher,” Dr. Ahsan Monsur, Executive Director, Policy Research Institute (PRI), told the Daily Messenger.

Meanwhile, the bill for a cargo of LNG supplied by Gunvor Singapore Pte Ltd was due on June 20. The bill amounts to $41.55 million. Some $13 million has been disbursed so far, while $28.55 million is yet to be paid.

The deadline for payment of one cargo (Cargo-8) of Total Energy was last June 20. Another cargo (Cargo-7) was scheduled to pay the LNG price on July 5. Petrobangla could not pay the bill.

The country produces about 2,300 million cubic feet per day (MMCFD) of gas from local gas fields to meet a demand of over 2,800 MMCFD, leaving a gap of 500 MMCFD.

Messenger/Disha