Photo : Messenger

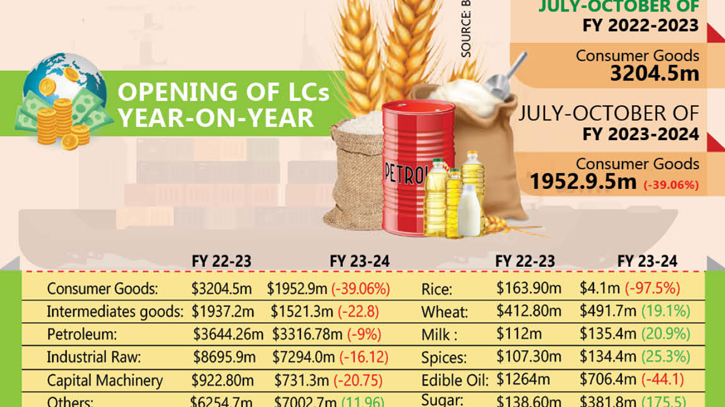

Bangladesh Bank (BB) has reduced import trade due to a decline in reserves, impacting the opening of import letters of credit (LCs). At the end of October this year, the opening of LCs for consumer goods imports in the country decreased by over 39 percent in one year.

Last year, LCs were opened for the import of daily necessities worth $3.2 billion, which has now reduced to $195 million. LC settlements also fell by 24 percent, according to an updated report from BB.

According to the report, LCs opened up to October this year amounted to $21.81 billion, which is $2.84 billion less than the previous year. Last year till October, LCs opened at $24.66 billion.

Among consumer goods, rice and wheat import credit openings fell by 14 percent. Last year till October, $57.67 crore LCs were opened, which reduced to $49.58 crore this year. However, the largest drop in LC opening for consumer goods imports was for oil. Last year, the LC opening for oil was $126.40 crore, which has decreased to $70.64 crore this year. Imports of milk and cream were worth $1.354 billion compared to $1.12 billion in the previous year.

At the same time, the import of spices increased by about $3 million. Sugar imports increased the most. Till October last year, sugar imports were worth $13.86 crore, which has increased to more than $380 million this year. However, overall consumer goods imports decreased by $1.25 billion.

Recently, there has been a massive foreign exchange crisis due to the reduction in reserves. Consequently, BB imposed restrictions on import trade, imposing a maximum margin of 100 percent on luxury goods imports. The central bank also imposes a margin of 75 percent on the import of foreign fruits. Besides, if the LC on any import is more than $5 million, there is a provision to seek prior permission. A few days later, it dropped from $5 to $3 million. BB's permission is still required to open an LC above $3 million.

Imports of capital equipment also declined during the period under review. LC openings till October stood at $73.13 crore as against $92.28 crore in the previous year. In other words, the import of machinery has decreased by $19 million within a year. The import of intermediate goods also decreased during this period. Last October, LCs were opened for the import of goods in this sector worth $193 million, which has reduced to $152 million this year.

Fuel imports decreased by 9 percent, which is $33 million less in the space of one year. Additionally, the import of industrial raw materials has also decreased by 16 percent. Imports in this sector decreased by $1.39 billion. Settlements have declined further, decreasing by 35.72 percent to $6.91 billion from $10.75 billion in the previous year.

Meanwhile, not only has the opening of LCs decreased, but also the payment of LCs has declined until October. According to the latest data analysis, LCs disbursed $28.94 billion until October last year. This year, it has decreased to $21.97 billion.

A BB official told The Daily Messenger, “The banks have paid the deferred LC bill in the first 6 months of the year, as a result of which LC repayments are now decreasing. In addition, import restrictions have been imposed since last year, causing imports to decrease. Therefore, the payment of import duties has also decreased.”

Meanwhile, no system can prevent the fall of the country's dollar. Due to various strictures of BB, the import cost has decreased, but the reserve is not increasing due to the regular sale of dollars from the reserve. In addition, the export earnings were not as per the government's estimate in September.

Remittances increased in October but decreased again in November. Last month, remittances reached $1.93 billion, $4.14 million less than the previous month. In October, remittances came in at over $1.97 billion.

Messenger/Disha