Photo : Messenger

The prices of shares of companies that are not in production, some of which have even shut down and incurred losses, are increasing rapidly due to an apparent act of manipulation by a vested quarter.

Market insiders said the syndicate, according to their set plan, has been pushing up share prices of only a few identified companies, for the last one and a half months.

Analysts are of the view that the capital market is on the brink due to a lack of confidence stemming from national elections and the dollar crisis. Additionally, three-fourths of the shares are at the floor price. The manipulative syndicate seizes this opportunity to extract profits, and ordinary investors, driven by greed, are investing again, leading to losses. Consequently, the regulatory body should take swift action against the manipulative syndicate for the sake of the market.

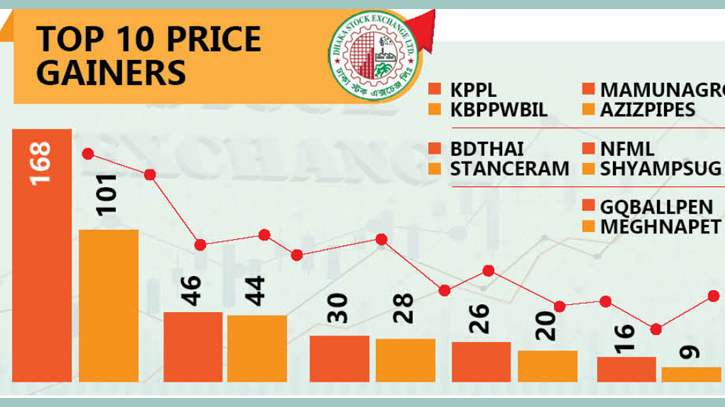

According to an investigation, the manipulative syndicate is increasing the share prices of Khulna Printing and Packaging, Khan Brothers PP Oven Bag Industries, Shyampur Sugar, Aziz Pipe, and Meghna Pet Industries, all of which have halted production. Loss-making companies like GQ-Ballpen, BD Thai, Standard Ceramics, Imam Button, and National Feed Mills are also experiencing a rise in share prices. The prices of shares for these companies have increased by 10 percent to 168 percent within a month, and the syndicate is making significant profits by selling shares.

Rumors in the capital market suggest that the trend of increasing prices for factories and loss-making companies will continue from December 15 to 20. During this period, the manipulative syndicate is profiting by selling shares at higher prices. Sources indicate the involvement of a government official in this syndicate, along with officials from various government and private organizations, including sports broker houses related to football and cricket.

Another group of manipulators consists of officers from a reputable group, accompanied by a group of 30 to 40 people. Additionally, three other small groups are manipulating the market to increase share prices for these companies.

Kazi Nabil, an investor at PFI Securities, commented on the situation, "Ahead of the upcoming elections, fraudsters are increasing share prices by targeting small-cap, non-productive, and loss-making companies. I have profited by investing in two companies like theirs, but now I am not investing again."

An official from a broker house, speaking on condition of anonymity, revealed that these companies were exposed to the manipulation syndicate at the beginning of October. They started buying shares from October 10, selling them at higher prices throughout November and December. Ordinary investors, driven by greed, are starting to buy shares. The official mentioned, "As far as I know, they have been harvesting sugarcane since December 15. They are withdrawing money by selling all the shares."

A former director of the Dhaka Stock Exchange (DSE) echoed similar sentiments, stating, "It was a market under the shadow of a regulatory body, a manipulative syndicate bilking ordinary investors."

Capital market analyst Al-Amin, an associate professor at the Accounting and Information Systems Department of Dhaka University, emphasized the abnormality of share prices increasing for companies that have ceased production. He called for action from the regulatory body against those involved in increasing share prices for these companies, in the interest of the capital market and investors.

Mohammad Rezaul Karim, executive director and spokesperson of the regulatory body Bangladesh Securities and Exchange Commission (BSEC), stated, "BSEC's job is to investigate abnormal price increases or manipulation in share price hikes. We are looking into that." He warned investors not to invest in manipulated stocks and advised caution even if they choose to invest.

Increase in share price of loss-making company:

Listed on the stock market on November 1, Khulna Printing and Packaging Limited, currently out of production, had a share price of 10 taka 70 paisa. Within just one month and five days, by December 5, the share price soared to 28 taka 70 paisa, marking an increase of 18 taka. During this period, the company's 7 crore 3 crore 40 thousand shareholders gained a profit of Tk 131 crore 47 lakh 20 thousand, a significant portion of which is believed to be manipulated by syndicates.

The second-highest gainer was Khan Brothers PP Oven Bag Industries Limited, with its share price climbing from 36 taka 60 paisa on November 1 to 73 taka 80 paisa on December 5, an increase of 37 taka.

Aziz Pipe experienced a surge in share price from 92 taka 40 paisa to 118 taka 40 paisa, marking an increase of 26 taka 40 paisa.

Additionally, shares of another loss-making company, Shyampur Sugar, traded from 153 taka 20 paisa to 183 taka 90 paisa, while Meghna Pet's share price increased from 34 taka 80 paisa to 38 taka on December 5.

Share price rises despite company losses:

Bangladesh Aluminium (BD Thai) Limited, despite reporting losses in the latest quarterly financial report, saw an increase in its share price. Starting at Tk 13 on November 1, the share price rose to Tk 19, reflecting a transactional increase of Tk 6.

Standard Ceramics, a ceramic sector company, had a share price of 108 taka 70 paisa on November 1, rising to 157 taka 10 paisa by December 5, a significant increase of 48 taka 40 paisa.

National Feed Mills Limited witnessed a 26.28 percent increase in its share price, rising from 13 taka 70 paisa to 17 taka 30 paisa, adding 3 taka 60 paisa.

Mamun Agro shares rose from 19 taka 80 paisa to 25 taka 90 paisa.

Shares of GQ-Ballpen increased from 139 taka 50 paisa to 162 taka 60 paisa, despite the latest financial reports of these companies indicating losses.

Messenger/Disha