Photo : Messenger

The auditor has alleged serious irregularities in the financial statements of Central Pharmaceuticals, listed in the capital market for the financial year 2022-23. The auditor did not find the truth of many aspects, including income, expenses, stock products, customer dues, deferred tax, fixed assets, undistributed dividends, tax payments, and bank accounts, as presented by the company authorities.

Capital market insiders have indicated that if the company's financial report is based on false information and if the company cheated investors, they should face consequences.

According to related sources, the National Board of Revenue (NBR) has written to Central Pharma on March 15, 2022, demanding income tax of Tk 98.82 crore from 2007 to 2021. However, the company only made a provision of Tk 28.02 crore, leaving Tk 70.80 crore unresolved with the NBR. This misrepresentation inflates the company's assets by Tk 70.80 crore.

Furthermore, the VAT authorities have demanded VAT and penalties of Tk 23.01 crore from the company for various financial years. The company has not paid the amount nor made provisions for it, resulting in an overstatement of the company's assets by Tk 23.01 crore.

Regarding these irregularities, Mohammad Rezaul Karim, Executive Director (ED), and Spokesperson of the Bangladesh Securities and Exchange Commission (BSEC), told The Daily Messenger, “The commission scrutinises the annual reports of listed companies at the end of the financial year. If any irregularity or inconsistency is found, the commission takes legal action. Central Pharma will be no exception.”

The auditor also found discrepancies in the company's financials, such as a loan of Tk 26.85 crore from Janata Bank, for which no bank statement or certificate was provided. The company claimed Tk 8.04 crore receivable from customers without sufficient evidence, raising doubts about the recovery. Additionally, the auditor found no evidence for Tk 1.48 crore shown as spare parts and supplies, expressing doubts about its legitimacy.

The auditor also questioned the authenticity of the company's stock of Tk 68,00,000 and raised concerns about the sale of medicines worth Tk 2.93 crore, the purchase of raw materials of Tk 1.55 crore, and the purchase of packaging material of Tk 39,00,000. The company failed to provide evidence against direct expenses of Tk 17,00,000, manufacturing overhead of Tk 2.92 crore, administrative expenses of Tk 82,00,000, and selling and distribution expenses of Tk 1.08 crore.

Meanwhile, since 2015, the tax authority has frozen three accounts of Central Pharma at Janata Bank’s Dhaka local office for tax arrears of Tk 9.31 crore. The company also maintains an account in Islami Bank, with other transactions conducted in cash. The auditor suggested that the reliance on cash transactions may lead to inaccurate reporting of income and expenditure.

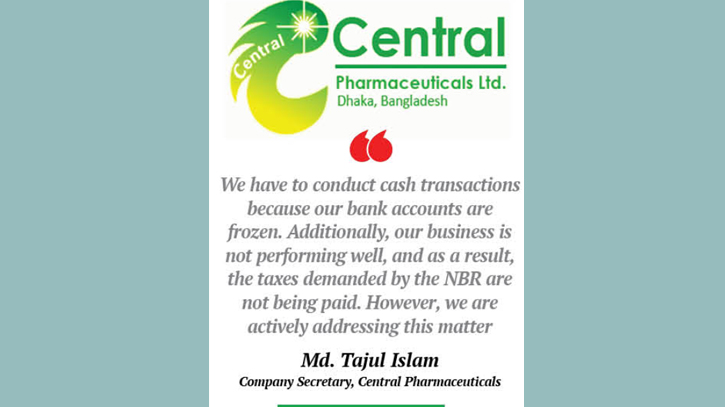

When asked about these concerns, Md. Tajul Islam, the Company Secretary of Central Pharmaceuticals, told The Daily Messenger, “We have to conduct cash transactions because our bank accounts are frozen. Additionally, our business is not performing well, and as a result, the taxes demanded by the NBR are not being paid. However, we are actively addressing this matter.”

In reply to the question of whether the investors are being cheated by showing more wealth through false information, he said that it is happening to some extent. However, all are mentioned in the audit report.

When asked about this, capital market expert Professor Abu Ahmed told The Daily Messenger, “If a listed company presents wrong information in its financial report, then it is a serious crime. BSEC should properly scrutinise the objections raised by the auditor. If the company has given false information, strict action should be taken against them.”

Messenger/Disha