Photo : Messenger

Progressive Life Insurance Company Limited is conducting business through 75 branches without the requisite approval from the regulator IDRA (Insurance Development and Regulatory Authority).

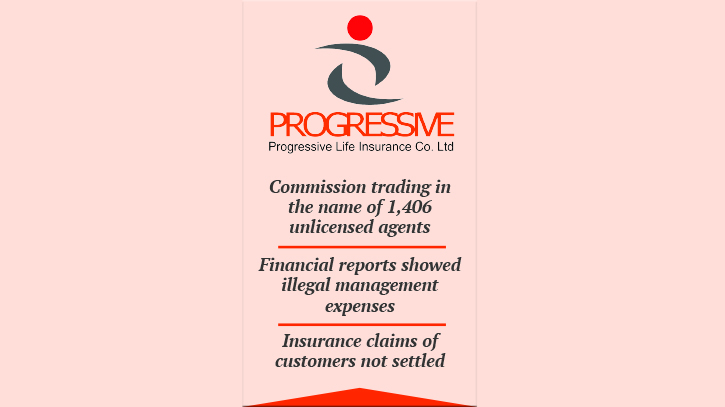

The company has engaged in commission trading by employing 1,406 unlicensed agents, and its financial reports reveal unauthorised management expenses. Furthermore, a special inspection by IDRA has exposed eight types of irregularities committed by the company listed in the capital market, including the non-payment of insurance claims to policyholders.

These irregularities have resulted in a twofold impact-shareholders have been deprived of their rightful dividends, and the management authorities of the company, led by directors and senior officials, have engaged in the misappropriation of customers' funds under various pretexts.

As per Section 14 of Insurance Act, 2010 and Establishment of Branch Office Regulations 2019, there is no opportunity to do business without a branch license. Progressive Life Insurance Company Limited currently has 180 branches. Of these, only 105 branches are licensed. That means 75 branches are doing business without IDRA approval. The company authorities also said that they do not have licenses for these branches, which is a clear violation of the Insurance Act.

Johir Uddin, the former company secretary of Progressive Life Insurance, admitted the irregularity. He told The Daily Messenger that the irregularities were caused by the board of the company.

The current Acting Chief Executive Officer (CEO) Shahjahan Azadi was contacted several times on the mobile phone but he did not receive the call. After sending a message on WhatsApp, he did not respond even after seeing it.

IDRA Director and Spokesperson Jahangir Alam told The Daily Messenger that the inspection team of IDRA found various irregularities in the company. They found evidence of non-payment of insurance claims, embezzlement of customers' money in various ways and recommended punishment for violation of law.

However, Progressive Insurance has already been penalised Tk 5 lakh for various irregularities, he added.

Insurance analysts say that the irregularities of insurance companies are increasing day by day. To get rid of this, the provisions of the present insurance law should be changed. Enact laws that make companies afraid of irregularities and implement them. If not, the confidence of the common people in the insurance sector will go down.

Earlier, IDRA's audit firm M/s ACNABIN found 21 irregularities in the company's 2015, 2016 and 2017 financial reports. The company was then fined as punishment. Still the company is doing similar irregularities.

According to IDRA sources, the head office of Progressive Life Insurance Company was visited on January 29 this year under the leadership of IDRA Director Shah-Alam. IDRA officer Sohel Rana was with him as a member.

During the inspection, the company's premium collection register, re-insurance register, agent license, branch license, management expenses of the company, various reports, returns and insurance claim registers for the period from January 1 to December 31, 2021 were reviewed on a sample basis. Eight types of irregularities were found that time.

As per Section 58 of Insurance Act, 2010, commission cannot be paid without agent license. Progressive Life Insurance features 2,031 active agents. But only 625 people are shown as licensed in the company's agent list. That is, 1406 people have no agent license. Company sources said that those who do not have agent license, have been given commission which is a violation of the Insurance Act and for this action can be taken against the company under Section 130 of the Insurance Act, 2010.

Meanwhile, it is a legal requirement for every life insurer to submit their financial statements to the authorities within six months of the following year's end, detailing the company's financial status for that year. However, Progressive Life Insurance failed to provide the audit team with its financial statements for both 2020 and 2021. The company attributed the delay to pending cases, stating that the accounts for these years have not been prepared yet. When questioned about this matter, the company was unable to provide a satisfactory response.

The company has not submitted the liability assessment report for 2020 and 2021 despite the legal obligation for every life insurer to submit the liability assessment report at least once a year within 9 months i.e. by September 30. Which is a clear violation of Section 30 and 32 of the Insurance Act, 2010.

Besides, in 2021, the company spent Tk 37,29,348 on vehicle maintenance. According to the Circular No. GAD 09/2012 issued by the authority, the report regarding vehicle usage and maintenance cost has been instructed to be presented in the company's AGM and board meeting on a quarterly basis, but the company could not provide the relevant proof when asked from the company.

Despite being legally obligated to submit insurance claims, investment details, stamp duty records, particulars of various meetings, and income tax returns to the authorities on a quarterly basis, the company failed to provide the inspection team with evidence of filing returns other than investment returns. This failure to comply constitutes a violation of Section 65 of the Insurance Act, 2010.

In contravention of regulations stipulating that insurance claims must be settled within 90 days of the expiry date, the company failed to fulfill this requirement in 2021. As a result, 23,154 insurance claims remained unpaid for over 365 days, amounting to Tk 81.50 crore, constituting a violation of Section 72 of the Insurance Act, 2010. Additionally, the company also breached the law by failing to submit relevant information to the authorities within 30 days of the reinsurance contract.

Messenger/Sajib