Photo : Messenger

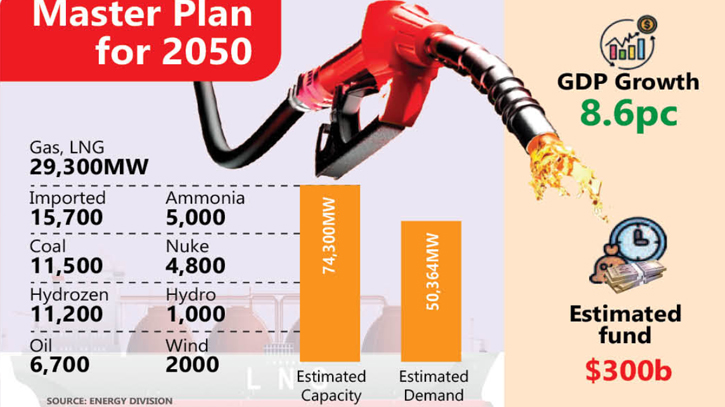

The government has outlined a master plan for 2050, estimating $300 billion, with a focus on LNG imports and setting a goal to achieve 8.6 percent GDP growth. However, experts consider this master plan imprudent.

Experts think that the government is currently struggling to pay outstanding bills for imported fuels. Moreover, the severe crisis in global fossil fuels has increased the price of this essential item. In this situation, an import-based plan may make the economy more vulnerable.

According to the plan, the demand for electricity is estimated to reach 50,364MW in 2041. In response to this demand, the production capacity is proposed to be increased by 74,300MW, which is 47 percent more than the demand.

This increased capacity includes 11,500MW from coal, 6,700MW from oil, 29,300MW from gas and LNG, 4,800MW from nuclear power plants, 1,000MW from hydropower, 20,00MW from wind, 6,000MW from solar, 11,200MW from hydrogen, and 5,000MW from ammonia. Additionally, 15,700MW will be imported by the year 2050.

In the master plan, the expenditure on the energy infrastructure sector is estimated at $179 billion up to the year 2050. This includes about $4 billion for LNG and gas infrastructure and an estimated $118.6 billion for power plant construction. The construction of the transmission line is expected to cost about $2 billion.

Energy Adviser of the Consumers Association of Bangladesh (CAB), Professor Shamsul Alam, told The Daily Messenger, “The plan is ambitious, and the estimation does not align with reality. In the past 13 years, the government could attract only $30 billion in foreign investment. As a result, significant amounts have been wasted annually on idle power plants, and the government is unable to pay electricity and gas dues. Electricity prices continue to rise.”

Referring to the new master plan as unrealistic, he said, “If implemented, the country's economy will further decline.”

He added that even with no demand, the government has provided business opportunities to preferred businessmen with power plants.

The Secretary for the Power Division, Habbiur Rahman, said that Bangladesh is expected to enter the developed world in 2041, and the master plan has been prepared according to the prevailing situation and economic conditions.

To meet the growing demand for natural gas, the government imported 40 cargoes of costly LNG from the spot market in June 2023. Eight LNG cargoes were purchased from the pricier spot market. Bangladesh was initially purchasing LNG from the spot market at $6-10 per MMBtu. However, after the war began in February, the price surged to over $57 per MMBtu this year.

Petrobangla has received Tk 23,500 crore as a subsidy over the last five years. The budget for the previous financial year included an allocation of about Tk 6,000 crore for LNG.

Petrobangla recently wrote a letter to the Finance Division, mentioning that its losses amounted to Tk 25,500 crore from 2019 to May this year, and it now requires a loan to pay LNG import bills. Due to inflation caused by the price hike of LNG in the spot market, an additional Tk 7,800 crore will be added to the outstanding bills.

The country produces about 2,300 million cubic feet of gas per day (MMCFD) from local gas fields to meet the demand of over 2,800 MMCFD, leaving a gap of 500 MMCFD.

Messenger/Disha