Photo : Messenger

The pursuit of government incentives by garment owners has sparked intense scrutiny and raised eyebrows as the manufacturers of these readymade garment (RMG) industries have continued pressing for additional support despite experiencing significant growth in their reserves.

Experts and industry insiders have branded the RMG companies' pursuit of additional cash incentives ‘a stark display of unwarranted demand’ even after recording notable growth.

They are also of the view that the owners’ push for immediate disbursement of incentives is not justifiable, rather appears as an act tainted with shame and a lack of ethical consideration.

Last week, a letter signed by BKMEA Executive President Mohammad Hatem was given to the Ministry of Commerce seeking urgent allocation of cash incentives amounting to Tk 4,000 crore by this December.

"For survival, we need government support – especially during the adverse situation of the global economy,” he quipped.

When asked, Research Director of Centre for Policy Dialogue (CPD) Dr Khondaker Golam Moazzem told The Daily Messenger, “The incentive structure should be reformed. It should be more target-oriented and restructured to overcome the obstacles to export, especially the issues related to the environment.”

For example, he said, the authority could slap fine on any factory that fails to comply with environmental requirements and give cash incentives to the factory that fulfils the requirements and maintains it.

During an investigation by this correspondent, it has been observed that the call for funds by RMG manufacturers coincides with a substantial rise in institutional investments recorded only in the previous month of November.

The Dhaka Stock Exchange (DSE) sources reveal that 18 among the 58 companies listed in the capital market observed an uptick in their institutional investments – thereby signalling a positive trajectory.

Concurrently, the institutional investments of 17 companies remained static, maintaining a steady course. However, a disconcerting trend emerged for the remaining 23 companies, where institutional investment notably dwindled during the month of November.

Notably, around 31 percent of the listed companies witnessed a significant surge in institutional backing during this period.

Furthermore, despite the challenging economic landscape due to COVID-19 and war-related uncertainties, major players in the garment industry have remarkably bolstered their reserves.

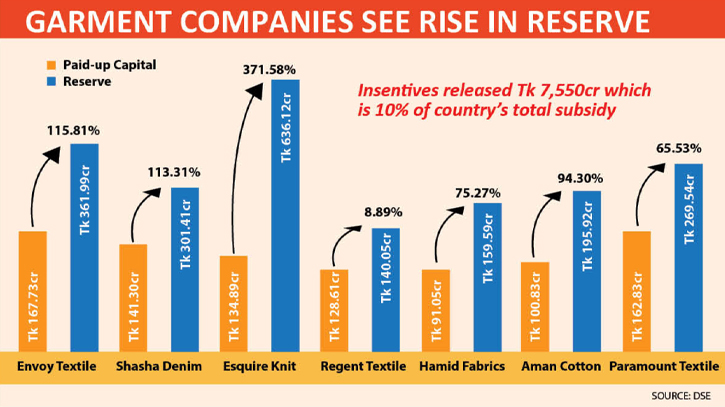

According to an OECD and United Nations report, "Production Transformation Policy Review of Bangladesh: Investing in the Future of a Trading Nation," released in September, for the fiscal year 2022–23, the total estimated cost of export cash incentives in Bangladesh amounted to Tk 7,550 crore ($700 million). This figure represents approximately 10 percent of the country's total subsidy expenditure in that year's budget.

Envoy Textile, for instance, showcased an impressive surge of 115.81 percent in reserves, boasting a paid-up capital of Tk 167.73 crore alongside reserves amounting to Tk 361.99 crore.

Similarly, Shasha Denim reported a commendable increase of 113.31 percent, with a paid-up capital of Tk 141.30 crore and reserves reaching Tk 301.41 crore. Esquire Knit demonstrated an exceptional surge of 371.58 percent, with a paid-up capital of Tk 134.89 crore and reserves soaring to Tk 636.12 crore. Notably, Regent Textile, Hamid Fabrics, Aman Cotton, and Paramount Textile also showcased significant increases in reserves.

Iqbal Hossain, a former employee of a buying house, told The Daily Messenger “The actual beneficiaries of these incentives, the producers, employ another tactic by inflating their prices to maximise their gains. For instance, if the true export price of a shirt is $3, some exporters may declare it as $4 to obtain a larger share of the incentive funds. To take advantage of this, they initially export their products at inflated prices."

However, the companies with increased institutional investment are Alif Industries, Alltex Industries, Argon Denims, C&A Textiles, Dulamia Cotton Spinning, Dhaka Dyeing & Manufacturing, Dragon Sweater & Spinning, Square Knit Composites, Howell Textiles, Matin Spinning Mills, ML Dyeing, Paramount Textiles, Rahim Textile Mills, RN Spinning Mills, Square Textiles, Tashrifa Industries, Jahin Spinning, and RN Spinning Mills Limited.

Executive President of Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA) Muhammad Hatem told The Daily Messenger, “Very few companies are making profit and expanding the business. But most of the companies are struggling with work orders. The EU and USA have declined to import garments from Bangladesh as their economies are still suffering from inflation.”

According to CPD’s Khondaker Golam Moazzem, “The government can also give incentives to fabric producers to encourage them to produce non-cotton fabric.”

He is also of the view that the entrepreneurs, who are producing new items, especially the value-added ones, and exporting a sizable amount, should be given incentives.

Square Knit Composite

Institutional investment in the company was 40.28 percent in October, which increased by 0.05 percent to 40.33 percent in November this year. At the same time, general investment fell by 0.05 percent to 12.72 percent in November from 12.77 percent.

Square Textiles

Institutional investment in the company was 22.44 percent in October, which increased by 0.03 percent to 22.47 percent in November this year. At the same time, general investment fell by 0.03 percent to 12.63 percent in November from 12.66 percent.

Matin Spinning Mills

Institutional investment in the company was 4.97 percent in October, which increased by 0.02 percent to 4.99 percent in November this year. At the same time, general investment declined by 0.02 percent to 26.29 percent in November from 26.31 percent.

RN Spinning Mills

Institutional investment in the company was 10.84 percent in October, which increased by 14.44 percent to 25.28 percent in November this year. At the same time, investment by entrepreneurs and managers increased by 6.63 percent to 36.63 percent from 30.00 percent in October. At the same time, general investment fell from 59.12 percent by 21.04 percent in November to 38.08 percent. Meanwhile, foreign investment fell to 0.01 percent from 0.04 percent in October, down from 0.03 percent in October.

Alif Industries

Institutional investment in the company was 14.35 percent in October, which increased by 0.07 percent to 14.42 percent in November this year. At the same time, general investment declined by 0.07 percent to 52.23 percent in November from 52.30 percent.

ALLTEX Industries

Institutional investment in the company was 7.47 percent in October, which increased by 0.05 percent to 7.52 percent in November this year. At the same time, general investment declined by 0.05 percent to 51.74 percent from 51.79 percent in November.

ARGONDENIM

Institutional investment in the company was 33.56 percent in October, which increased by 0.47 percent to 34.03 percent in November this year. At the same time, general investment fell by 0.47 percent to 30.32 percent in November from 30.65 percent in November.

Dragon Sweater and Spinning Mills

Institutional investment in the company was 13.40 percent in October, which increased by 0.04 percent to 13.44 percent in November this year. At the same time, general investment declined by 0.04 percent to 54.39 percent in November from 54.43 percent.

C&A Textiles

Institutional investment in the company was 14.49 percent in October, which increased by 1.18 percent to 15.67 percent in November this year. At the same time, general investment declined by 1.18 percent to 62.19 percent in November from 64.37 percent.

Dulamia Cotton Spinning

Institutional investment in the company was 6.63 percent in October, which increased by 0.23 percent to 6.86 percent in November this year. At the same time, general investment declined by 0.23 percent to 60.13 percent in November from 60.36 percent.

Dhaka Dyeing and Manufacturing

Institutional investment in the company was 18.52 percent in October, which increased by 3.76 percent to 22.28 percent in November this year. At the same time, general investment fell by 4.13 percent to 47.21 percent in October from 57.34 percent in October. At this time, the company's foreign investment also increased by 0.37 percent. The company's foreign investment increased from 0.04 percent in October to 0.39 percent in November to 0.41 percent.

Hwa Well Textiles

Institutional investment in the company was 7.76 percent in October, which increased by 0.03 percent to 7.79 percent in November this year. At the same time, general investment declined by 0.03 percent to 41.32 percent in November from 41.35 percent.

L. Dyeing

Institutional investment in the company was 17.49 percent in October, which increased by 0.04 percent to 17.53 percent in November this year. At the same time, general investment declined by 0.04 percent to 51.90 percent in November from 51.94 percent.

Paramount Textiles

Institutional investment in the company was 10.07 percent in October, which increased by 0.02 percent to 10.09 percent in November this year. At the same time, general investment declined by 0.02 percent to 24.58 percent in November from 24.60 percent in November.

Style Crafts

Institutional investment in the company was 6.05 percent in October, which increased by 0.08 percent to 6.13 percent in November. Institutional investment decreased by 0.08 percent to 55.06 percent from 55.14 percent during the period under discussion.

Shepherd Industries

Institutional investment in the company was 23.27 percent in October, which increased by 0.08 percent to 23.35 percent in November this year. At the same time, general investment declined by 0.08 percent to 15.68 percent in November from 15.76 percent in November.

Zaheen Spinning

Institutional investment in the company was 23.91 percent in October, which increased by 0.33 percent to 24.24 percent in November this year. At the same time, general investment declined by 0.33 percent to 44.66 percent in November from 44.99 percent.

Rahim Textile Mills

Institutional investment in the company was 7.31 percent in October, which increased by 0.01 percent to 7.32 percent in November this year. At the same time, general investment declined by 0.01 percent to 21.74 percent from 21.75 percent in November.

Messenger/Disha