Photo : Messenger

In recent years, both public and private sector banks in the country have been grappling with the burden of loans, creating significant challenges. This predicament has led to a dual crisis where banks struggle to recover outstanding loans from borrowers while also facing increasing indebtedness themselves.

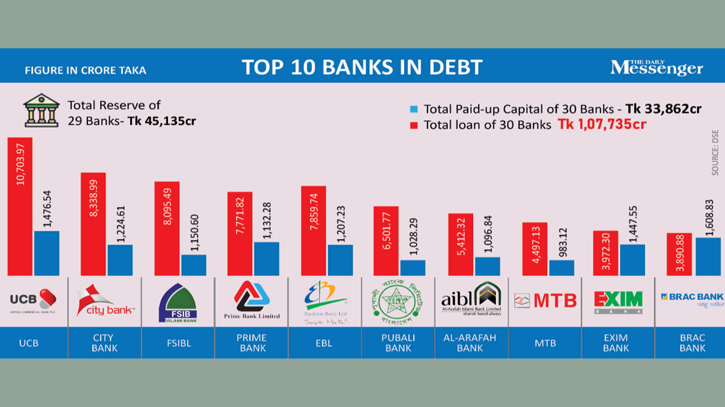

An analysis of the financial standing of banks listed in the country's capital market has unveiled a concerning scenario. Currently, 35 banks are enlisted in the capital market. Among these, the cumulative loan portfolio of 30 banks amounts to Tk 1,07,735 crore. In stark contrast, the combined Paid-up Capital of these banks stands at Tk 33,862 crore. This disparity indicates that the outstanding loan amount of these 30 banks surpasses their Paid-up Capital by Tk 73,872.89 crore.

The investigation conducted by The Daily Messenger, analyzing data from the Dhaka Stock Exchange (DSE) until December 31, 2022, has shed light on a pertinent financial situation concerning 30 banks. These banks collectively possess a reserve and surplus amounting to Tk 44,940 crore. Remarkably, if these banks were to utilize this reserve to repay their outstanding loans, it would substantially alleviate their debt burden, reducing it by nearly half.

Experts within the banking sector have highlighted that the existing debt surpasses the paid-up capital of these banks, signifying that the banks themselves are in a state of indebtedness. Advocates for swift repayment of loans have emphasized the urgency for banks to address these liabilities promptly. Under the Companies Act, there exist no constraints on utilizing reserve funds to settle debts.

Shaifur Rahman Mazumdar, the Chief Operating Officer of the Dhaka Stock Exchange (DSE), affirmed that there are no legal impediments to using reserve funds for loan repayment. Companies typically invest reserve funds, considering them as assets. Thus, leveraging these assets by selling them off could facilitate the repayment of debts, providing a viable avenue for banks to address their outstanding liabilities.

He also said that the reserves that the banks have shown, how much capital or liquidity is there, should be seen. If there is more liquidity, it will be easier to repay the loan.

However, bankers said, loans are taken as per the board of directors' decision. And most of the bank's loans are bond loans. Some of these bonds have tenures of 5 years, 10 years or 15 years.

When asked about this, AB Mirza Azizul Islam, the former caretaker government's finance advisor, told The Daily Messenger, “Just as non-performing loans are not desirable, banks should not be in debt either. Bangladesh Bank's report on non-performing loans of banks is also devoid of reality. Those who are not paying their loans, their assets will be confiscated and punished severely. must be brought under control.”

According to DSE data, United Commercial Bank PLC (UCB) has the largest number of loans in terms of loan volume. This includes long term loans of Tk 10,703.97 crore. Besides, there is Paid-up Capital of Tk 1,476.54 crore and Reserve & Surplus Tk 2,395.77 crore.

First Security Islami Bank PLC is in the second position in terms of loans. Long-term loan of the bank is Tk 8,095.49 crore. Tk 1,150.60 crore Paid-up Capital of Bank has Reserve & Surplus Tk 1,077.75 crore.

City Bank's Paid-up Capital is Tk 1,224.61 crore, Long-term loan Tk 8,338.99 crore and Reserve & Surplus Tk 2,012.36 crore. Eastern Bank's long-term loan is Tk 7,859.74 crore, Reserve & Surplus Tk 2,368.93 crore and Paid-up Capital Tk 1,207.23 crore.

Prime Bank's long term loan is Tk 7,771.82 crore, Reserve & Surplus Tk 1,963.59 crore and Paid-up Capital Tk 1,132.28 crore. Al-Arafah Islami Bank's Paid-up Capital is Tk 1,096.84 crore, Reserve and Surplus Tk 1,494.90 crore and Long-term loan Tk 5,412.32 crore.

Bank Asia's Long-term loan is Tk 4,404.10 crore, Paid-up Capital Tk 1,165.91 crore and Reserve & Surplus Tk 1,680.48 crore. Long-term loan of Pubali Bank is Tk 6,501.77 crore, Paid-up Capital Tk 1,028.29 crore and Reserve & Surplus Tk 3,286.33 crore.

Mutual Trust Bank's long-term loan is Tk 4,497.13 crore, Reserve and Surplus Tk 1,040.46 crore and Paid-up Capital Tk 983.12 crore. EXIM Bank's long term loan is Tk 3,972.30 crore, Reserve & Surplus Tk 1,739.25 crore. BRAC Bank's Long-term loan is Tk 3,890.88 crore, Paid-up Capital Tk 1,608 crore and Reserve & Surplus Tk 4,121 crore.

Besides, Dhaka Bank has long term debt of Tk 3,538.50 crore, reserves of Tk 1,144.39 crore. South East Bank's debt is Tk 3,363.84 crore, reserves are Tk 1,786 crore. Mercantile Bank has loans of Tk 3,402.51 crore, reserves of Tk 1,455 crore. NCC Bank has a loan amount of Tk 2,909.11 crore and reserves of Tk 1,205.74 crore.

DutchBangla Bank has loans of Tk 2,828.34 crore and reserves of Tk 3,414.84 crore. Premier Bank has a loan amount of Tk 2,793.19 crore and reserves of Tk 1,250 crore. Union Bank has a loan of Tk 2,718 crore and reserves of Tk 541 crore, IFIC Bank has a loan of Tk 2,062.10 crore and a reserve of Tk 1,530.34 crore. ONE Bank PLC has a loan amount of Tk 2,053.90 crore and reserves Tk 848.59 crore.

Trust Bank's debt is Tk 2,187 crore, reserves Tk 1,147 crore. AB Bank's debt is Tk 1,075 crore, reserves Tk 1,697.96 crore. ICB Islami Bank has a debt of Tk 478.82 crore and a negative reserve of Tk 1,895 crore.

Jamuna Bank has a loan of Tk 1,399 crore and reserves of Tk 1,154 crore. Midland Bank's loan is Tk 824 crore and reserve is Tk 194.98 crore. National Bank's debt is Tk 1,258 crore and reserves Tk 1,972 crore. NRBC Bank has loans of Tk 1,262 crore and reserves of Tk 498 crore. Rupali Bank's debt is Tk 1,541 crore and reserves Tk 532.94 crore. The loan of South Bangla Agriculture and Commerce Bank is Tk 403 crore and the reserve is Tk 266.93 crore. Uttara Bank's debt is Tk 186.42 crore and reserves Tk 1,312.70 crore.

Note that listed Islami Bank, Shahjalal Islami Bank, Social Islami Bank, Global Islami Bank and Standard Bank Limited have no loans.

In this regard, Zahid Hussain, the former chief economist of the World Bank’s Dhaka office, told The Daily Messenger that debt is never good for a company. And it will be worse if the bank's capital and reserves combined are less than its loans. In that case the bank will become weaker. There will be shortage of capital, failure to repay the debt.

Messenger/Disha