Photo : Collected

In November, the private sector witnessed a further decline in short-term foreign loans, reflecting a shift in business priorities towards the repayment of existing loans rather than acquiring new ones. Bangladesh Bank data reveals a decrease from $12.13 billion in October to $11.96 billion in November, continuing a trend observed since June when the short-term foreign loan stood at $13.65 billion. Notably, this represents a significant drop from the figure recorded in December 2022, which was $16.41 billion.

Additionally, buyer's credit experienced a decline, decreasing from $6.65 billion in October to $6.47 billion in November. This trend is indicative of a cautious approach by businesses amid the economic challenges faced by the country over the last two years, particularly concerning a dollar crisis. The heightened demand for foreign exchange has exerted pressure on reserves, leading to a substantial reduction. External debt has been identified as a contributing factor to the strain on reserves and the overall economic crisis.

The central bank has attributed increased dollar expenditure to the mounting pressure of debt and interest payments. Notably, the primary stressor in this regard is the short-term foreign debt within the private sector. Bankers point to a decline in these short-term loans, linking it to businesses prioritising the repayment of existing loans. Challenges in securing new foreign loans are attributed to outstanding loan amounts and diminishing confidence in foreign institutions.

The prevailing economic conditions, characterised by import restrictions and a persistent dollar crisis, have prompted businesses to scale back their activities. This reduction in business operations has further contributed to the decline in short-term loans.

Despite the decrease in short-term loans, there has been a notable uptick in debt services, which increased by $100 million in November. The debt service figure rose to $2.51 billion in November, compared to $2.41 billion in October

The latest data from Bangladesh Bank reveals a nuanced picture of the country's external debt situation. As of September, there has been a slight reduction in Bangladesh's external debt, which now stands at $96.54 billion, down from $98 billion in June. However, when assessing the broader trend, it's evident that there has been a significant 51 percent surge in foreign debt over three years, escalating from $65.27 billion in June 2020 to $98.93 billion in June 2023.

This rapid increase in external debt is a cause for concern, prompting questions about the country's ability to effectively manage its debt obligations.

External debt encompasses the total amount of money owed by a country to foreign creditors, including foreign nations, international organizations, and foreign private entities.

The Economic Relations Division's projection of Bangladesh's annual debt repayment nearly doubling to $4.02 billion in FY25 from $2.4 billion in FY22 underscores the growing financial challenges facing the country. Foreign debt plays a crucial role in funding various development activities, relying on loans and grants from donor agencies.

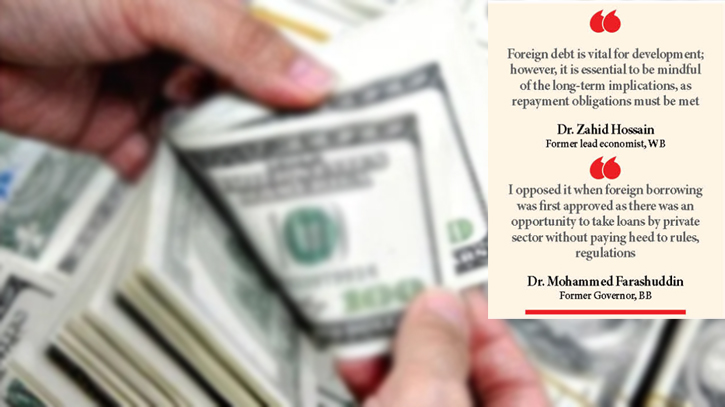

However, Dr. Zahid Hossain, the World Bank's former Lead Economist at Dhaka, warns about the importance of managing foreign debt wisely.

He told The Daily Messenger, “Foreign debt is vital for development; however, it is essential to be mindful of the long-term implications, as repayment obligations must be met."

Dr. Zahid also cautioned against undertaking unnecessary development activities that could potentially pose a threat to the country's economy. Notably, looming debt obligations for significant projects, such as Rooppur, Matarbari, Metrorail, and Rampal, add to the pressure on the country's reserve.

The cautionary advice from experts about the high external liability facing Bangladesh highlights the potential strain on the country's finances, particularly with a substantial portion of its income allocated for debt repayment.

Experts further stress the critical need for the country to carefully manage its resources and prioritise sustainable economic development. The goal is to gradually reduce the country's dependence on foreign borrowing, as a heavy reliance on external funds can lead to financial vulnerabilities.

Former Bangladesh Bank Governor Dr. Mohammed Farashuddin told The Daily Messenger, "I opposed it when foreign borrowing was first approved for the private sector as there was an opportunity to take loan by not paying heeding to rules and regulations, there was a possibility of its misuse, and in the end most of the loans were misused."

“It is necessary to check how much the loan was spent by those who took loans for setting up factories. Due to this, the burden on the country has increased. However, the reduced amount now is a good sign. It is important to know why and how it decreased so much.”

He further said, "Whether public or private, foreign debt is always sensitive. The private sector borrows short-term. So, the credit of this sector is risky. This loan has to be paid from the reserve. Therefore, the lower the debt in this sector, the more the reserve situation will be under control.”

The devaluation of the local currency against the US dollar, witnessed as the exchange rate increased from Tk 84.80 to Tk 110 after the central bank allowed a floating rate, has had notable consequences.

As of January 10, the gross foreign exchange reserve in Bangladesh, following International Monetary Fund guidelines, stands at $20.18 billion.

Import payments for the July-November period in the financial year 2023–24 have decreased by 20.94 percent to $25.72 billion. This contrasts with the figure of $32.53 billion recorded during the same period in the financial year 2022–23. The decline can be attributed to various initiatives undertaken by the government and the central bank to curtail imports, particularly those related to luxury items.

Messenger/Disha