Photo : Collected

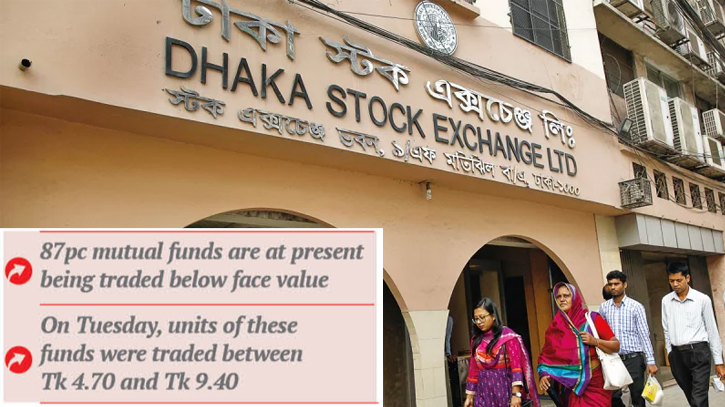

Most of the mutual funds listed on the capital market have provided better cash dividends compared to companies in other sectors. These firms also boast a higher asset value per unit. Despite these, approximately 87 percent of the listed mutual funds' unit prices still remain below face value. Consequently, investors have incurred losses exceeding Tk 2,022 crore.

According to data from the Dhaka Stock Exchange (DSE), the main capital market of the country, there are a total of 37 mutual funds listed. Among these, only 6 mutual funds’ units were traded above face value, that is Tk 10.

The unit price of 31 mutual funds is below Tk 10. On Tuesday (January 23), the units of these institutions were traded between Tk 4.70 and Tk 9.40. In other words, investors in these mutual funds have suffered losses ranging from Tk 0.60 to Tk 5.20 per unit. The total loss for these investors amounts to Tk 2022.50 crore.

Market insiders attribute the declining confidence in the mutual fund sector to mismanagement of assets, inefficiency, nonprofessional behavior, and a lack of accountability. Additionally, financial irregularities and corruption allegations against fund managers have further diminished the sector's popularity.

Shahidul Islam, the chief executive of the asset management company VIPB, told The Daily Messenger, “Some of us could not establish trust with investors due to an extreme lack of professionalism. Consequently, people no longer trust us, and bringing in new investments has become challenging.”

However, as mutual funds are a part of the capital market, Shahidul Islam believes that the overall market recession and the widespread lack of confidence among common investors are also affecting the mutual fund industry.

Capital market expert Professor Abu Ahmed told The Daily Messenger, “A section of fund managers has used investors' money arbitrarily, treating it as if it were their own. They fail to return the money at the end of the specified period, consistently happening over time. Additionally, instead of providing a cash dividend of Tk 100, unit certificates with a market value of Tk 40 to Tk 50 have been compulsorily given in the name of reinvestment, a practice mandated by the regulatory body itself."

He also said, “Mutual fund laws should be amended. Asset managers should be held accountable, and management fees should be determined based on their performance. If someone performs well, they will receive higher fees; if they do not perform well, they will receive less. This approach will encourage qualified individuals to enter this sector.”

When enquired, Arif Khan, the former commissioner of the Bangladesh Securities and Exchange Commission (BSEC), told The Daily Messenger, “People are not aware of the investment opportunities in this sector. The regulatory body and the government must take special measures to encourage investors in this sector.”

According to DSE data, the unit holders of PHP First Mutual Fund incurred a loss of Tk 5.20 by purchasing each unit at Tk 10, resulting in a total loss of Tk 149.40 crore. Similarly, the unit of Popular Life First Mutual Fund traded at Tk 4.90, leading to a loss of Tk 5.10 per unit and a total loss of Tk 158.52 crore for investors. The First Janata Bank Mutual Fund experienced a loss of Tk 139.16 crore, and unit holders of AB Bank 1st Mutual Fund suffered a loss of Tk 119.54 crore.

Among the mutual funds that also incurred losses are AIBL1STIMF, ATCSLGF, CAPMBDBLMF, DBH1STMF, EBL1STMF, EBLNRBMF, EXIM1STMF, FBFIF, GREENDELMF, ICB3RDNRB, ICBAGRANI1, ICBAMCL2ND, ICBEPMF1S1, ICBSONALI1, IFIC1STMF, IFILISLMF1, LRGLOBMF1, MBL1STMF, NCCBLMF1, PF. 1STMF, PHPMF1, PRIME1ICBA, SEMLFBSLGF, SEMLIBBLSF, SEMLLECMF, TRUSTB1MF, VAMLBDMF1, and VAMLRBBF.

Messenger/Fameema