Photo : Messenger

Five of the country’s general insurance companies listed in the capital market have been found to have embezzled Tk 70 crore in premiums owed to the customers, known as policy holders.

Country’s insurance sector regulator the Insurance Development and Regulatory Authority (IDRA) has revealed this upon investigation.

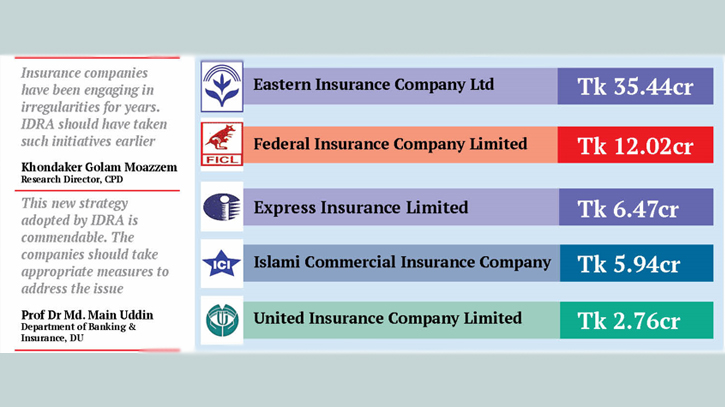

The companies in question are Eastern Insurance Company Limited, Federal Insurance Company, Express Insurance, Islami Commercial Insurance, and United Insurance Company Limited.

Among these, Eastern Insurance Company Limited stands out with the highest number of swindling premiums.

According to the financial reports of insurance companies and information from the Unified Messaging Platform (UMP), the Insurance Development and Regulatory Authority (IDRA) has found discrepancies in premium earnings.

The regulatory body, IDRA, has issued letters to the insurance companies, requesting clarification regarding the mismatch of premiums. These institutions have been granted a time frame of five working days to respond to the inquiry. This directive was recently communicated by IDRA Deputy Director Md Solaiman in a formal letter bearing his signature.

IDRA Director and Spokesperson, Mohammad Jahangir Alam, conveyed to The Daily Messenger that IDRA maintains strict vigilance to prevent companies from misappropriating funds belonging to customers.

He highlighted that upon cross-referencing financial reports with data from the Unified Messaging Platform (UMP), discrepancies indicating potential misappropriation by insurance companies came to light. Initially, five companies were questioned regarding the inconsistencies between the information provided in their financial reports and the UMP. Alam emphasised that if satisfactory explanations are not provided, appropriate legal actions will be taken against the companies involved.

According to IDRA, Eastern Insurance's financial report for 2022 indicates a gross premium income of Tk 49 crore 59 lakh 697. However, data from the Unified Messaging Platform (UMP) reveals that Eastern Insurance's gross premium for 2022 (comprising net premium income + PSB) amounts to Tk 85 crore 35 lakh 53 thousand 659.

This indicates a shortfall of Tk 35 crore 76 lakh 52 thousand 962 in Eastern Insurance's reported gross premium income, accounting for 72% of the total premium claimed by the company.

It's important to note that in 2022, non-life insurance companies collectively received Tk 9 crore 61 lakh 48 thousand 241 from government property insurance.

Federal Insurance ranks second among companies in terms of this discrepancy. In its financial report for 2022, the company has recorded a shortfall of Tk 19 crore 32 lakh 80 thousand 148, which accounts for approximately 29% of the company's gross premium.

According to data from the Unified Messaging Platform (UMP), Federal Insurance's gross premium for 2022 (inclusive of net premium income + PSB) amounts to Tk 87 crore 18 lakh 21 thousand 356. However, the company's financial report indicates a gross premium income of Tk 67 crore 85 lakh 41 thousand 208.

According to Express Insurance, the average discrepancy is Tk 6 crore 47 lakh 99 thousand 501. As per the company's financial report for 2022, the gross premium income is recorded as Tk 57 crore 36 lakh 91 thousand 786. However, data from the Unified Messaging Platform (UMP) indicates that Express Insurance's gross premium for 2022 (inclusive of net premium income + PSB) amounts to Tk 63 crore 84 lakh 91 thousand 287.

Express Insurance's 2022 financial report indicates a shortfall of Tk 6 crore 47 lakh 99 thousand 501 in gross premium income, which amounts to 11 percent of the total premium shown by the company.

For Islami Commercial Insurance's financial report for the year 2022, the gross premium income is reported as Tk 53 crore 38 lakh 76 thousand 749. However, data from the Unified Messaging Platform (UMP) reveals that Islami Commercial Insurance's gross premium for 2022 (inclusive of net premium income + PSB) amounts to Tk 59 crore 32 lakh 86 thousand 927.

As a result, the 2022 financial report of Islami Commercial Insurance has displayed a shortfall of Tk 5 crore 94 lakh 10 thousand 178 in gross premium income, representing 11 percent of the total premium shown by the company.

In contrast, United Insurance's financial report for 2022 records a gross premium income of Tk 58 crore 56 lakh 80 thousand 500. However, information obtained from the Unified Messaging Platform (UMP) indicates that United Insurance's gross premium for 2022 (inclusive of net premium income + PSB) amounts to Tk 61 crore 32 lakh 80 thousand 833.

As a result, United Insurance's 2022 financial report indicates a shortfall of Tk 2 crore 76 lakh 333 in gross premium income, accounting for approximately 5 percent of the total premium shown by the company.

In response to this issue, the Chief Executive Officer (CEO) of Eastern Insurance, Iqbal Mahmud, stated, "I have been with the company for 32 years. Our premium income has never exceeded Tk 56 crore. However, IDRA is claiming that our premium income is 85 crores. This amounts to an average increase of more than 35 crore taka which is unrealistic."

Iqbal Mahmud said that the premium income of Tk 49 to 85 crore is completely wrong. Even if it is an average of lakhs or crores of taka, it could be assumed. He said, “apparently there is double entry of premium income in this account. But we are trying to find out.”

It is to be noted that the regulatory agency IDRA launched the Unified Messaging Platform or UMP to ensure improved customer service, transparency in management, transparency and accountability in collection of premium by agents. On January 28, 2019, the authorities issued instructions to the insurance companies regarding the implementation of the UMP.

Center for Policy Dialogue (CPD) Research Director Dr. Khondaker Golam Moazzem expressed to The Daily Messenger that insurance companies have been engaging in irregularities for years. He emphasised that IDRA should have taken such initiatives earlier.

Dr. Md. Main Uddin, Professor and former Chairman of the Department of Banking and Insurance at Dhaka University, stated that this new strategy adopted by IDRA is commendable. He expressed hope that the company will take appropriate measures to address the issue.

Messenger/Fardin