Photo : Messenger

Bangladesh Bank has decided to provide additional special facilities to Shariah-based banks facing a liquidity crisis. For this purpose, an interest-free facility will be provided, termed 'Special Liquidity Support,' as proposed by the Debt Management Department of the central bank.

In this regard, officials from the central bank said that the government had promised to disburse funds to the banks as fertilizer importers. Liquidity support will be extended to Islamic banks through 'Shariah-based special bonds' issued for this purpose.

A deficiency in the cash reserve ratio or CRR is termed a liquidity crisis. These banks have been in deficit for an extended period. Economists emphasise the need to identify why the crisis persists.

Zahid Hussain, an economist, questions, “How long will Bangladesh Bank support these banks without addressing the main problems?”, adding “The central bank should first identify the problem, provide support, and bring banks under accountability to resolve the issue. Additionally, interest-free support is creating disparity in the banking sector, with some obtaining loans at 8 percent interest and others without any interest. This discrepancy is unsustainable.”

Zahid Hussain also added, “The loans given by these banks should be monitored to determine if they are being repaid. If not, it is crucial to understand why and what steps the board of directors have taken to recover the loans."

Earlier this month, on the 17th, the Ministry of Finance directed Bangladesh Bank to issue Tk 2,482 crore in profit-free or interest-free Shariah-based special bonds for Islami Bank, the largest private bank. Consequently, the central bank issues bonds, referred to as promissory notes. It is proposed that Islami Bank can use these bonds to increase the Statutory Liquidity Ratio (SLR) or meet liquidity asset requirements. Furthermore, the bank can avail a liquidity facility using these bonds.

An official from the concerned department of Bangladesh Bank said that no interest will be charged against these bonds because interest has no place in Islamic banking. No interest will be charged, aligning with Islamic economic principles.

Another official mentioned that the central bank has ceased lending money to the government, leading to a government liquidity crisis. Consequently, the government is unable to fulfill promised payments. To address this, the Ministry of Finance has instructed to provide this facility.

The proposed bonds, according to the bond issue's prospectus, will be callable with possible maturities of 90 and 180 days, allowing the government to withdraw the bonds before maturity after paying the principal amount.

Sources revealed that this development occurs at a time when several Shariah-based banks are facing a serious liquidity crunch. Additionally, allegations have been made against several banks for involvement in serious irregularities.

The managing director of a leading private bank questions why these banks cannot be brought to a better position even with special facilities. Speaking on the condition of anonymity, he told The Daily Messenger, “If we borrow from Bangladesh Bank, we do not do it without interest. At least 1 percent interest has to be paid. So, will these banks receive this special benefit? Moreover, the central bank lacks accurate information about how these banks use loans. The money that will be given may be misused, leading to further inflation.”

A top official of the central bank, wishing to remain unnamed, told The Daily Messenger, “Some banks are in very bad condition. If money is given to these banks, we have to monitor the sector in which they spend it. Five banks have a negative current account. It would be beneficial if their accounts are reconciled with this bond money.”

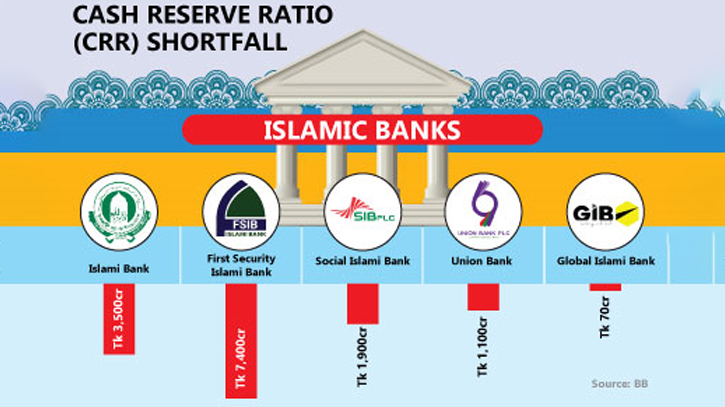

According to the data, the total current account deficit of five Islamic banks was around Tk 14,000 crore until the 18th of this month. Having such a significant negative balance indicates that the central bank is providing maximum support to these banks.

The negative balance in the current account of First Security Islami Bank was Tk 7,400, Islami Bank Tk 3,500, Social Islami Bank Tk 1,900, Union Bank Tk 1,100, and Global Islami Bank Tk 70 crores.

Former governor of Bangladesh Bank, Saleh Uddin Ahmed, told The Daily Messenger, “Islamic banks cannot access the normal money market. Consequently, there is no easy way to solve the liquidity crisis of these banks. Therefore, the central bank has to provide special benefits. While it's not bad, the problem is how long these banks will receive benefits without addressing the basic problem. There will be no benefit if monetary support is given without resolving the issue.”

According to the working paper of the bond issue, Bangladesh Bank can take a 5 percent haircut on the value of the bond issue. Afterward, the remaining money can be paid to the banks, subject to the permission of Bangladesh Bank's board.

Meanwhile, this special bond facility is said to be limited until June 30, 2023, to settle the government's outstanding payments to fertilizer and power importers. For this purpose, instructions have been given to open an 'SLS Card Account' in the central bank system.

The deed also states that the bonds held as collateral will be free of lien after the maturity of the bonds. According to Bangladesh Bank sources, the central bank will issue a circular on this matter shortly.

Messenger/Fameema