Photo : Messenger

Although there has been a substantial development in the country’s energy landscape in recent years – largely fueled by massive engagement with private producers – this progress has come at a price, which stands as high as a 160.57 percent increase in electricity generation costs compared to the state-owned power plants.

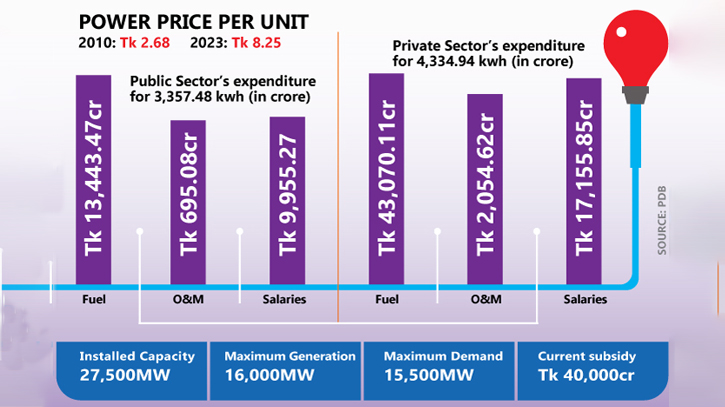

In the last decade, Bangladesh has witnessed remarkable growth in its electricity generation, surging from 4,000 megawatts (MW) to an impressive 27,500 MW.

Data from the recent fiscal year reveals that private producers have outspent their public counterparts significantly. Experts point to higher expenditures on office maintenance and employee salaries as key contributors to this disparity. Additionally, the private sector's reliance on short-term fuel contracts, more expensive than the government's long-term contracts from stable markets, has further escalated costs.

The Power Division says the Power Development Board (PDB) spent Tk 13,307.67 crore in the last fiscal year, covering salaries, maintenance, and fuels, resulting in a per-unit power price of Tk 7.63. In contrast, other state-owned power plants spent Tk 10,788.25 crore, with a per-unit price of Tk 6.85. The total expenditure on state-owned power plants amounted to Tk 24,095.92 crore.

Conversely, the private sector's expenditure, inclusive of fuel costs, soared to Tk 62,766.59 crore during the same period, with a per-unit cost of Tk 14.48. This marked a staggering 160.57 percent higher spending than the public sector. Further analysis of fuel costs reveals that PDB spends Tk 4.46, while other government plants spend Tk 3.60. The average office maintenance cost of PDB stands at Tk 0.21, with a fixed cost of Tk 2.97 per unit. In comparison, the private sector incurred Tk 3.96 per unit as a fixed cost and Tk 3.04 in maintenance costs.

State Minister for Power, Energy, and Mineral Resources Nasrul Hamid told The Daily Messenger, ““It is not possible for government to develop the power sector alone. We have to engage the private sector for faster growth.”

Nasrul Hamid pointed to India, a neighbor that has successfully engaged the private sector in power and energy development, leading to its status as a power-rich country.

Nasrul also acknowledged the challenges posed by outstanding bills and a global economic downturn, highlighting Bangladesh's efforts to navigate a dollar crisis. He expressed gratitude for the private sector entities collaborating with the government, emphasizing their crucial role in maintaining a continuous power and gas supply, essential for the nation's progress.

Energy expert Professor M. Shamsul Alam, speaking to the Daily Messenger, shed light on the challenges faced by small power plants catering to local demands. These diesel-powered facilities incur high costs, a burden exacerbated by low-quality equipment used by many private-sector power plants.

Prof. Alam pointed out that the efficiency of Power Development Board (PDB) plants keeps overall fuel costs relatively lower, while the majority of private-sector plants struggle due to the use of subpar equipment, leading to increased fuel consumption. He emphasized that despite a few private plants boasting good-quality equipment with costs below those of PDB, the overall condition of many private plants remains poor, resulting in high capacity charges.

Adding to the concerns, Professor M. Tamim highlighted the mounting debts of the Bangladesh Power Development Board (BPDB) to electricity companies. The financial crisis, coupled with outstanding bank loans, poses a serious threat. Prof. Tamim warned that prolonged bill delays could lead to supply disruptions in the near future, potentially impacting Bangladesh's oil supply business.

A recent study by the Center for Policy Dialogue (CPD) revealed that BPDB paid 25 percent more for electricity from certain power plants, despite having similar types. The lack of competitive contracts with 54 private power plants was identified as a key factor contributing to escalating costs in the power sector.

The energy landscape is further complicated by substantial outstanding bills owed by several electricity generation and fertilizer companies to Petrobangla, totaling Tk10,000 crore. In a broader context, both private and public entities owe the government a staggering Tk32,000 crore. Petrobangla, responsible for importing over five million tonnes of petroleum products, primarily liquefied natural gas (LNG), faces significant financial burdens from suppliers such as Qatar Gas, Oman Trading, and the Spot Market, amounting to $4.5 billion.

Despite these challenges, the Bangladesh Power Development Board paid only Tk283 crore in December towards outstanding bills, while two Independent Power Producers (IPPs) contributed Tk41 crore, according to the Power Division.

The earlier increase of over 22 percent failed to alleviate losses claimed by distribution companies, prompting renewed efforts to raise gas prices before the year's end.

Mohammad Hossain, Director General of Power Cell, shed light on the financial challenges faced by the government in subsidizing electricity costs. Hossain revealed that the government, which previously subsidized electricity with an amount ranging from Tk10,000 crore to Tk12,000 crore, now grapples with a staggering subsidy of Tk40,000 crore. This increase is attributed to the surge in fuel prices on the international market.

To address the financial strain, the Bangladesh Power Development (BPD) has reportedly submitted an application to the Power Division, seeking an 80 percent increase in power prices. If approved, this hike could have significant implications for consumers already grappling with the economic impact of previous adjustments.

Messenger/Fameema