Photo: Messenger

Country’s central bank in its latest move has introduced the ‘SMART’ rate, tying interest rates to the six-month moving average rate of treasury bills. This approach involves adding an additional 3.75 percent to the last six months of government bills, resulting in consumer loan interest rates of 13.5 percent in February, with industrial debt at 12.43 percent. The government has also withdrawn incentives on 43 export products, which altogether has sparked concerns among businessmen and industry leaders about the potential shock to the country's economy.

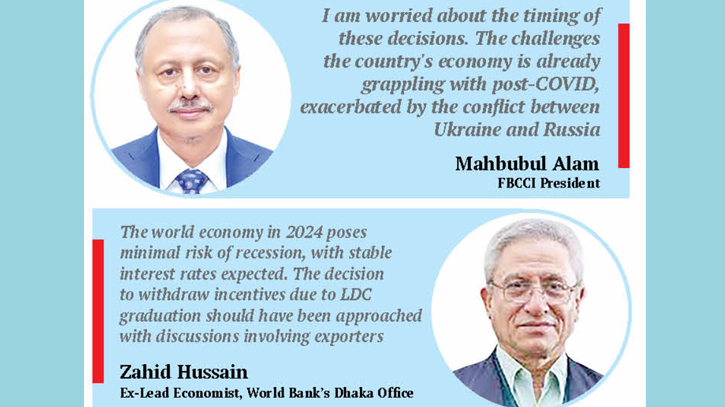

Mahbubul Alam, president of Federation of Bangladesh Chamber of Commerce and Industries (FBCCI), told The Daily Messenger, “I am worried about the timing of these decisions. The challenges the country's economy is already grappling with post-COVID, exacerbated by the conflict between Ukraine and Russia. The strained trade, coupled with economic uncertainties, leaves the business environment precarious.”

Additionally, he lamented the lack of consultation with the business community regarding the withdrawal of export incentives.

He continued, "If exports shrink, the income of entrepreneurs will decrease, directly impacting billions of consumers, especially those in the garment sector." He suggested that a phased-out approach through negotiations would have been more prudent than an abrupt withdrawal of incentives.”

President of Bangladesh Textile Mills Association (BTMA) Mohammad Ali Khokon echoed these sentiments, emphasizing that while the government can make decisions for the country's development, timing and context are crucial. Expressing regret over the lack of consultation, he questioned the sudden issuance of the circular, raising concerns about its potential adverse effects on the country's economy.

The discontent among industry leaders underscores the need for a balanced and well-timed approach to economic policy changes. As the country navigates global uncertainties and domestic challenges, the government's decisions on interest rates and export incentives play a pivotal role in shaping the economic landscape. Collaborative efforts and consultations with stakeholders are essential to ensuring the stability and growth of Bangladesh's economy.

When asked for his take on the issue, Executive President of Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA) Mohammad Hatem expressed his anger to The Daily Messenger.

He said, “We are passing through such a critical time where we are not getting electricity, we are not getting gas even if we pay extra price. Our production is down by 40 percent.

Meanwhile, transportation costs have also increased. Order intake has decreased. It is at this point that one must consider why such a stubborn decision was taken and whose advice was taken. In whose interest is this decision taken that’s the question to ponder upon?’

Hatem also criticised the Bangladesh Bank's departure from the single credit limit policy, which was intended to reduce inflation. He questioned the effectiveness of such measures, pointing out that inflation persists in the market, evident in the high prices of everyday commodities such as potatoes, rice, and onions. Hatem highlighted the role of low-interest loans in establishing numerous factories, generating employment opportunities. However, with the loan limit now increased to 12.5 percent and banks raising interest rates on existing loans, traders face a four-fold pressure, risking increased instability unless job creation is prioritised.

Shahidullah Azim, Vice-President of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), shared concerns with The Daily Messenger about the withdrawal of cash assistance on five major products crucial to the ready-made garment industry.

“The products, including T-shirts, sweaters, knitted shirts, men's undergarments, and oven trousers and jackets, accounted for 55.52 percent of the sector's total export income last fiscal year, amounting to 25.95 billion dollars in the financial year 2022-23,” added Shahidullah.

“Furthermore, emerging markets, including Japan, India, and Australia, have also been excluded from export incentives. These three countries contributed approximately 8 percent, equivalent to $3.77 billion, of the total export earnings in the apparel sector during the last fiscal year. The withdrawal of almost 70 percent of existing incentives in the garment sector, justified under the banner of reducing incentives, is anticipated to significantly impact exports. Traders are already grappling with challenges, and the timing of this decision by the government is a cause for concern. Further discussions on this matter are imperative,” said BGMEA vice president.

Zahid Hussain, the former Lead Economist of the World Bank's Dhaka Office, told The Daily Messenger, “There are three pressing issues in the economy. Firstly, there is a challenge of high inflation, secondly, a foreign exchange imbalance, and thirdly, the fragility of the financial sector, marked by increased defaulted loans and capital shortages in various institutions.

Zahid emphasizes the urgency of addressing these problems promptly."

He further said, “The world economy in 2024 poses minimal risk of recession, with stable interest rates expected. This stability extends to various product prices, including fuel oil, providing an international context conducive to stabilizing our economy. However, this stability requires proactive initiatives rather than relying on automatic mechanisms. The decision to withdraw incentives due to LDC graduation should have been approached with discussions involving exporters.”

Messenger/Disha