Photo : Messenger

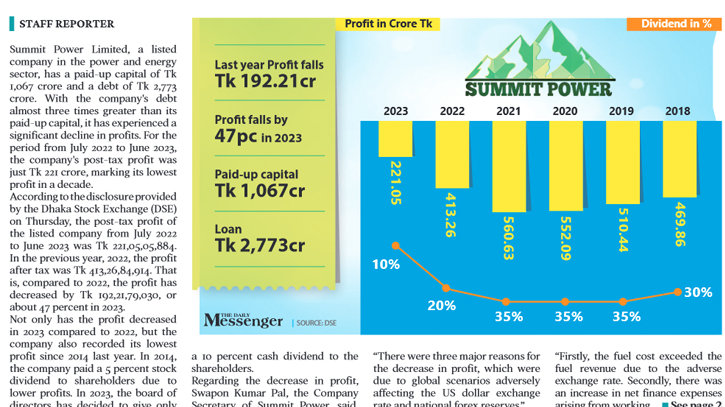

Summit Power Limited, a listed company in the power and energy sector, has a paid-up capital of Tk 1,067 crore and a debt of Tk 2,773 crore. With the company's debt almost three times greater than its paid-up capital, it has experienced a significant decline in profits. For the period from July 2022 to June 2023, the company's post-tax profit was just Tk 221 crore, marking its lowest profit in a decade.

According to the disclosure provided by the Dhaka Stock Exchange (DSE) on Thursday, the post-tax profit of the listed company from July 2022 to June 2023 was Tk 221,05,05,884. In the previous year, 2022, the profit after tax was Tk 413,26,84,914. That is, compared to 2022, the profit has decreased by Tk 192,21,79,030, or about 47 percent in 2023.

Not only has the profit decreased in 2023 compared to 2022, but the company also recorded its lowest profit since 2014 last year. In 2014, the company paid a 5 percent stock dividend to shareholders due to lower profits. In 2023, the board of directors has decided to give only a 10 percent cash dividend to the shareholders.

Regarding the decrease in profit, Swapon Kumar Pal, the Company Secretary of Summit Power, said, “There were three major reasons for the decrease in profit, which were due to global scenarios adversely affecting the US dollar exchange rate and national forex reserves.”

“Firstly, the fuel cost exceeded the fuel revenue due to the adverse exchange rate. Secondly, there was an increase in net finance expenses arising from working capital support through local banks, attributed to excessive delays in payment of bills from the sole off-taker, BPDB. Lastly, there was an increased foreign exchange loss on the quarterly servicing of foreign currency project financing,” he added.

The company has also informed DSE that no dividend has been declared out of the Capital Reserve account, the Revaluation Reserve account, through reducing Paid-up Capital, or through any Unrealised Gain or from the Profit Earned prior to the incorporation of the company, if any, or by doing anything that would make the post-Dividend Retained Earnings negative or result in a debit balance.

The Reserve & Surplus without OCI of the company, listed in 2005, is Tk 2000.94 crore. As per the audited financial report as of June 30, 2022, the company has short and long-term debt of Tk 2,773.61 crore. This includes a Short-term loan of Tk 1,013.07 crore and a Long-term loan of Tk 1,760.54 crore.

The total number of shares of the company is 106,78,77,239. Of these, 63.18 percent are held by entrepreneurial directors, 18.67 percent by institutional investors, 3.65 percent by foreign investors, and 14.50 percent by common shareholders. The shares were last traded at Tk 25.70 on Thursday. The market capitalisation of the company stood at Tk 2,936.66 crore.

Meanwhile, the annual general meeting (AGM) of the company has been scheduled for April 18 for the unanimous approval of the shareholders to approve the 10 percent cash dividend, i.e., 1 taka per share, totalling Tk 106,78,77,239. The record date has been set for March 14. As per the latest calculations, the company’s net asset value per share (NAV) stood at Tk 38.02.

Messenger/Fameema