Photo : Messenger

The entrepreneurs and directors of companies listed in the capital market are obligated to maintain a minimum shareholding of 30 percent. Additionally, there is a requirement for all stakeholders, except individual directors, to hold at least 2 percent shareholding. However, it has come to light that directors of 26 companies have failed to comply with these regulations.

However, despite these regulations set by the BSEC in 2011 following the 2010 stock market crash, 26 listed companies have failed to comply with these directives over the past 13 years. As a result, BSEC is now gearing up to take stringent measures against these non-compliant companies.

According to sources from the Dhaka Stock Exchange (DSE), among the listed companies, entrepreneurs and directors of 26 companies have fallen short of holding at least 30 percent of the total shares. These companies span various sectors, including textiles, pharmaceuticals, chemicals, engineering, IT, food, finance, jute, life insurance, mutual funds, corporate bonds, and banking.

The companies identified for non-compliance are: Familytex Limited, Active Fine, Aftab Automobiles, Alhaj Textile, Apollo Steel, BD Thai Aluminium, Beximco Green Sukuk, Central Pharma, C&A Textile, Delta Spinning, Eastern Cables, FAS Finance, Fu-Wang Food, Generation Next Fashion, IFIC Bank, Fine Food, Intech Limited, Information Services Network Limited, Mithun Knitting, Northern Jute, Olympic Accessories, Pharma Aid, Popular Life Insurance, Popular Life First Mutual Fund, Shurwid Industries, and Ratanpur Steel Re-Rolling Mills Limited.

According to analysts in the capital market, a decrease in the shareholding of entrepreneurs and directors within a company often leads to a lack of attention towards its business operations. This neglect can have detrimental effects on ordinary investors, who may unwittingly invest in such companies, only to suffer losses. However, if at least 30 percent of the shares are held by entrepreneurs and directors, it can inject a significant amount of funds into the company, potentially alleviating the ongoing liquidity crunch in the capital markets.

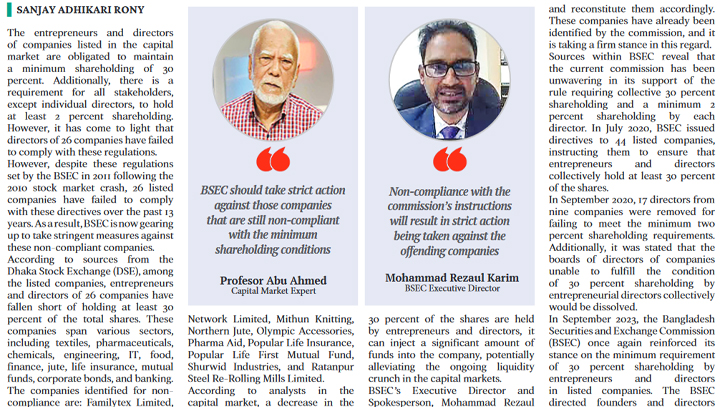

BSEC's Executive Director and Spokesperson, Mohammad Rezaul Karim, emphasised that non-compliance with the commission's instructions will result in strict action being taken against the offending companies. BSEC plans to dissolve the boards of directors of companies that fail to meet the minimum shareholding conditions and reconstitute them accordingly. These companies have already been identified by the commission, and it is taking a firm stance in this regard.

Sources within BSEC reveal that the current commission has been unwavering in its support of the rule requiring collective 30 percent shareholding and a minimum 2 percent shareholding by each director. In July 2020, BSEC issued directives to 44 listed companies, instructing them to ensure that entrepreneurs and directors collectively hold at least 30 percent of the shares.

In September 2020, 17 directors from nine companies were removed for failing to meet the minimum two percent shareholding requirements. Additionally, it was stated that the boards of directors of companies unable to fulfill the condition of 30 percent shareholding by entrepreneurial directors collectively would be dissolved.

In September 2023, the Bangladesh Securities and Exchange Commission (BSEC) once again reinforced its stance on the minimum requirement of 30 percent shareholding by entrepreneurs and directors in listed companies. The BSEC directed founders and directors of companies failing to meet this threshold to submit plans to rectify the situation by September 30 of that year, allowing a 15-day window for compliance.

According to data from the Dhaka Stock Exchange (DSE), as of May 31, 2023, entrepreneurs and directors of 29 listed companies fell short of holding 30 percent of the shares. However, between December 2020 and May 2023, entrepreneurs and directors of 15 companies managed to meet the 30 percent shareholding requirement, aligning with the directives set by the regulatory body.

In response to these developments, Professor Abu Ahmed, a prominent expert in the capital market, emphasised the importance of adhering to the minimum shareholding requirement and told The Daily Messenger, “Owning a company without holding the minimum share is unacceptable, and despite some directors challenging the BSEC order and going to the High Court, the verdict ruled against them.”

Professor Ahmed urged the BSEC to take strict action against those companies that are still non-compliant with the minimum shareholding conditions, emphasising the benefits such measures would bring to investors and the government alike.

It's noteworthy that BSEC had received numerous complaints from investors prior to issuing the directive on 30 percent shareholding. The Commission believes that adherence to universal norms is essential for listed companies, enabling entrepreneurs and directors to focus on company affairs and restoring order to the stock market.

Messenger/Disha