Photo : Messenger

The government is likely to float international bidding on March 10 for inviting foreign companies to explore oil and gas in the country’s Bay of Bengal.

“We’re hopeful a good number of companies will participate in the bidding round,” said Chairman of Petrobangla Zanendra Nath Sarker to journalists recently.

According to the officials of the state hydrocarbon corporation Petrobangla, the bid invitation document will be sent to local newspaper in a day or two to publish it.

In addition, it will be published on the websites of Implementation Monitoring and. Evaluation Division (IMED) and Bangladesh’s foreign mission abroad, they said.

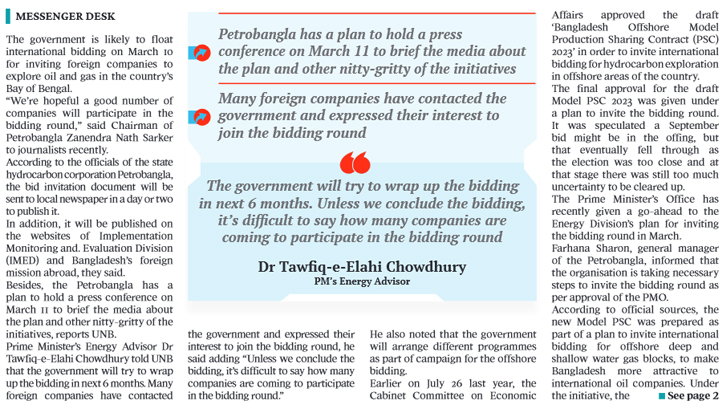

Besides, the Petrobangla has a plan to hold a press conference on March 11 to brief the media about the plan and other nitty-gritty of the initiatives, reports UNB.

Prime Minister’s Energy Advisor Dr Tawfiq-e-Elahi Chowdhury told media that the government will try to wrap up the bidding in next 6 months.

Many foreign companies have contacted the government and expressed their interest to join the bidding round, he said adding “Unless we conclude the bidding, it’s difficult to say how many companies are coming to participate in the bidding round.”

He also noted that the government will arrange different programmes as part of campaign for the offshore bidding.

Earlier on July 26 last year, the Cabinet Committee on Economic Affairs approved the draft ‘Bangladesh Offshore Model Production Sharing Contract (PSC) 2023’ in order to invite international bidding for hydrocarbon exploration in offshore areas of the country.

The final approval for the draft Model PSC 2023 was given under a plan to invite the bidding round. It was speculated a September bid might be in the offing, but that eventually fell through as the election was too close and at that stage there was still too much uncertainty to be cleared up.

The Prime Minister’s Office has recently given a go-ahead to the Energy Division’s plan for inviting the bidding round in March.

Farhana Sharon, general manager of the Petrobangla, informed that the organisation is taking necessary steps to invite the bidding round as per approval of the PMO.

According to official sources, the new Model PSC was prepared as part of a plan to invite international bidding for offshore deep and shallow water gas blocks, to make Bangladesh more attractive to international oil companies.

Under the initiative, the gas price was tagged with the price of Brent Crude in the international market to ensure flexibility.

“Under the plan, we’re going to offer the price of gas at 10 percent of Brent Crude,” the Petrobangla official told media.

The official said if Brent Crude is traded at USD $75 per barrel, the gas price would be USD 7.5 per thousand cubic feet (MCF). The gas price will always remain linked to the international oil price, he said, referring to the new provision of the Model PSC 2023.

British oil & gas consultancy Wood Mackenzie has been advising the Bangladesh government and Petrobangla on the latest PSC revisions.

Official sources said the country has a total of 48 blocks, of which 26 are located offshore. Of the 26 offshore blocks, 11 are located in shallow sea (SS) water while 15 are located in deep sea (DS) water areas.

Of the offshore blocks, 24 remain open for IOCs while two blocks — SS-04 and SS-09 – are under contract with a joint venture of ONGC Videsh Ltd and Oil India Ltd where drilling work has recently started.

Bangladesh's offshore area remains unexplored despite the settlement of its dispute with neighbouring Myanmar and India over maritime boundary almost nine years ago.

Currently, about 2300 mmcfd gas is being produced from 22 gas fields in the country, while about 600 mmcfd gas is being imported from abroad to meet the demand of about 4000 mmcfd, leaving a deficit of about 1200 mmcfd daily.

Messenger/Fameema