Photo: Messenger

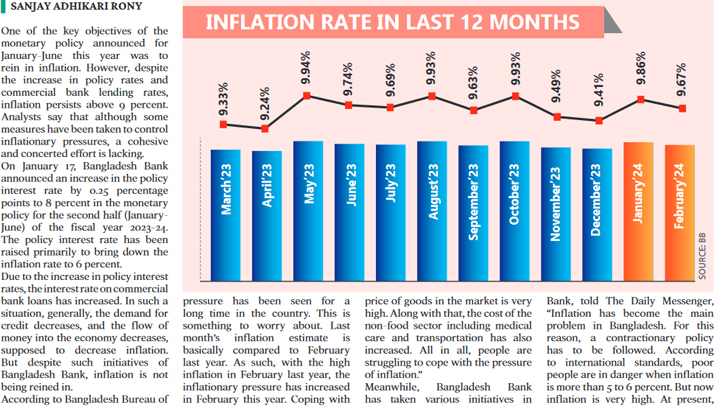

One of the key objectives of the monetary policy announced for January-June this year was to rein in inflation. However, despite the increase in policy rates and commercial bank lending rates, inflation persists above 9 percent. Analysts say that although some measures have been taken to control inflationary pressures, a cohesive and concerted effort is lacking.

On January 17, Bangladesh Bank announced an increase in the policy interest rate by 0.25 percentage points to 8 percent in the monetary policy for the second half (January-June) of the fiscal year 2023-24. The policy interest rate has been raised primarily to bring down the inflation rate to 6 percent.

Due to the increase in policy interest rates, the interest rate on commercial bank loans has increased. In such a situation, generally, the demand for credit decreases, and the flow of money into the economy decreases, supposed to decrease inflation. But despite such initiatives of Bangladesh Bank, inflation is not being reined in.

According to Bangladesh Bureau of Statistics (BBS) data, inflation in the country has remained at 9 percent for a year. Headline inflation stood at 9.67 percent in February. In January, this rate was 9.86 percent. Last month, food inflation in the country was 9.44 percent and non-food inflation was 9.33 percent. Inflation eased slightly in February but still remains above 9 percent.

Economists said that inflationary pressure has been seen for a long time in the country. This is something to worry about. Last month’s inflation estimate is basically compared to February last year. As such, with the high inflation in February last year, the inflationary pressure has increased in February this year. Coping with this pressure is very difficult for common people.

In this regard, AB Mirza Azizul Islam, the former caretaker government’s finance adviser, told The Daily Messenger, “Inflation is like a type of tax, which increases the pressure on everyone, regardless of whether they are rich or poor. Rising inflation means increasing hardship for the poor and middle class. The price of goods in the market is very high. Along with that, the cost of the non-food sector including medical care and transportation has also increased. All in all, people are struggling to cope with the pressure of inflation.”

Meanwhile, Bangladesh Bank has taken various initiatives in the last one year to deal with high inflation. Besides, several steps have been taken on the advice of the International Monetary Fund (IMF). Bangladesh Bank has announced it will move away from the money supply-dependent policy to prevent inflation and start formulating monetary policy targeting interest rates.

Mohammed Farashuddin, former governor of Bangladesh Bank, told The Daily Messenger, “Inflation has become the main problem in Bangladesh. For this reason, a contractionary policy has to be followed. According to international standards, poor people are in danger when inflation is more than 5 to 6 percent. But now inflation is very high. At present, three crore people in Bangladesh are below the poverty line. In such a situation, if inflation increases, they will face extreme financial danger.”

The former governor also mentioned that there is no opportunity to introduce a free market economy in a country like Bangladesh. “To keep commodity prices and financial conditions stable in this country, everything must be kept under control. Though inflation eased slightly last month, we shouldn't celebrate just yet. We need to reduce inflation much more,” he added.

Selim Raihan, professor of the Economics Department at Dhaka University and executive director of the South Asian Network on Economic Modeling (SANEM), said that efforts to reduce inflation through monetary policy and fiscal policy have not been as effective as they should have been. Policy rates should have been raised much earlier. Additionally, there was an opportunity to further reduce import duties on essential goods, but it was not taken.

“In such a situation, the government increased the price of electricity again. Inflationary pressure may increase again. There is a danger that traders will be more unrestrained by the opportunity to increase the price of electricity,” he added.

Regarding this matter, Golam Rahman, president of the Consumers Association of Bangladesh (CAB), told The Daily Messenger, “We could not take the traditional measures that other countries have taken to control inflation. There was a 9/6 system of interest rates in the country. That may be the reason for the delay in raising the policy interest rate. Additionally, the government has taken loans from the central bank, leading to an increase in inflation.”

He also mentioned that there should be competition to protect consumer interests in the free market system. Once there were 30-40 importers, but now it has reduced to five-six. This reduction in competition has led to syndicates. Even if a new entrant wants to enter the market, it is not possible for them to break the syndicate. In this situation, the government should directly intervene in the market, but such initiatives are not visible.

Messenger/Disha