Photo : Messenger

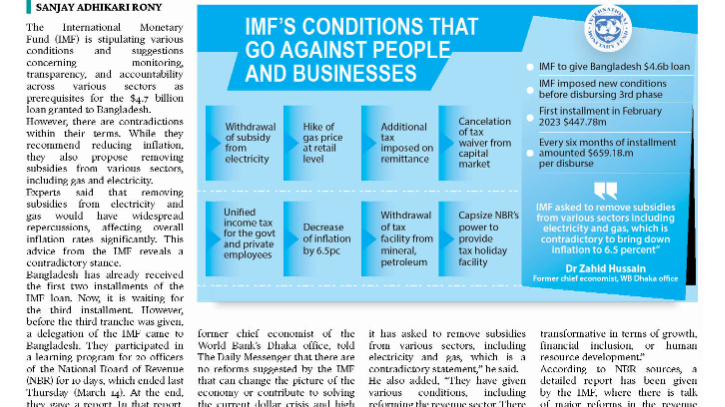

The International Monetary Fund (IMF) is stipulating various conditions and suggestions concerning monitoring, transparency, and accountability across various sectors as prerequisites for the $4.7 billion loan granted to Bangladesh. However, there are contradictions within their terms. While they recommend reducing inflation, they also propose removing subsidies from various sectors, including gas and electricity.

Experts said that removing subsidies from electricity and gas would have widespread repercussions, affecting overall inflation rates significantly. This advice from the IMF reveals a contradictory stance.

Bangladesh has already received the first two installments of the IMF loan. Now, it is waiting for the third installment. However, before the third tranche was given, a delegation of the IMF came to Bangladesh. They participated in a learning program for 20 officers of the National Board of Revenue (NBR) for 10 days, which ended last Thursday (March 14). At the end, they gave a report. In that report, they added some new conditions along with the old conditions.

In this regard, Dr Zahid Hussain, former chief economist of the World Bank's Dhaka office, told The Daily Messenger that there are no reforms suggested by the IMF that can change the picture of the economy or contribute to solving the current dollar crisis and high inflation. "On one hand, they have asked to bring down inflation to 6.5 percent by June. On the other hand, it has asked to remove subsidies from various sectors, including electricity and gas, which is a contradictory statement,” he said.

He also added, “They have given various conditions, including reforming the revenue sector. There is no way to deny the terms that the IMF has given. But no reforms are in sight that will lead to anything transformative in terms of growth, financial inclusion, or human resource development.”

According to NBR sources, a detailed report has been given by the IMF, where there is talk of major reforms in the revenue sector. At the same time, they have also mentioned which of these reforms should be done within a certain period.

The IMF has called for tax to be collected from government employees at the same rate as private employees. Besides, they have asked to impose tax on the entire income of the taxpayer without giving any tax deduction.

However, tax experts said that several of the IMF's recommendations, including equal taxation for all, are good. However, if some parts of their suggestions are against the interest of the country, people, and industry after review, the government can take a decision considering its own interest.

According to the IMF, both public and private employees should pay equal taxes. This should be done from the next financial year. Apart from that, no tax deduction or concession can be given to salaried employees. And after the tax-free income limit of the individual, the slab of 5 percent of the first 1 lakh should be cancelled, and the tax should be collected directly from 5 to 8 lakh at the rate of 10 percent.

The country's ICT sector has tax holiday benefits until 2024. Now the IMF is saying that it should not be increased in any way. This will also be announced in the coming budget. At the same time, the IMF has said that the tax holiday benefits of the productive industrial sector will not be increased after 2025.

Analysts believe that currently, the ICT sector is developing due to tax incentives. If this suggestion of the IMF is followed, there may be some slowdown in this case. In the case of the industry too, if the tax holiday facility is given away, the cost of production of goods will increase, and the cost for the consumer will increase.

Companies in the gas extraction sector get a special tax benefit called ‘Depletion Allowance’. Although the companies do not actually spend anything in this sector, they get tax benefits in this sector. The IMF says there is no need to keep this facility.

From the upcoming budget, the IMF has said that the country's big corporate institutions and top companies will be made mandatory to submit income tax returns online. Otherwise, the organisation has recommended the cancellation of all tax concessions given to them.

Another major reform has been announced by the IMF that the agency has asked for the cancellation of NBR's voluntary powers to provide tax holiday benefits. Under this power, tax officials of NBR can grant tax holidays to any taxpayer, individual or company. The IMF believes that only Parliament can have such powers.

Apart from that, a list of which sectors will get tax holiday benefits in the current budget has been announced. But beyond this list, NBR can give tax holiday benefits to any sector if it wants - such power is said to be in the budget. The IMF says this power also need not be in NBR's hands.

The organisation is against the capital gains tax of listed companies, tax-free interest on bonds and zero-coupon bonds, and other profits. The organisation wants these interest or profit tax-free benefits to be cancelled from the budget.

Besides, the IMF advised the government to impose tax on expatriate income. Currently, there is a complete tax exemption on remittances as part of the government's multifaceted initiative to increase remittances at this time of reserve crisis in the country. Besides, a 2.5 percent cash incentive is also being given on expatriate income.

However, NBR officials said it will not be possible to give these facilities overnight, even if the IMF wants. It is related to the economic progress of the country. So, the government has to take a decision in the light of the reality of the country.

No responsible official of NBR agreed to speak in this regard. However, an official, who did not want to be named, said, “The IMF has made these suggestions because of the loan conditions. Not all of them are bad; not all of them are good. There are many things like equal taxation on everyone, cancellation of tax exemptions for the ICT sector, or cancellation of tax holidays from the upcoming budget. There are sensitive issues, which may not be possible for the government to implement overnight.”

While approving a $4.7 billion loan to Bangladesh early last year, the IMF imposed as many as 30 conditions, including the rationalisation of tax expenditures. To this end, NBR has taken initiatives to reduce tax expenditure, as part of which some VAT and tax benefits have been reduced last year. However, the government has not taxed remittances for a long time.

Messenger/Fameema