Photo : Messenger

Against the backdrop of the ongoing financial crisis and the dollar shortage, the government is struggling to settle outstanding payments owed to domestic and international power plants.

Consequently, arrears owed to both state-owned and private power producers continue to rise at an alarming rate day by day. In an effort to address this dire situation, the government has resorted to issuing bonds as a means of raising funds to clear the mounting arrears and provide subsidies.

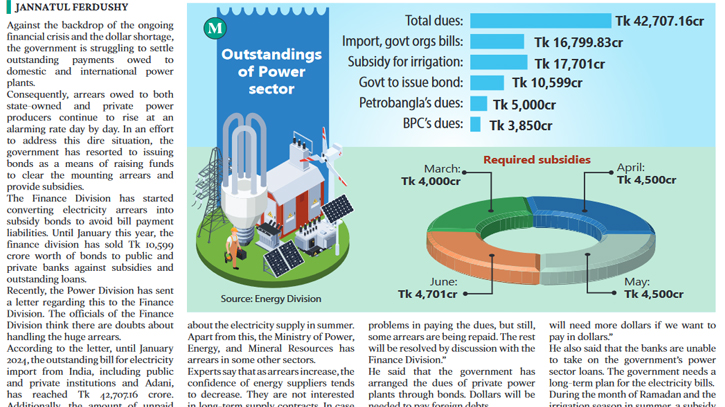

The Finance Division has started converting electricity arrears into subsidy bonds to avoid bill payment liabilities. Until January this year, the finance division has sold Tk 10,599 crore worth of bonds to public and private banks against subsidies and outstanding loans.

Recently, the Power Division has sent a letter regarding this to the Finance Division. The officials of the Finance Division think there are doubts about handling the huge arrears.

According to the letter, until January 2024, the outstanding bill for electricity import from India, including public and private institutions and Adani, has reached Tk 42,707.16 crore. Additionally, the amount of unpaid bills of government power generation companies and import-dependent coal-based power plants stands at Tk 16,799.83 crores.

The Power Division has never seen such a huge arrears burden before. Therefore, the company is worried about the electricity supply in summer. Apart from this, the Ministry of Power, Energy, and Mineral Resources has arrears in some other sectors.

Experts say that as arrears increase, the confidence of energy suppliers tends to decrease. They are not interested in long-term supply contracts. In case of delay in payment of dues, penalties are also payable as per the agreements. Also, the banks increase the fees for opening new import credit cards.

State Minister for Power, Energy, and Mineral Resources Nasrul Hamid told The Daily Messenger, “We have some problems in paying the dues, but still, some arrears are being repaid. The rest will be resolved by discussion with the Finance Division.”

He said that the government has arranged the dues of private power plants through bonds. Dollars will be needed to pay foreign debts.

Policy Research Institute of Bangladesh (PRIB) Executive Director Dr. Ahsan H. Mansoor told The Daily Messenger, “The electricity import contracts with foreigners should have been done more carefully. If we provide more electricity per unit, we will need more dollars if we want to pay in dollars.”

He also said that the banks are unable to take on the government's power sector loans. The government needs a long-term plan for the electricity bills.

During the month of Ramadan and the irrigation season in summer, a subsidy of Tk 17,701 crore was needed. In the financial year 2023-24, Tk 35,000 crore was estimated for subsidy support. Meanwhile, the Power Division asked for Tk 4,000 crore for March, Tk 4,500 crore for April, Tk 4,500 crore for May, and Tk 4,701 crore for June as subsidies.

Bangladesh Oil, Gas, and Mineral Resources Corporation (Petrobangla) has an outstanding bill of about Tk 5,000 crore. This includes the bills of LNG supply companies. Apart from this, many bills of international oil and gas extraction companies (IOCs) that extract and supply domestic gas have also fallen due. On the other hand, the arrears of the oil supplying companies to the Bangladesh Petroleum Corporation (BPC) are about Tk 3,850 crores.

However, from the start of the summer season in March, additional fuel will be needed to run the power plants. Imports of gas, coal, and fuel oil should be increased. But it started raining in the middle of March. The policymakers of the Power Division want rain throughout the summer season. Because of the lack of money and the dollar crisis, doubts have arisen about whether enough fuel can be imported for power plants.

Messenger/Disha