Photo : Messenger

Following various irregularities in Shariah-based banks, the growth of deposit has slowed down. However, loan disbursement has not witnessed a similar decline. As a result, a significant portion of deposits is being allocated to loans. Consequently, these banks are unable to meet the central bank's deposit requirements, leading to fines that they are failing to settle.

For several months, five Islamic banks faced significant deficits. Suddenly, these banks are now in surplus. However, these Shariah-based banks are encountering difficulties in increasing deposits, causing them to fall behind in collecting deposits.

Recently, a report about Islamic banks published by Bangladesh Bank has revealed such information. The banks that returned to surplus after overcoming liquidity deficits include First Security Islami Bank, Global Islami Bank, Islami Bank Bangladesh, Social Islami Bank, and Union Bank.

According to relevant sources, five Islamic banks have suddenly recovered from significant deficits with special liquidity assistance from Bangladesh Bank. Despite the improvement in liquidity, these Shariah-based banks have fallen behind in deposits. Bankers and economists have essentially said that various irregularities and mismanagement in some Shariah-based banks have negatively affected the deposits of Islamic banks.

When asked about this, Moslehuddin Ahmed, MD and CEO of Shahjalal Islami Bank, told The Daily Messenger, “The country’s banking sector is going through a tough time. Not only are Shariah banks affected, but every bank is facing a liquidity crunch. Consequently, they have to regularly take loans from the central bank. However, Islamic banks are slightly better off.”

“However, some conventional banks in Bangladesh have converted to Shariah banks. Also, there is a lack of trust among the general public regarding the overall situation of the banking sector. Additionally, due to inflation, people are unable to save; rather, they are losing their savings. In this situation, deposits have decreased somewhat, but not significantly. There has also been an impact due to the emergence of loan scams in one or two Islamic banks. However, overall deposits in our banks have increased despite this crisis,” he added.

Despite the liquidity surplus, Shariah-based banks have fallen behind in deposits. In other words, the rate at which deposits have increased in conventional banks has not matched that of Islamic banks. There are 10 Shariah-based banks in the country. Among them, the other banks outside the five banks that have emerged from the crisis into surplus are ICB Islamic, Exim, Shahjalal Islami, Al-Arafah Islami, and Standard Bank.

Syed Mahbubur Rahman, Managing Director of Mutual Trust Bank, told The Daily Messenger, “The world economy, including Bangladesh, has faced various crises. These crises have also negatively impacted the deposits of the country’s banking sector. Furthermore, due to various negative news, some clients have withdrawn money from banks. Due to high inflation, common people do not have money to save. Overall, the decrease in bank deposits is a manifestation of the economic crisis.”

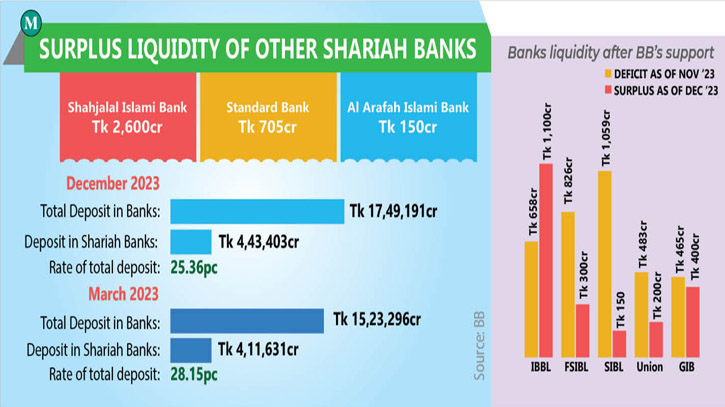

Meanwhile, at the end of December 2023, total deposits in the banking sector increased to Tk 17,49,191 crore. Among them, deposits in 10 Shariah-based banks and other banks offering Islamic services totalled Tk 4,43,403 crore. This accounted for 25.35 percent of the total deposits in the banking sector.

In March of the previous year, the share of Islamic banks in total deposits was 27.02 percent. At that time, the total amount of deposits in the banking sector was Tk 15,23,296 crore, with Islamic banks holding Tk 4,11,631 crore in deposits. Meanwhile, some Shariah-based banks have continued lending or investing despite falling behind in deposits. In March of the previous year, Islamic banks accounted for 28.15 percent of the banks' total loans, which increased to 28.92 percent in December of the same year.

Dr. Zahid Hussain, former chief economist of the World Bank's (WB) Dhaka office, told The Daily Messenger, “Bangladesh Bank has a fund for Islamic banks. For the past several months, they have been using this fund to meet liquidity deficits. However, the problem of Islamic banks has become chronic, causing concern among customers.”

According to the Bangladesh Bank report, Islami Bank had a liquidity deficit of around Tk 658 crore in September of the previous year. However, by the end of December of the same year, the surplus liquidity stood at around Tk 1,100 crore. Meanwhile, First Security Islami Bank's surplus liquidity stood at around Tk 300 crore, whereas the bank had a liquidity deficit of around Tk 826 crore in September.

By the end of December, the surplus liquidity of Social Islami Bank stood at around Tk 150 crore, despite a liquidity deficit of Tk 1,059 crore in September. Similarly, Union Bank's liquidity deficit was Tk 483 crore at the end of September, but by the end of December, the surplus liquidity stood at Tk 200 crore. Global Islami Bank, on the other hand, had a liquidity surplus of Tk 400 crore at the end of December, compared to a deficit of Tk 465 crore in September.

It is noteworthy that Bangladesh Bank provided a special loan of around Tk 22,000 crore to these five banks and seven other private banks without any collateral on the last working day of 2023 to showcase good annual financial conditions. Consequently, there is a liquidity surplus in five Islamic banks.

These banks have struggled to maintain the Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR) set by the central bank for an extended period. The Treasury Bills and Bonds held by these banks for SLRs were utilised to mortgage the borrowed money, leaving them with no means or instruments to borrow again. They simply extended the tenure of earlier loans. Additionally, the current account maintained with the central bank for settlement of inter-bank transactions of five Shariah-based Islamic banks also turned negative. However, some banks have shown recent improvement.

According to the central bank's report, by the end of December, Shahjalal Islami Bank had a surplus liquidity of Tk 2,600 crore, Standard Bank Tk 705 crore, and Al-Arafah Islami Bank Tk 150 crore, among other Islamic banks.

Messenger/Disha