Photo: Messenger

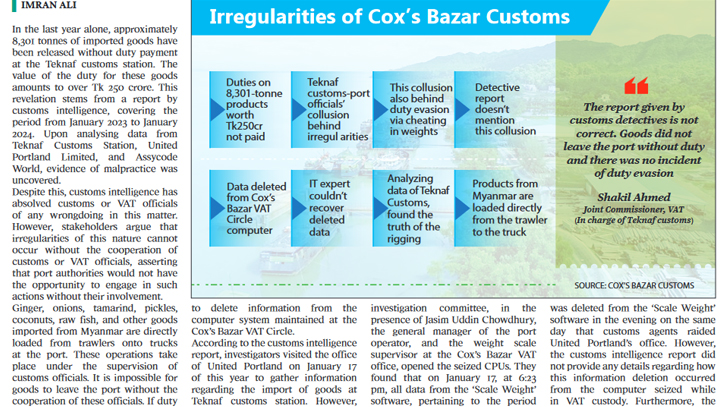

In the last year alone, approximately 8,301 tons of imported goods have been released without duty payment at the Teknaf customs station. The value of the duty for these goods amounts to several hundred crores of taka. This revelation stems from a report by customs intelligence, covering the period from January 2023 to January 2024. Upon analysing data from Teknaf Customs Station, United Portland Limited, and Assycode World, evidence of malpractice was uncovered.

Despite this, customs intelligence has absolved customs or VAT officials of any wrongdoing in this matter. However, stakeholders argue that irregularities of this nature cannot occur without the cooperation of customs or VAT officials, asserting that port authorities would not have the opportunity to engage in such actions without their involvement.

Ginger, onions, tamarind, pickles, coconuts, raw fish, and other goods imported from Myanmar are directly loaded from trawlers onto trucks at the port. These operations take place under the supervision of customs officials. It is impossible for goods to leave the port without the cooperation of these officials. If duty evasion occurs due to manipulation of weights, it is likely done in collusion with port customs personnel. However, the customs detective's report does not mention this aspect. Additionally, there is no indication of who might be involved in attempting to delete information from the computer system maintained at the Cox's Bazar VAT Circle.

According to the customs intelligence report, investigators visited the office of United Portland on January 17 of this year to gather information regarding the import of goods at Teknaf customs station. However, upon arrival, they discovered that the day before, on January 16, a team of 15 members from Chattogram VAT had conducted a search at the premises and seized four CPUs associated with weight scales along with a laptop.

Subsequently, on February 20, the investigation committee, in the presence of Jasim Uddin Chowdhury, the general manager of the port operator, and the weight scale supervisor at the Cox's Bazar VAT office, opened the seized CPUs. They found that on January 17, at 6:23 pm, all data from the 'Scale Weight' software, pertaining to the period until January 16, had been deleted from the computer system.

An IT expert from Cox's Bazar was brought in to attempt the recovery of the deleted information, but unfortunately, the efforts were unsuccessful. It appears that the data was deleted from the 'Scale Weight' software in the evening on the same day that customs agents raided United Portland's office. However, the customs intelligence report did not provide any details regarding how this information deletion occurred from the computer seized while in VAT custody. Furthermore, the report conveniently sidestepped any mention of involvement by customs and VAT officials.

In response to these developments, Chattogram VAT has rejected the findings of the detective's report.

In response to the situation, Joint Commissioner Shakil Ahmed of the Chattogram VAT Commissionerate, responsible for the Teknaf Customs Station, clarified that during their raid, they recovered two damaged and two operational computers along with one laptop from the Teknaf Customs Station. He noted that the day after their operation, Customs conducted their intelligence operations, as their objectives align in such matters. Ahmed stated that the customs intelligence report contains inaccuracies.

When questioned about whether goods had left the port without duty payment, Ahmed emphasised that their investigation did not uncover any incidents of duty evasion. However, they did identify some systemic errors. He added that their search did not yield information regarding the date of data deletion from the Customs Intelligence computer, and despite attempts, they could not retrieve any information for that date. After sending a letter to the port's General Manager, the information received did not reveal the expected loophole. Ahmed also mentioned discrepancies in the customs detective's calculations. Nevertheless, he assured that the port authorities would be able to account for the goods allegedly cleared without duty. He emphasised that the National Board of Revenue (NBR) could scrutinise the customs intelligence report and take action if any inaccuracies were found.

Additionally, officials from the Customs Intelligence and Investigation Department, including Joint Director Saifur Rahman, emphasised the need for further investigation. They vowed to take strict action against those involved in significant revenue evasion.

Messenger/Disha