Photo : Messenger

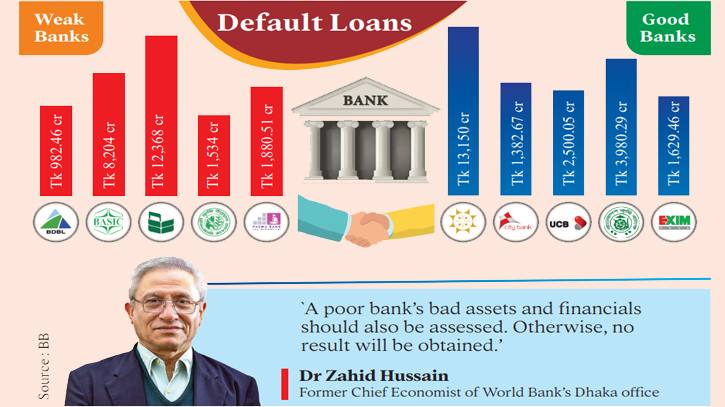

Five weak banks – three state-owned and two private ones – are being merged with a collective Tk 24,969 crore of default loans. The state-owned banks are Bangladesh Development Bank Limited (BDBL), BASIC Bank, and Rajshahi Krishi Unnayan Bank (RAKUB) while the private ones are National Bank and Padma Bank.

The process of merging BDBL with the state-owned Sonali Bank, BASIC Bank with the private sector’s City Bank, National Bank with United Commercial Bank, RAKUB with Bangladesh Krishi Bank, and Padma Bank with Exim Bank has started.

Among the banks to be merged with others, BDBL has default loans of Tk 982.46 crore. 42.46 per cent of the bank’s total disbursed loans are defaulted.

BASIC Bank’s default loans are Tk 8,204 crore, which is 64 per cent of its total disbursed loans. National Bank’s default loans amount to Tk 12,368 crore, which is 29 per cent of its total loans.

Besides, RAKUB’s default loans stand at Tk 1,534 crore, which is 21.37 per cent of its total loans. Padma Bank’s default loans amount to Tk 1,880.51 crore, which is 46.39 per cent of its disbursed loans.

The bad loan situation of banks with which weak banks are being merged is not that good either. According to the Bangladesh Bank data, Sonali Bank’s default loans amount to Tk 13,150 crore, which is 14.13 per cent of its total loans. This large public sector bank has no provision deficit.

United Commercial Bank’s default loans amount to Tk 2,500.05 crore, which is 5 per cent of its total loans. The bank has no provision deficit.

City Bank’s non-performing loan is 3.52 per cent of its total loans. The default loan amount of the bank is Tk 1,382.67 crore.

Another government-owned specialised Bangladesh Krishi Bank has default loans of Tk 3,980.29 crore, which is 12.64 per cent of its total loans. Exim Bank’s default loans amount to Tk 1,629.46 crore, and the Shariah-based bank has a default rate of 3.47 per cent.

Initially, it was proposed to merge 10 weak banks with relatively good ones. Banks in the red zone were also identified as weak ones.

But in the end, the central bank withdrew from that stance. It recently said not 10, but five weak banks are currently being merged.

The experience of the five banks will be revisited later, it added.

These banks became burdened with default loans and were mired in the lack of good governance, various irregularities, and corruption. The Bangladesh Bank gave guidelines at different times to appoint observers so that the banks could turn around, but no results have come. In the end, it decided to remove the existence of these banks by merging them with good ones.

Zahid Hussain, former lead economist at the World Bank’s Dhaka office, told The Daily Messenger which bank is merging with which one is important.

“It should also be seen whether the merger or acquisition is being done professionally. A poor bank’s bad assets and financials should be assessed as well,” he said.

“Otherwise, no result will be obtained if one bank is merged with another.”

Messenger/Fameema