Photo: Messenger

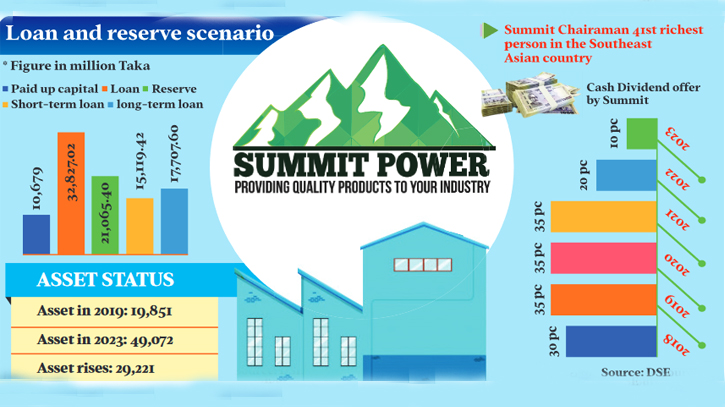

Summit Power Limited (SPL), the country's largest private sector power generation company, has borrowed a staggering Tk 32,827.02 million from various banks, while its paid-up capital stands at Tk 10,679 million. Of this total, long-term loans amount to Tk 17,707.6 million, and short-term loans to Tk 15,119.42 million.

As of June 30, 2019, the current assets value of SPL was Tk 19,851 million, while it stood at Tk 49,072 million on June 30, 2023. In the span of four years, it increased by Tk 29,221 million.

Although the company's reserves stand at Tk 21,065.4 million and its Other Comprehensive Income (OCI) is Tk 2,372.4 million, the company is reluctant to repay the loans.

Under Power Purchase Agreements (PPA), Summit Power establishes long-term, contractually backed concession agreements with governments and state utilities. In return, Summit Power International receives stable revenue streams based on contracted capacity payments.

Professor Shamsul Alam told The Daily Messenger, “Such malpractices have weakened the banking sector, creating a liquidity crisis in the banks, resulting in other entrepreneurs being deprived of loans.”

He added, “Due to the misuse of the banking sector, the entire economy of the country has been suffering. So, to tackle the sectoral crisis, the government is imposing price hikes on the people's shoulders.”

He commented, “These business tycoons have become the 'cancer' of the power and energy sector. They are highly pampered.”

He mentioned that not only that, but Summit Power also violated the agreement of the Meghnaghat Power plant. According to the agreement, electricity should be generated by furnace oil, but they use diesel, and the Power Development Board has paid the high bills.

Meanwhile, the company provided a 12 percent cash and 6 percent stock dividend to the shareholders in 2015, and in 2016, the company did not pay any dividend to the shareholders, according to the Dhaka Stock Exchange data.

Later, in 2017, the shareholders got a 30 percent cash dividend, while in 2018, the company provided a 30 percent cash dividend, and in 2019, 2020, 2021, the company has given a 35 percent cash dividend. But later, the company gradually declined the dividend. Due to profit decline, the company provided a cash dividend of only 20 percent in 2022 and only 10 percent in 2023.

Company Secretary Swapon Kumar Pal FCA did not comment on the issue even after repeated attempts through calls and emails. Other officials of the company also did not comment as they are not entitled to speak with the media.

Meanwhile, other power generation companies listed in the capital market are providing higher cash dividends than Summit Power. Doreen Power declared an 11 percent cash dividend, United Power declared an 80 percent cash dividend, and Shajibazar Power declared an 11 percent cash dividend for 2023.

Currently, Summit is the largest Independent Power Producer (IPP) in the country, reflecting 17 percent of Bangladesh's total private installed capacity and 7 percent of Bangladesh's total installed capacity. SPI owns and operates a total of 18 power plants in operation or under development with a total capacity of 2,255 MW, a further 277 MW through its associate company Khulna Power Company Limited (KPCL), and operates Bangladesh's second Floating Storage and Regasification Unit and LNG import terminal with a capacity of 500 mmcfd.

SPL was established on March 30, 1997, in Dhaka, Bangladesh. Muhammed Aziz Khan is the founding chairman of Summit. It is a subsidiary of Summit Power International based in Singapore. On June 7, 2004, Summit Power was made into a public limited company.

Bangladesh-born Aziz Khan, who lives in Singapore, also featured in the ‘Singapore's 50 richest’ list by Forbes in 2023. He was the 41st richest person in the Southeast Asian country.

Messenger/Disha