Photo: Messenger

Bangladesh's borrowing for major infrastructure projects, power projects, and other development activities has doubled in just seven years. A large part of the debt that Bangladesh is incurring now is going towards the repayment of that debt.

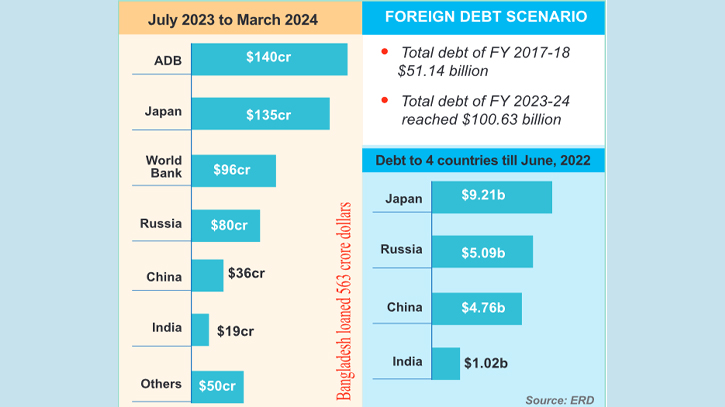

At the end of FY 2017-18, total public and private debt of Bangladesh was $51.14 billion, which reached $100.63 billion in the last quarter of FY 2023-24.

Bangladesh takes loans from international organizations as well as from different countries for the implementation of various projects and budget support.

According to the data of Economic Relations Division (ERD), Bangladesh has taken and is still taking maximum loans from Japan, China, Russia, and India under bilateral agreements.

With the increase in foreign debt, its interest and principal repayments are also increasing every year. By analysing various indicators of the economy, revenue collection, export trade, dollar crisis and reserve situation, economists fear that the economy of Bangladesh may come under more pressure in the future while repaying the foreign debt.

According to ERD data, the Bangladesh government's external debt was $55.60 billion as of June 2022. More than half of these loans or 57 per cent are to the World Bank and Asian Development Bank (ADB). Japan, Russia, China, and India are the four main countries from which Bangladesh has taken loans under bilateral agreements.

Bangladesh owes the most to Japan in terms of bilateral agreements. Bangladesh's debt to Japan is $9.21 billion. After that, Bangladesh owes $5.09 billion to Russia, $4.76 billion to China, and $1.02 billion to India.

Currently, this debt is much more. Because, in the current fiscal year from July 2023 to March 2024, Bangladesh has loaned 563 crore dollars. Among these, Bangladesh has taken the largest loan of 140 crore dollars from ADB and 96 crore dollars from the World Bank.

At the same time, 135 crore dollars was borrowed from Japan, 80 crore dollars from Russia, 36 crore dollars from China, 19 crore dollars from India, and 50 crore dollars from other sources under bilateral agreements.

Dr. Fahmida Khatun, Executive Director of the Centre for Policy Dialogue (CPD), told The Daily Messenger, “There remains a concern about debt repayment and thinking about the future. Of the $100 billion dollars, most of it, or $79 billion, is government debt. It's close to 17 per cent of the GDP, which is not a lot of pressure. The amount is much more than interest and principal.”

Meanwhile, Bangladesh's foreign debt repayment amount is also continuously increasing. In the current financial year, more than $3 billion have to be allocated in the budget for foreign debt repayment. It will exceed $4 billion in the coming years.

Ahsan H. Mansur, Executive Director of Policy Research Institute, told The Daily Messenger, “The tax-GDP ratio in Bangladesh is only 7.50 per cent compared to national income, which is a problem. The foreign debt in terms of taka has increased by almost 40 per cent. The value of the dollar has gone from Tk 82 to Tk 117. That means the government has to collect 40 per cent more revenue. It's a huge challenge. We have to keep the stability in the economy.”

Economists said that the income is not increasing according to the demand of Bangladesh. On the other hand, money laundering, higher education, and medical treatment abroad are costing billions of dollars more, which is a matter of concern. Also, the reality in Bangladesh is that there are delays in the implementation of major projects and cost overruns. Besides, the government has a huge debt burden in the power sector. Reserves are also continuously decreasing.

According to them, all the responsibility of foreign debt will ultimately fall on the shoulders of the people. The income of the government should be increased by collecting direct and indirect taxes from the people. The government is trying to increase the income tax in the next financial year as a direct tax. Again, indirect taxes, such as the decision to impose 15 per cent VAT on metro rail tickets are being heard. If these decisions are passed in the budget, people will have to pay more tax as direct and indirect taxes.

The annual development programme (ADP) that the government is planning to implement for the fiscal year 2024-25 amounts to Tk 2 lakh 78 thousand crore. Of this, a record Tk 1 lakh crore of funding is planned from foreign sources.

Messenger/Disha