Photo: Messenger

It is said that the impact of the conditions for the International Monetary Fund’s (IMF) Bangladesh loan programme on the FY25 budget is quite large. In particular, several suggestions of the lending agency to increase revenue collection are being reflected in the budget. This information is known from sources at the Finance Division under the Ministry of Finance and the National Board of Revenue (NBR).

Those concerned said that the government used to prepare the budget on its own before. However, after the IMF loan approval on January 30 last year, the current budget reflects the conditions of the organisation. It is now becoming clearer in the upcoming budget. According to the people concerned, the IMF conditions are generally good for a country's economy.

However, if all the conditions are implemented together in a weak economy, it can be counterproductive.

It has been reported that Finance Minister Abul Hassan Mahmood Ali will present the new budget titled “Commitment to Build a Happy, Prosperous, Advanced and Smart Bangladesh” in parliament on June 6. It will contain the announcement of the implementation of the IMF conditions. One of the conditions of the IMF loan programme is that the tax-GDP ratio should be increased by 0.5 per cent in the next financial year.

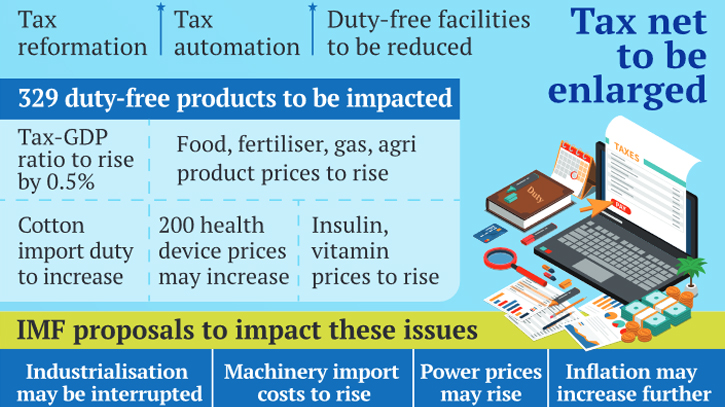

In order to increase revenue, the agency has suggested expanding the scope of taxes, reforming the tax administration, and automating the collection process as well as reducing tax exemptions and duty-tax exemptions to zero within the next three fiscal years. Accordingly, the NBR has for the first time adopted a strategy to increase revenue by reducing tax exemptions and duty-tax concessions in the upcoming budget.

As part of this, more than half a hundred zero-duty products may be subject to import duty at the rate of 1 per cent from the next financial year. At present, 329 products are duty-free. This list includes food products, fertilisers, gas, pharmaceutical raw materials, agricultural materials, etc. In the next budget, 15-20 per cent of the products on the list may be subject to a minimum 1 per cent duty. The initial list of products that are being considered for 1 per cent import duty includes wheat, maize, mustard seeds, cotton seeds, various vegetable seeds, coal, gypsum, vitamins, penicillin, insulin, various chemicals, plastic coils, paper boards, steel products, industrial raw materials, machinery parts, etc.

In this regard, Professor Dr Wahiduddin Mahmud, former advisor to the caretaker government, told The Daily Messenger, “There is no reason to believe that the IMF knows too much about the economy of Bangladesh. Apart from that, the IMF goes to all countries and gives the same formula. But one policy does not apply to all countries. Therefore, the advice of the IMF should be accepted considering the interests of the country and the people.”

Meanwhile, referrals or specialised hospitals are allowed to import medical devices and equipment under duty-free facilities at 1 per cent duty, subject to compliance with certain conditions. In the next budget, it may be increased to 10 per cent in case of importing more than 200 medical devices and equipment. At the same time, value added tax (VAT) may be increased on some locally manufactured electronics products that are currently exempt from tax. VAT may also increase on products like liquefied petroleum (LP) gas cylinders. However, despite the IMF's advice not to increase the tax exemption in the information and technology sector, the facility may remain for a few more years.

The new VAT law has a standard VAT rate (15 per cent). However, due to various reasons, it could not be retained. For this, VAT is being collected at multiple rates. This rate will be rationalised in the next budget. In this case, NBR plans to increase the VAT rate on non-essential products. Standard VAT rates will be imposed on all goods and services in a phased manner by 2026.

In this regard, Dr Salehuddin Ahmed, former governor of the Bangladesh Bank, told The Daily Messenger that all the conditions given by the IMF for the loan are good for the economy. “But we have to consider where and in what context they can be used. The NBR is already under pressure to collect revenue. Now, to comply with their terms, care must be taken not to contradict the interests.”

Despite the rise in inflation, the tax-free income limit is not increased in the new budget as a revenue-raising strategy aimed at raising income tax. Besides, there may be a decision to impose “capital gain” tax on profits of more than Tk 40 lakh by investing in the capital market. This rate can be 15 per cent. There are steps to collect additional tax from the rich in the budget. The maximum tax rate for individual taxpayers is being increased from 25 per cent to 30 per cent.

Additional duty on cigarettes and mobile phone calls or internet may be announced in the upcoming budget. Additional duty of 5 per cent may be added in these cases. At present, 7.50 per cent VAT is charged on entry and rides in amusement parks and theme parks. There are plans to increase it to 15 per cent. VAT on soft drinks, carbonated beverages, energy drinks, and fruit juices may be increased from 5 per cent to 10 per cent. Besides, the minimum tax on carbonated beverages may be increased by another 2 per cent to 5 per cent.

Another major condition of the IMF is that subsidies should be reduced, especially on energy and electricity, for the sake of proper budget management. The agency suggested expanding the social protection programme with the subsidy reduction money. The government is already coordinating with the international market to determine the prices of fuel to remove the subsidy. In addition, there is a plan to increase the price of electricity four times in the next financial year as well.

In this regard, SM Nazer Hossain, vice-president of Consumers Association of Bangladesh (CAB), told The Daily Messenger, “Indirect tax hikes that will have the same effect on both the rich and the poor are an injustice to the people, which is not acceptable for a welfare state. We think there should be ability-based tax. So, one should be more careful in making such decisions. If these initiatives are taken only to implement the conditions of the IMF loan programme, the discontent among the people will increase.”

Officials of the Ministry of Finance said that the government is currently subsidising electricity to the tune of Tk 3,000 crore per month. If the new plan is implemented, this subsidy will come down to Tk 2,000-2,500 crore by the end of the next financial year. Similarly, the government has decided to reduce the subsidy in this sector to zero within the next three financial years.

On the advice of the IMF and considering the current economic situation, the next budget is expected to be very contractionary. There will be initiatives to reduce the budget deficit and debt from savings bonds to negative levels. According to sources in the Ministry of Finance, the budget of Tk 7 lakh 96 thousand 900 crore is being finalised. This is 4.60 per cent higher than the current budget. In the previous financial years, the budget was usually given with a growth of 12 to 15 per cent over the previous year.

Messenger/Disha