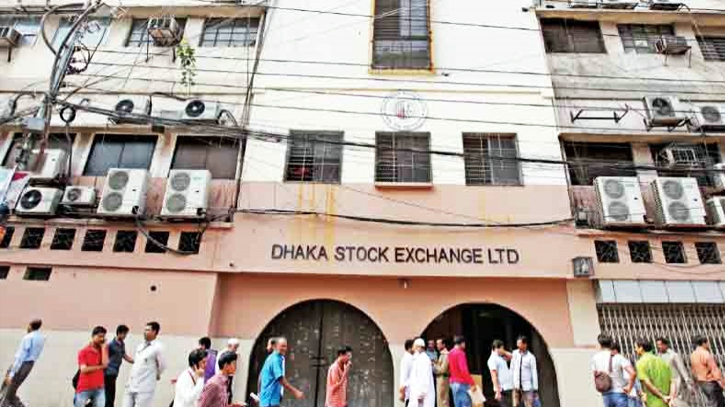

Photo: Collected

The proposed budget for the financial year 2024-25 leaves nothing for the capital market. Even during the recession, the stock market has not received incentives. On the contrary, capital gains have been taxed. All stakeholders, including investors, are unhappy with this. However, the Dhaka Stock Exchange (DSE) is quite happy despite not getting anything.

This information was revealed in a press release sent by DSE Deputy General Manager Md Shafiqur Rahman on Friday. It said that Finance Minister Abul Hassan Mahmood Ali has proposed the budget for FY2024-25 to build a happy, prosperous, developed and smart Bangladesh with the priority of controlling inflation, diversifying export products, creating employment and increasing opportunities for the marginalised people. He presented a budget of Tk 7 lakh 97 thousand crore. For that, Chairman of the Dhaka Stock Exchange Dr Hafiz Muhammad Hasan Babu offers hearty congratulations.

The press release also said, “The DSE is of the view that the budget has been enacted with a strategy to accelerate the economy through developmental and productive activities. The budget proposed for the fiscal year 2024-25 envisages building a happy, prosperous, developed, and smart Bangladesh by 2041. Dhaka Stock Exchange Chairman Prof Dr Hafiz Muhammad Hasan Babu is congratulating the budget proposal.”

However, the finance minister proposed a new tax on capital gains in the budget. Even before the budget, all parties concerned with the stock market, including the DSE itself, had demanded that no new tax be imposed on individual investors. But that demand was not fulfilled in the end.

In this regard, an investor named Azad Ahsan Bachchu told The Daily Messenger that the capital market of the country has been in dire straits for a long time. “Because of this, investors expected that the government will take steps to develop the capital market in the budget. But instead of giving any benefit in the budget, capital gains tax has been imposed, which is very sad. And it is even sadder to congratulate this budget on behalf of DSE.”

The finance minister proposed in the budget that individual investors will not be taxed on capital gains up to Tk 50 lakh. However, if the profit is more than Tk 50 lakh, it will be taxed. It is also proposed in the budget that the profit made by any corporate entity other than individual investors by investing in the stock market will be taxed.

People related to the capital market said that 90 per cent of the investors in the stock market are institutional investors. They include entrepreneur-directors of various companies, placement shareholders, stock brokers, and dealers. All institutional investors are taxed on capital gains at a minimum rate of 5 per cent to a maximum of 10 per cent. Capital gains are not taxed only by ordinary individual investors, who account for only 10 per cent of total investors in the stock market.

After the issue of taxation on capital gains was published in the media, the issue came into discussion. As a result, before the budget proposal, Dhaka Stock Exchange (DSE) and Chittagong Stock Exchange (CSE) held a press conference and demanded not to impose this tax. However, the finance minister did not meet that demand until the end.

Apart from this, it was also demanded to increase the corporate tax rate gap between listed and unlisted companies to encourage listing of good companies in the stock market. Along with this, the DSE authorities demanded to reduce the tax rate of listed companies to 17.5 per cent. And in case of unlisted companies, it was demanded to be increased from 37.5 to 40 per cent. But the finance minister did not take those demands into consideration.

In this regard, stock market analyst professor Abu Ahmed told The Daily Messenger, “The proposed budget is disappointing for the capital market. Nothing is there for the sector. Even if the previous incentive system is kept, now it is far away – all the privileges of the capital market are being removed by imposing new taxes.”

He also said, “The stakeholders gave various proposals to the government before the budget, but in reality, there is no reflection in the budget. As a result, the efforts of BSEC, DSE or related stakeholders to improve the capital market are killed through the budget.”

Messenger/Fameema