Photo: Messenger

India-based power plant Adani has suspended electricity supply to Bangladesh, exacerbating the country's ongoing power crisis. This coincides with several other major power plants in Bangladesh undergoing simultaneous maintenance.

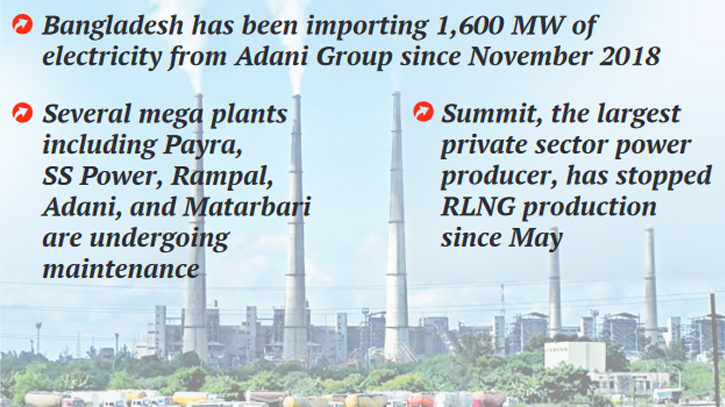

According to the Bangladesh Power Development Board (BPDB), Bangladesh has been importing 1,600 MW of electricity from the Adani Group since November 2018. A Power Purchase Agreement (PPA) between BPDB and Adani Power was signed in November 2017 for 25 years, with electricity transmitted through a 400kV dedicated transmission line connected to Bangladesh's national power grid, operated by Power Grid Company of Bangladesh Ltd (PGCB).

An official from the Power Development Board confirmed to The Daily Messenger that Adani has gradually ceased power supply to Bangladesh. He also mentioned that the Payra plant has reduced generation due to coal shortages.

The Power, Energy, and Mineral Resources Ministry has requested the Finance Division to disburse Tk 3,800 crore to pay bills owed to the Indian Adani Group for electricity imports.

Officials said they have written to the Power Division seeking funds as a subsidy from the 2023-2024 fiscal year budget to ensure uninterrupted power supply.

BPDB data from June 27 shows Adani supplying 350 MW, Rampal (1,320 MW capacity) supplying 550 MW, and Payra (1,320 MW capacity) supplying 620 MW. Matarbari, with a 1,200 MW generation capacity, did not supply electricity on that day but had supplied 502 MW on May 28.

Senior Secretary Md. Habibur Rahman of the Power Division told The Daily Messenger on Thursday, “The mega plants Payra, SS Power, Rampal, Adani, and Matarbari are undergoing maintenance.” He added that Payra would resume operations within 2 to 3 days, while Matarbari and SS Power's electricity would not be available until the transmission project is completed. Adani was expected to increase power supply on Thursday night but stopped supply on Saturday.

On Saturday, the senior secretary said, “Outstanding payments are a continuous process. We are paying previous bills and creating new ones, so it's a common phenomenon between partners. I hope Adani will resume supplying electricity from one unit by tonight.”

Professor Shamsul Alam, energy advisor to Consumers Association of Bangladesh (CAB), told The Daily Messenger, “It's not possible for all plants to undergo maintenance simultaneously. There should be planning for maintenance. It's clear that they have to cut and stop generation due to dues.”

He added, “If we don't import from Adani, we'll lose more as the plant factor of Adani is 95. As a result, the capacity charge for Adani is high.”

Professor Alam noted that the cost of the Adani plant is high because the government did not follow competitive procedures when awarding the contract to the Adani Group.

An official from BPDB said that although there were discussions with India about paying dues in Rupees, Adani insists on receiving payment in dollars as per the agreement.

The government is also struggling to purchase LNG and coal due to fund shortages. Summit, the country's largest private sector power producer, has stopped RLNG production since May due to unpaid bills.

Dr. Ahsan H. Mansoor, Executive Director of the Policy Research Institute of Bangladesh (PRIB), told The Daily Messenger, “The electricity import contracts with foreign entities should have been negotiated more carefully. If we pay more per unit of electricity, we'll need more dollars if we want to pay in that currency.”

He also noted that banks are unable to take on more of the government's power sector loans and emphasised the need for a long-term plan to address electricity bills.

However, analyzing the import data from India, Adani is charging more than double. The per-unit cost for the fiscal year 2022-2023 is as follows: NVV LTD 250 MW India at Tk 4.22, NVV LTD 160 MW Tripura India at Tk 8.45, NVV LTD 300 MW India at Tk 7.15, PTC India 200 MW at Tk 9.5, and Sembcorp Energy Ltd at Tk 9.95.

As of February, the import bills of Indian companies stood at Tk 3,637.16 crore for Adani, Tk 667.04 crore for Sembcorp Energy Ltd, Tk 586.06 crore for PTC India (200 MW), Tk 65.46 crore for NVV LTD (160 MW Tripura), and Tk 61.93 crore for NVV LTD (250 MW India).

The total outstanding amount for imports from India aggregated to Tk 5,297 crore, with Tk 3,637.61 crore owed to the Adani Group alone. As of February 2023, the Bangladesh Power Development Board's (BPDB) total outstanding debt stood at Tk 33,108 crore.

Messenger/Disha