Photo : TDM

Taking excess loans from the country’s banking sector to meet budget deficit may result in negative impact on investment in the private sector as well as employment.

Expressing fear in this regard, economists said the overall resulting effect may not be good for the economy.

The size of the proposed budget for the financial year 2023-24 has been estimated at Tk 7,61,785 crore. Of this, the National Board of Revenue (NBR) and non-NBR revenue collection targets have been set at Tk 5,00,000 crore. As a result, the budget deficit stood at Tk 2,61,785 crore.

To meet this shortfall, a total of Tk 1,55,395 crore of borrowing from domestic sources has been targeted, while Tk 1,06,390 crore will come from foreign sources (including grants). The government plans to take Tk 1,32,395 crore or 50.6 percent from the banking sector.

Economists said banks themselves are now suffering from liquidity crisis. In this situation, the central bank has to print money to meet the government’s loan demand. In the current fiscal year too, Bangladesh Bank has exceeded printing Tk 70,000 crore for government lending. They said dependence on bank borrowing is increasing due to inefficiency in revenue collection.

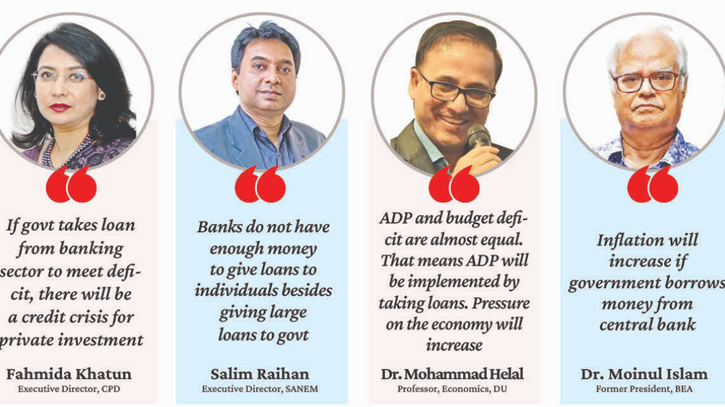

According to Center for Policy Dialogue (CPD) Executive Director Dr Fahmida Khatun, the government’s dependence on debt can create various crises in the economy.

She said if the government takes loan from the banking sector to meet the deficit, there will be a credit crisis for private investment. Thus, growth will be hindered on one hand, employment opportunities on the other hand will shrink. And if Bangladesh Bank prints money and gives loans to the government, inflation may increase.

The managing director of a private bank, who did not want to be named in this regard, said to The Daily Messenger, “Usually, private banks are supposed to give loans to individuals. However, sometimes the government also takes loans from private banks due to the circumstances that arise. If the amount of debt taken by the government is high, it is normal for other sectors to suffer.”

Executive Director of the South Asian Network on Economic Modeling (SANEM) Dr Salim Raihan said, “If the government takes a loan from a commercial bank, individual entrepreneurs may be deprived. In this budget, individual entrepreneurs are expected to make large investments. So where will they get the money to invest? They will go to the banks as our capital market is very weak. Now the banks do not have enough money to give loans to individuals besides giving large loans to the government.”

On the other hand, if the government borrows from the central bank, then they will print notes. This may have an impact on inflation, which may increase further. Last year, the central bank lent Tk 70,000 crore to the government. It is debated whether this has an impact on the inflation that is now rising.

Professor of Economics at Dhaka University Dr. Mohammad Helal said, “Our annual development programme (ADP) and budget deficit are almost equal. That means ADP will be implemented by taking loans. But its size will increase when interest and principal are to be paid back. Also, pressure on the economy will increase.”

Former President of Bangladesh Economics Association Professor Dr. Moinul Islam said, “If the domestic debt ratio is less than five percent of the GDP, then there is no problem. But more than that is a problem. The government has to incur this debt due to inefficiency in revenue collection. The foreign debt burden in the next budget will be four billion dollars. He thinks that inflation will increase if the government borrows money from the central bank.

Meanwhile, Bangladesh’s foreign debt has got doubled over the past seven years, according to BB. The total foreign debt of the country was 95.23 billion dollars in the financial year 2021-22, which was 41.17 billion dollars in the financial year 2015-16.

The per capita foreign debt has now stood at $558.

TDM/SD