Photo : TDM

In the face of a continuous decline in garment exports to traditional markets, the Bangladesh Garment Manufacturers and Exporters (BGMEA), the apex trade body of garment makers, has embarked on a new branding strategy: "Made in Bangladesh." The aim of the branding is to tap into the growing demand for garments in nearer Asian destinations.

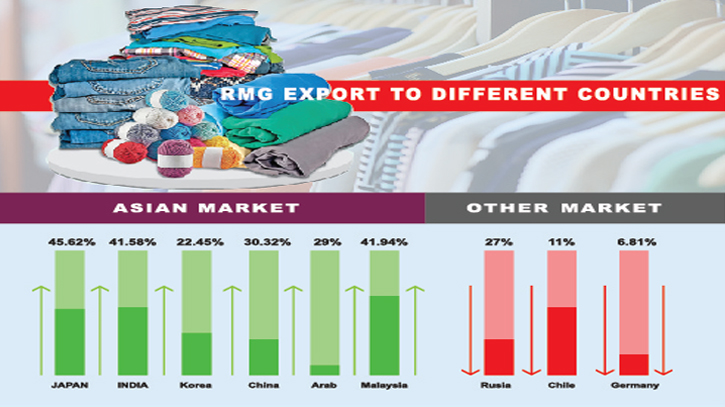

According to recent data from the BGMEA for the fiscal year 2023, apparel exports to various Asian countries have witnessed a significant increase. Bangladesh's garments exports to India surged by 41.58 percent, Japan by 45.62 percent, Korea by 22.45 percent, China by 30.32 percent, Saudi Arabia by 29 percent, and Malaysia by 41.94 percent.

However country’s garments export to Germany showed a decline of 6.81 percent, Russia 27 percent and Chile 11 percent. In the just ended fiscal year, export to EU increased by 9.93 percent, the UK by 11.78 percent, and Canada by 16.55 percent.

Notably, Bangladesh earned $1.01 billion from India, $1.59 billion from Japan, $503 million from Korea, $2289 million from China, $292 million from Arab countries, and $297.09 million from Malaysia. Exporters believe that during the war, as importers sought nearer destinations to shorten lead times, Asian countries expanded their imports of garments from Bangladesh. Additionally, businesses are increasingly expanding into Asian markets due to relaxed factory rules and regulations imposed by Asian buyers.

"Garments exports to all markets have been steadily increasing as Bangladesh has become a dependable country," stated Sahahidullah Azim, Vice President of BGMEA to The Daily Messenger. "Furthermore, as non-conventional markets, we receive a 4 percent incentive for exporting to Asian countries," added Azim.

One crucial advantage for buyers is the shorter lead time of 10 to 12 days for delivering products to Asian countries, compared to the 35 to 40 days required for Europe and America. The proximity of Asian destinations allows buyers to reduce freight charges significantly. Importantly, buyers are also more relaxed about factory rules and regulations in Asian countries, Azim added.

"The fiscal year has ended with positive growth, which is essential for the overall economic situation. The readymade garment (RMG) sector, in particular, achieved double-digit growth, and other sectors like man-made filament also saw growth last fiscal year, which will have a positive impact on the country's reserves," commented Khondaker Golam Moazzem, Research Director of the Centre for Policy Dialogue (CPD).

Moazzem acknowledged that while missing export targets presents a challenge for the central bank, the overall positive growth could help address the economic crisis. He emphasized the need for the central bank to closely monitor whether exporters are repatriating their export earnings properly. Moazzem also called on the government to establish a unified exchange rate for the dollar to encourage exporters.

Addressing the export relationship with the USA, Moazzem stated that there are no political complexities affecting trade. Although the US economy is struggling with unemployment and stagflation, Bangladesh's garment exports have not been affected. He expressed optimism that when the US economy stabilizes, Bangladesh's garment exports to the country will increase.

It is worth noting that garment exports faced a decline in 2020 due to COVID-19 restrictions on global ports. However, the loss was recovered in 2021, only to face setbacks again in 2022 due to war and severe inflation, which led to a reduction in work orders.

Bangladesh's main exports to the global market consist of trousers, shirts, skirts, blouses, underwear, and sweaters, according to the BGMEA. In 2023, the country generated $46.99 billion from the global market, as reported by the trade body.

END/TDM/ARS