Photo : Courtesy

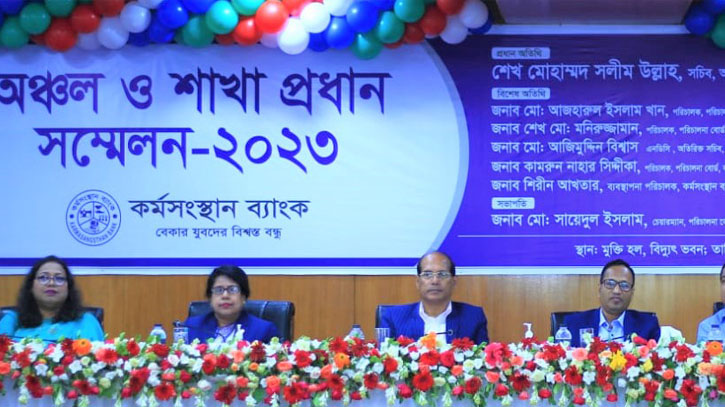

Karmasangsthan Bank Regional and Branch Head Conference-2023 was held on 22 July 2023 at the release of Biddut Bhaban in the capital Dhaka.

Chairman of the board of directors of the bank and former secretary of the People's Republic of Bangladesh, Md. Sayedul Islam, as the chief guest, Sheikh Mohammad Salim Ullah, secretary of the financial institutions department of the Ministry of Finance, was present on the occasion. Director General of NGO Affairs Bureau SK. Md. Moniruzzaman, Additional Secretary of National Skill Development Authority Quamrun Naher Siddiqui, and Managing Director Shirin Akhter were present as special guests. Besides, Additional Secretary of Financial Institutions Department Md. Azimuddin Biswas was present as a special guest. Meanwhile, Deputy Managing Director of the bank Meher Sultana, General Manager Mr. Gautam Saha and General Manager Mahmuda Yasmin along with high officials of head office, all divisional head and audit officers, all regional managers and branch managers of 277 branches were present in the conference.

In his speech, the Chief Guest emphasized on creating more jobs by taking advantage of the demographic dividend. In the recently concluded financial year 2022-23, the amount of classified loans of the Karmasangsthan Bank is Tk 90 crore 17 lakhs which is only 2.72% of the total loans. The bank disbursed loans of Tk 2358.98 crore and collected Tk 2108.97 crore in the financial year 2022-23. In FY 2022-23 compared to FY 2021-22, the bank achieved growth of 27% and 22% respectively in loan disbursement and loan collection. The state-owned bank has achieved an operating profit of Tk 87.07 crore in the recently concluded financial year, increasing its profit from Tk 64.28 crore in the financial year 2021-22 after record success in all indicators indicating business targets. The profit growth rate is 36% which is the highest since the establishment of the bank.

TDM/SNE