Photo : Messenger

The government, in its desperate bid to rapidly boost electricity generation and alleviate the severe issue of power crunch in the country, has greenlit short-term power generation projects with substantial associated costs, which have now emerged as a significant challenge for the country.

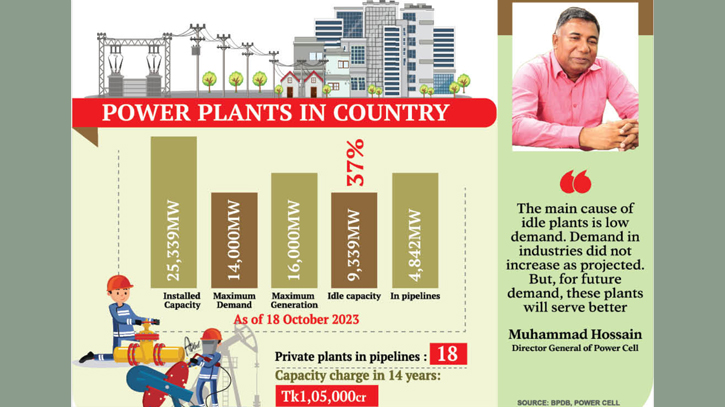

As per data from the Bangladesh Power Development Board (BPDB), more than 37 percent of the country’s installed power capacity lies dormant, yet the government remains liable to pay capacity charges.

At present, the nation's installed capacity stands at 25,339MW, while the maximum demand is 16,000MW – with the routine peak generation reaching 14,500MW.

Experts are of the view that although the demand hasn't surged as initially projected, the country's power generation capacity is on an upward trajectory.

Currently, a substantial 40-50 percent of production capacity remains untapped, and this proportion is poised to grow in the foreseeable future.

Quite strikingly, these idle power plants continue to accrue capacity or rental charges as stipulated by their contractual agreements.

Muhammad Hossain, Director General of Power Cell, a pivotal planning arm of the Power Division, told The Daily Messenger, "The primary reason behind these dormant plants lies in the subdued demand. The industrial demand hasn't materialized as envisaged. Nevertheless, these plants are anticipated to serve as a valuable asset in meeting future demand."

Over the past 14 years, private power plant owners have reaped more than Tk 1 lakh crore from the government within this sector. Furthermore, there are an additional 54 power plants in the pipeline, and if brought online, they will bear the onus of capacity charges until 2050.

Experts argue that the government, in negotiations concerning capacity charges with private power plant proprietors, has not adequately safeguarded its own interests. Moreover, the approval of supplementary and costly power plants to cater to growing demand has predominantly safeguarded the interests of power producers.

Professor M Shamsul Alam, Consumer Advisor for the Consumers Association of Bangladesh (CAB), told The Daily Messenger, "The operation of these plants will escalate the pressure of capacity payments. To defray these expenses, the government may find it imperative to raise the cost of electricity."

He added that power plants operate at only 45 percent of their capacity throughout the year, and 18 plants with a combined capacity of 4,842MW, slated for future operation, will continue incurring charges until 2050, thereby imposing an additional burden on the public.

A recent report from the Planning Commission's Implementation, Monitoring, and Evaluation Department (IMED) highlighted the severe strain on Bangladesh's foreign currency reserves and budget due to the power sector's development, which appears to follow a 'looting' model.

Md. Habibur Rahman, Senior Secretary of the Power Division, told The Daily Messenger, "Ideally, there should be 15-20 percent excess production capacity compared to demand, catering to maintenance and peak-time load management. However, ideally the generation capacity needs to be 30 percent more than the demand."

Recent disclosures from the Minister of State for Power revealed that, during the three terms of the current government until June 30, 73 Independent Power Producers (IPPs) and 30 rental power plants have collectively received approximately Tk 1,05,000 crore in capacity charges.

The Summit Group claimed the highest capacity charges, totaling around Tk 17,610 crore for its 9 power plants, while US-based Agrico International received Tk 8,310 crore for its 7 facilities, and the United Group was granted Tk 7,758 crore for its six plants."

Messenger/Jannatul/Disha