Photo : Messenger

Factories in the country’s industrial belts have demanded scheduled loadshedding and quality power for better productivity in the context of ongoing power supply disruptions due to a shortage of primary fuel.

The government is unable to import a sufficient amount of coal, LNG, and fuel oil due to an acute dollar crunch – thereby causing load shedding in power plants. As a result, factories cannot run their production smoothly within the standard eight working hours. They are event uncertain about when load shedding will occur again.

To address this crisis, product makers want scheduled load shedding so that they can plan production around available electricity. Furthermore, they are willing to implement night shifts if power distributors can guarantee uninterrupted power supply.

Shahedul Islam Helal, Managing Director of Bengal Pacific Pvt Ltd, told The Daily Messenger, “In fact, we are in the dark. We don't know when load shedding will occur, so I can't predict how many hours I need to halt production. For every hour of interruption, I incur significant losses. With the right information, I can manage the factory.”

He also provided data on the factory's load shedding experiences. He said that on October 5, they faced load shedding five times, and throughout October, there were only three load-shedding-free days in Savar and Narayanganj. It takes one minute to make 200 bags. If production is interrupted for one hour, it results in a loss of 12,000 units.

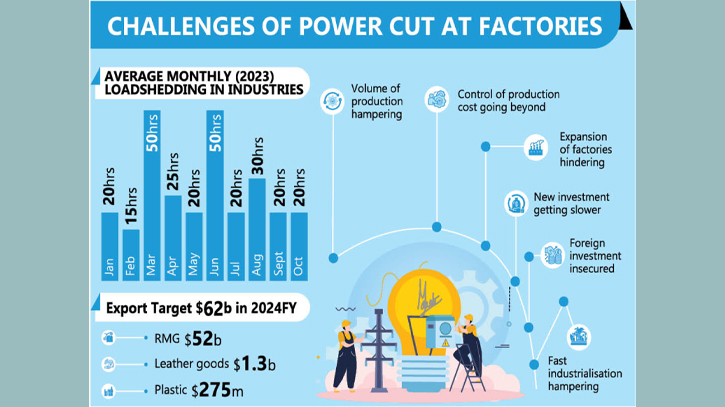

Helal shared data on load shedding for different months, indicating that in January, there were 24 hours of load shedding, March had 50 hours, June had 50 hours, July had 20 hours, August had 30 hours, and September had 20 hours. The unpredictable load shedding patterns have made it challenging to maintain a stable factory operation schedule and control costs.

He added that his plastic factory uses high-precision machines that are sensitive to power fluctuations. Consequently, the machines are used less frequently, and spare parts are often ordered due to frequent disruptions.

The government has assured the industry of uninterrupted power supply, even increasing the gas price by $30.5 per cubic feet, despite the buying price being only $14 per cubic feet. Unfortunately, the government has failed to fulfill this commitment due to the dollar crisis.

Humayun Rashid, CEO of Energypac, told the Daily Messenger, “To ensure an adequate supply of quality power, the government has raised gas prices by over 50 percent. We were in agreement, but since June, we have been facing a power crisis.”

Furthermore, he warned that the target of exporting $50 billion may be jeopardized if the power supply remains unreliable. He said, “We have set a target to export $50 billion next year, and this will be a challenge due to the lack of uninterrupted electricity.”

He thinks that the government should inform the industry of the load shedding schedule at the beginning of each month so that businesses can plan their working hours. He also pointed out that the absence of a smart grid for power transmission is another challenge the government needs to address.

Helal emphasised that the uncertainty about load shedding times makes them feel insecure, affecting employment security, investments, production costs, and timely repayment of bank loans. He also stressed that foreign and local investments depend on a stable power and energy supply, and without it, local investors may hesitate to invest in the manufacturing industry.

Muhammad Hatem, the Executive President of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), said, “Currently, what the RMG industry needs most is quality power, not additional facilities. To remain competitive, we must have an uninterrupted electricity supply.”

According to the Export Promotion Bureau (EPB), the export targets for 2023-24FY are RMG at $52 billion, leather and leather goods at $1.3 billion, and plastic goods at $275 million.

LNG prices have fallen from $50 to $14 per cubic feet. In the international market, Brent crude futures were down 47 cents, or 0.5 percent, at $89.38 per barrel, as reported by the news agency Reuters on October 23.

Messenger/Jannatul/Disha