Photo : Messenger

Banks are increasingly turning to legal action as their efforts to collect loans through standard procedures have proven unsuccessful. Consequently, the volume of cases in Orthoreen Adalat (Money Loan Court) is steadily rising. However, despite the escalating number of cases, the rate of resolution is not keeping pace with this increase.

Bank officials have expressed concern over the substantial financial exposure associated with these cases, which is leading to a decline in the banks' profits. This situation is causing banks to lose momentum in their overall operations, and it is also having a detrimental effect on the country's economy.

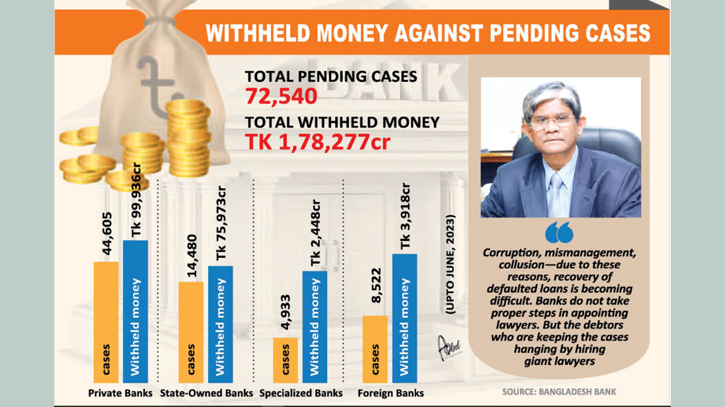

Based on data from Bangladesh Bank, as of last June, there were 72,540 pending cases in the Orthoreen Adalat, involving approximately Tk 1,78,277 crore. In comparison, in December of the previous year, there were 72,189 pending cases with a total amount withheld at Tk 1,66,887 crore. This indicates that in the first six months of the current year, not only have new cases emerged, but the amount of funds stuck in these cases has also increased.

Economists have pointed out that a significant portion of these loans has been acquired through various irregularities and fraudulent means. Consequently, collecting these loans through the conventional methods has become increasingly challenging. Despite multiple incentives and concessions extended to defaulters, they are not repaying the loans. To address this issue, banks have resorted to litigation in the Orthoreen Adalat to recover these loans. However, for various reasons, the resolution rate of these cases remains quite low.

Dr Salehuddin Ahmed, former governor of Bangladesh Bank, told The Daily Messenger that insufficient measures are being taken in the loan recovery process, highlighting a lack of effective action by the bank. Furthermore, the collateral held against these loans often turns out to be non-genuine. When bankers attempt to visit the listed addresses, they often find that there is no tangible asset or property.

“Recovery of defaulted loans is becoming difficult due to corruption, mismanagement, and collusion. In this case, the banks are not able to control everything with a firm hand. In many cases, the investigation has to be delayed. Many people are trying to save themselves from being defaulter by filing writs in the court as these loans were taken for illegitimate purposes,” he added.

The former governor also said that due to lack of judges, thousands of cases are pending in the Financial Court. In this case, the banks do not take proper steps in appointing lawyers. Banks should hire expert lawyers. But it is the debtors who are keeping the cases hanging by hiring high profile lawyers. Banks should be more active in this regard. All activities including case management should be world class. Administrative action should be taken against defaulters, he added.

According to the report of Bangladesh Bank, in the first six months (January-June) of this year, the amount of money claimed by the bank in the cases filed in the court increased by Tk 11,390 crore. At the same time, pending cases increased by 351.

Among these, the number of pending cases of private banks is the highest. They have Tk 99,936 crore withheld against 44,605 cases. Their impounded amount was Tk 88,858 crore against 43,153 cases in December last year.

On the other hand, at the end of last June, the number of pending cases of the state-owned banks stood at 14,480. Against this, the outstanding amount stood at Tk 75,973 crore. Six months ago, the number of pending cases was 15,604 and the outstanding amount was Tk 71,764 crore. Meaning that, in six months, the number of cases of the state-owned banks has decreased, but the amount of money stuck has increased.

Besides, the number of cases of specialized banks stood at 4,933 and Tk 2,448 crore is stuck in these cases. On the other hand, the number of cases of the foreign banks is 8,522 and the amount of money stuck in these cases is Tk 3,918 crore.

In such a situation, the Governor of Bangladesh Bank, Abdur Rouf Talukder, has given various instructions to the banks for quick settlement of the cases of defaulted loans in the bankers’ meeting. It has been reported that the action plan-G part of the legal department of Bangladesh Bank’s strategic plan 2020-2024 related to Objective 9-4 (B) includes the issue of monitoring defaulted loans under litigation of banks and financial institutions.

In line with the strategic plan of the central bank, which aims to reduce the level of defaulted loans in banks and financial institutions, a decision was made in December 2021 to carry out regular supervisory activities by the law department. The primary objective of these actions is to expedite the resolution of pending cases. Consequently, the law department offers consistent guidance, advice, and various forms of assistance to banks in their efforts to achieve prompt settlements in these related cases.

However, despite these efforts, cases pertaining to the recovery of defaulted loans in banks are still being settled at a slower rate. Several factors contribute to this issue, including the shortage of financial loan courts, a scarcity of judges, and the inability to provide adequate time and necessary documentation to the bank's legal representatives to obtain legal opinions, all of which hinder the expeditious resolution of these cases.

In this regard, Syed Mahbubur Rahman, former chairman of Association of Bankers Bangladesh (ABB) and Managing Director (MD) of Mutual Trust Bank, told The Daily Messenger that due to various reasons including the length of the legal process, there is a delay in settling the cases in the Orthoreen Adalat.

“Sometimes judges are on leave or transferred. Besides, there is also a shortage of experienced lawyers. Another problem is that when the case is filed, the debtors file writ against it and take a stay order,” he added.

Messenger/Disha