Photo : Collected

The Dhaka Mercantile Co-operative Society Limited (DMCS) illegally used the word 'Bank' in their organisation's name, in defiance of Bangladesh Bank's instructions, thereby deceiving the public.

A central bank investigation report in 2016 revealed that despite the ban on using the term 'bank' in the name of cooperative societies, several institutions continued to engage in banking activities. One such institution was The Dhaka Mercantile Cooperative Society Limited.

These institutions not only engaged in banking activities but were also involved in money laundering. Then the Governor of Bangladesh Bank Fazle Kabir expressed profound dissatisfaction with this situation. The matter had previously been reported to Bangladesh Bank's Financial Intelligence Unit (BFIU) by the Directorate of Cooperatives.

Earlier, on May 27, 2015, based on a decision made during a coordination meeting of Bangladesh Bank, action was supposed to be taken against cooperative societies that were misleading customers by incorporating the term 'bank' in their name, in accordance with the Prevention of Money Laundering Act.

As per the Act, no Primary Cooperative Society, Central Cooperative Society, or National Cooperative Society, except for the Cooperative Land Development Bank, Central Cooperative Land Development Bank, and Bangladesh Cooperative Bank, is allowed to include the term 'bank' in their name. Violation of this provision is subject to punishment, including imprisonment for up to seven years, a fine of Tk 10 lakh, or both. Clause 19 of the law explicitly states that no cooperative society, except Bangladesh Co-operative Bank, can accept deposits or provide loans to individuals or institutions other than their members.

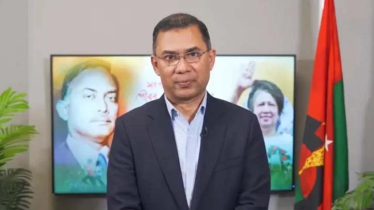

In this context, Mezbaul Haque, Executive Director and Spokesperson of Bangladesh Bank, said that some cooperative societies had deceived customers by using the term 'bank' in their names, thereby violating the law. As a result, Bangladesh Bank issued strict instructions to prevent any cooperative society from including the term 'bank' in their name.

Dr. Salehuddin Ahmed, the former governor of Bangladesh Bank, told the Daily Messenger, “Several institutions were accused of engaging in illegal banking and micro-credit activities within the framework of cooperative society registrations. This occurred mainly due to the negligence of both the central bank and the Directorate of Cooperatives, allowing these fraudulent institutions to swindle funds from the public through fraudulent means.”

He further noted that, following the revelation of these issues, many of these institutions were shut down externally, and Bangladesh Bank adopted a stringent stance, taking legal action against some of them. Nevertheless, there are reports that certain institutions are still secretly engaging in banking activities without using the term 'bank,' occasionally surfacing in the media. He emphasised the need for the central bank to remain vigilant in addressing this issue.

Messenger/Disha