In the event of failing to pay two consecutive installments of the restructured loan, the institution's loan is supposed to be defaulted, as per the rules of the Bangladesh Bank (BB). First Security Islami Bank (FSIBL), an Islamic bank in the private sector, is turning default loans into regular ones in defiance of this rule. Not a single penny has been recovered from the 758 crore taka owed by five institutions of the bank's customer, Sikdar Group. Despite this, these institutions are being kept on the regular list.

In response, BB has asked FSIBL to provide a reason within a week, but the bank has not provided any information. Therefore, the central bank has written to add these companies to the list of loan defaulters. BB has also asked FSIBL to report after putting the concerned companies in the list of loan defaulters within seven working days of receiving the letter.

According to central bank sources, BB issued a policy in January 2015 to facilitate the large debt restructuring of major debtors due to various reasons, including the 2014 election-centered political unrest. Under that facility, about Tk 15 thousand crores of loans for 11 major industrial groups of the country were restructured. Even with the facility of loan restructuring, it has not been possible to recover any amount of defaulted loans from these groups. On the contrary, some groups took on new and larger loans.

While it is impossible to collect the money from the defaulters, the banks are facilitating the customers. The banks are not declaring default loans even in the case of defaultable loans.

According to the BB policy, the restructured loan cannot be rescheduled. If a beneficiary institution fails to pay installments on time, all benefits will be canceled. Failure to pay two consecutive installments will be considered as default loans. Besides, if two consecutive installments are defaulted, the concerned bank can file a case under bankruptcy law to recover the entire amount of the concerned institution. However, although many of the benefited institutions defaulted long ago, there was no news of filing a case under the bankruptcy law.

According to the information received from BB, those five institutions are not paying the loan installments of FSIBL despite taking special benefits. The bank is allowing these institutions to show their loans as regular and facilitating in various ways without receiving payment from them, which is a direct violation of the rules of the Bangladesh Bank.

According to the letter sent by BB, FSIBL restructured the loans of the five institutions of the Sikdar Group. At present, the outstanding balance of the company's loans stands at Tk 758.45 crore. FSIBL could not collect any amount against customer loans in September, December last year, and the March quarter of this year. Even after the bank was unable to collect any amount for three consecutive installments, the bank continues to regularise the loans of these companies without putting them in the list of defaulters. This directly violates Circular No. 4 (g) issued by the Banking Regulation and Policy Department (BRPD) of BB in the year 2015. Besides, in another notification of BRPD, the loan account was supposed to be defaulted even if it failed to pay at least 60 and 50 percent against the installments. But in defiance of that directive, FSIBL regularised the loans of these companies.

The letter also states that the amount of defaulted loans of the bank was understated because the loan accounts were not properly classified. Therefore, the central bank instructed the bank to show these institutions’ loan default within seven working days.

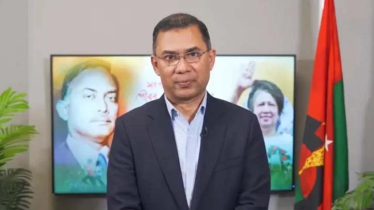

Efforts were made to contact the Managing Director and Chief Executive Officer of FSIBL, Md. Wasek Ali. However, he did not answer repeated calls, and queries sent to his WhatsApp number went unanswered.

While speaking to the public relations officer of the bank, Shahzada Basunia, he said, “We are all busy in a meeting.” After saying, “Write whatever you want,” he hung up the phone.

In this regard, the spokesperson and executive director of Bangladesh Bank, Md. Mezbaul Haque, told The Daily Messenger, “Explanations are sought from banks that violate the rules of the Bangladesh Bank. This is also the case in this regard. If the bank does not provide an explanation on time, they may request additional time. It is not possible to say at this moment whether they asked for time or not. But I can say that every bank is operating within a rule.”

Earlier, FSIBL illegally waived interest of more than Tk 1600 crore of Sikdar Group. The bank also came under fire from BB.

The financial situation of the bank is also worsening. According to a special source of the bank, the bank's current account with the central bank has become empty. Bank operations are being run on loans. According to the latest data, at the end of September this year, the loan amount of the bank stood at Tk 55218 crores. Out of which, Tk 1344.31 crore has been defaulted.

A related top official of BB told The Daily Messenger on condition of anonymity, "The bank (FSIBL) is regularly engaging in un-Islamic practices in the name of Islam. The financial base of the bank has also weakened. However, the Bangladesh Bank is providing regular liquidity facilities to the bank. There is doubt about how long the bank will survive like this.”