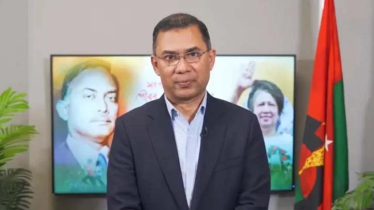

Photo: Collected

Masud Biswas, the former head of the Bangladesh Financial Intelligence Unit (BFIU), has been arrested by the Anti-Corruption Commission (ACC).

The arrest was made during an operation today (18 January) with the assistance of the Detective Branch (DB) of Dhaka Metropolitan Police (DMP). Masud has been taken into custody, said ACC Deputy Director Md Akhtarul Islam.

He mentioned that Masud would be taken to the ACC for questioning around noon. On 2 January, the ACC filed a case against Masud, accusing him of acquiring assets beyond his known income sources.

According to the case statement, he allegedly amassed Tk1.87 crore in illegal wealth and retained it under his control.

The ACC has also issued a separate notice under Section 26(1) of the ACC Act, seeking a wealth statement from Masud's wife, Kamrun Nahar, after identifying Tk72.56 lakh in unexplained assets in her name.

The ACC said the couple owns properties, including land and flats in Dhaka, which are being scrutinised during the investigation.

On 25 September 2024, the watchdog initiated a probe into Masud after the agency's intelligence unit uncovered substantial corruption evidence.

Allegations against Masud include involvement in suspicious aircraft purchases for Sky Capital Airlines Limited, where he reportedly accepted bribes to suppress issues instead of reporting them to law enforcement.

He is also accused of mishandling a money laundering case involving Tamal Parvez, chairman of NRB Commercial Bank, where he submitted a report as a general observation instead of under the Money Laundering Prevention Rules, 2019.

Masud allegedly intervened in transactions involving Himadri Limited by lifting a suspension in exchange for financial gain. Despite evidence of money laundering and fraud involving Tanaka Group, SA Group, and Anwar Group, he failed to report these cases to law enforcement, benefiting personally.

Additionally, Masud is accused of collaborating with Saiful Alam, chairman of S Alam Group, to siphon money abroad through fraudulent loans from Islami Bank. He is further implicated in accepting unethical benefits from Abdul Kadir Mollah's Thermax Group and laundering money overseas.

Masud is also accused of covering up money laundering cases involving Zeenat Enterprises in exchange for bribes, leading to the accumulation of significant assets.

A four-member investigation committee, led by ACC Deputy Director Gulshan Anowar Pradhan, has been formed to probe the allegations.

Messenger/JRTarek