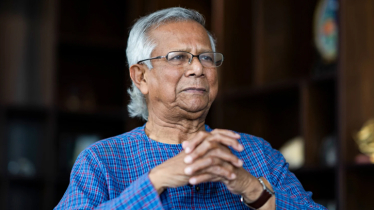

Photo: Collected

It is unnerving indeed that millions of takas are being siphoned off by the highly corrupt elements lurking in the business and banking sectors. They mostly operate in cahoots with powerful people in the corridors of power. When this continues to happen with uncanny regularity, the newcomers in business get demoralized. The freshers enter the business sector with dreams of contributing to the growth of the economy. But if they keep hearing of the opportunities of laundering money in such an easy manner and becoming billionaires overnight, many of them might get allured to join the bandwagon.

It is usually known that money is laundered through under-invoicing and over-invoicing, and also through hundi. And this almost has become a norm in this country to over invoice or under invoice when opening Letter of Credits. Because of a weak monitoring system, in the past years, billions have been laundered out of the country.

Economist and researcher of international repute Rehman Sobhan, said recently, money laundering in the country is connected with default loans. This he said at a discussion on the theme "Bangladesh Banking Sector Crisis: Problems and Solutions," which was organised by the Social Research Centre. He also explained the relationship between money laundering and default loans. While elaborating his contention, the economist said, "Many people take a loan of Tk50 crore and import equipment worth Tk40 crore. The remaining Tk10 crore is laundered. If the loan money is smuggled out of the country this way, the ability of the borrower to repay the loan also decreases."

We tend to believe other economists when they commented that writing-off loans is like sweeping dirt under the carpet and that the actual amount of defaulted loans would be much higher than what has been reported so far. It is believed that many bank directors have taken huge loans from their banks and have not paid back the entire amount. Many believe that corrupt political influence has become quite rampant in the banking sector, which makes some defaulters bold and careless.

No doubt, the defaulters are setting very bad examples before the new generation businessmen. But this cannot be allowed to happen any further.

Messenger/Disha