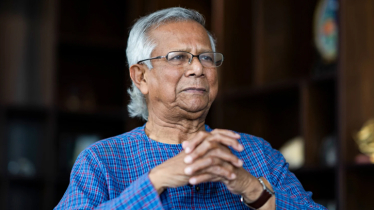

Photo : Collected

It is very important to restore order in the country's banking sector. There is extreme chaos in all public and private sector banks. If there is any impact on the banking sector due to irregularities or lack of good governance, it leads to risk and uncertainty for the overall economy of the country.

Immediately after August 5, agitations started for several demands including change of ownership in some banks. To protect the country's financial sector from this situation, Bangladesh Bank has to play an important role as soon as possible.

At present, the banking sector of Bangladesh is going through a delicate situation, which requires a unified effort of all to overcome it. Banking policy needs to be formulated in such a way that it can be useful for the development of the country.

Bangladesh Bank has not seen any significant effective steps to strengthen the banking sector in the past few years. Even the autonomy and independence of Bangladesh Bank has been undermined due to political interference in various areas. Good governance can be ensured by allowing the central bank of the country to function independently.

Chaos, irregularities and corruption are not new in the banking sector. The crisis has intensified especially since the establishment of the new bank due to political considerations. The situation is such that the owners of the private sector banks bypass the central bank and run the entire financial sector. Arbitrariness of the board of directors of the private banks and administrative and political interference in the government banks are the biggest reasons for the failure of the banking sector. The country's banking sector is in a very fragile state. The Central Bank should be allowed to exercise the powers conferred upon it by law rather than allowing inefficiency, mismanagement and corruption to fester.

We expect that the interim government will take all measures to restore good governance in the banking sector. During the tenure of the previous government, giving one after the other benefits to the defaulters, the family control of the owners for a long time, all the arrangements have made the banking system of Bangladesh individual and group. We believe that saving the banking sector from such a situation will be considered as a priority.

Messenger/Fameema