Photo : Messenger

This article explores the growing connection between Islamic banking and green finance, sustainability, ESG, and CSR in key Islamic finance markets. While more developed OIC nations prioritize ethical financial practices, a contrasting scenario is observed in less developed regions where Islamic banking is significant. The aim is to uncover correlations between Islamic banking and socially responsible initiatives, envisioning a unified and sustainable future in the diverse landscape of Islamic finance.

In recent years, the landscape of Islamic banking and finance has witnessed a transformative shift towards embracing green finance, sustainability, ESG (Environmental, Social, Governance), and corporate social responsibility (CSR). This paradigm shift is particularly conspicuous in well-established Islamic finance markets, where financial institutions are increasingly aligning themselves with ethical and sustainable practices.

However, a notable dichotomy emerges when considering the less developed markets where Islamic banking and finance play a significant role. In these regions, the sensitivity to green finance, sustainability, and ESG factors appears to be considerably lower. This raises intriguing questions about the relationship between Islamic banking and finance and socially responsible practices in diverse Islamic finance landscapes.

Anecdotal evidence suggests a positive correlation between the incidence of Islamic banking and finance and the adoption of green finance, sustainability, ESG principles, and corporate social responsibility, especially in more developed countries. The rationale behind this correlation may stem from a greater awareness and emphasis on ethical and sustainable financial practices in these economically advanced Islamic finance markets.

Moreover, another compelling correlation surfaces when examining the economic development within the Organization of Islamic Cooperation (OIC) block. There is anecdotal evidence indicating that Islamic banking and finance thrive more prominently in tandem with higher levels of economic development within the OIC member countries. This correlation hints at a potentially brighter future for Islamic banking and finance in the more economically developed Muslim-majority nations.

Conversely, in less developed Muslim-majority countries within the OIC block, Islamic banking and finance are yet to assume significant importance. The reasons for this disparity may be multifaceted, including lower awareness, regulatory challenges, and a prioritization of more immediate economic concerns over sustainable financial practices.

The implications of these observations are noteworthy. For Islamic banking and finance to become a driving force for sustainable development across the entire spectrum of OIC member countries, concerted efforts are required to bridge the gap in awareness and implementation. This involves not only promoting the principles of green finance, sustainability, and ESG within Islamic finance institutions but also fostering an environment that encourages their adoption in less developed markets.

Governments, regulatory bodies, and financial institutions in less developed Muslim-majority countries can play a pivotal role in advancing these principles. This might involve creating incentives, developing supportive regulatory frameworks, and promoting educational initiatives to enhance awareness and understanding of the benefits associated with integrating green finance and sustainable practices within the Islamic banking and finance sector.

In conclusion, the positive correlations observed between Islamic banking and finance, green finance, sustainability, ESG, and corporate social responsibility in developed countries and economically advanced OIC member nations underscore the potential for Islamic finance to become a catalyst for positive change. To ensure a more inclusive and impactful future for Islamic banking and finance, efforts must be directed toward extending these positive correlations to less developed markets, thus creating a more unified and sustainable Islamic finance landscape across the OIC block.

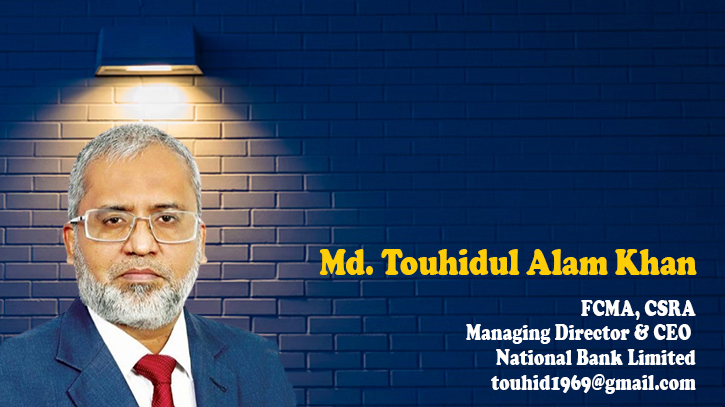

The author is the Managing Director & CEO of National Bank Limited. He is a fellow member of the Institute of Cost & Management Accountants of Bangladesh (ICMAB) and the first Certified Sustainability Reporting Assurer (CSRA) in Bangladesh. He is also a post-graduate diploma from the Institute of Islamic Banking & Insurance (IIBI), United Kingdom.

Messenger/Fameema