Photo: Messenger

Islam's economic history examines the evolution of Muslim societies through the lens of Islamic economic norms. This field extracts relevant information from broader historical contexts to systematically present and evaluate the adherence to Islamic principles in economic activities. By assessing conformity to and deviations from these norms, the field seeks to understand their impact on human well-being. Success in embodying Islamic values such as freedom, justice, cooperation, and economic prosperity is attributed to individual behavior, state policies, and collective actions. In contrast, failure is often linked to misdirected policies, faulty behavior, and ineffective actions. The underlying factors include the state of knowledge, the will to do good, and the ingenuity of individuals, along with external influences. The role of an economic historian of Islam is to contextualize these factors within the broader historical narrative.

The initial twenty-three years of Islamic history are unique due to the intertwining of the Prophet Muhammad's (pbuh) Sunnah with the transformation of society from pre-Islamic to Islamic ways of living. This period involves studying how Islamic values were received, interpreted, and practiced, focusing on human liberation, freedom in submission to God's will, social justice, human dignity, and universal brotherhood. Key aspects include the establishment of legal equality, cooperative living, social security, public property, and inheritance laws.

The development during the thirty years following the Prophet’s (pbuh) era is evaluated against this backdrop. The economic policies of the Four Pious Caliphs are scrutinized to identify elements of progress and setbacks. This period also involves analyzing the economic behavior of the common people, the role of inherited institutions, and the emergence of new ones in an expanding economy.

It is widely accepted that the adherence to Islamic norms in Muslim society varied significantly in the centuries following 40 A.H. A thorough re-examination of original historical materials is necessary to set the records straight. The fluctuating adherence to Islamic values during these ages needs to be studied to uncover the causes of failures and the circumstances that allowed progress in certain aspects.

As the Islamic world expanded, it encompassed regions with diverse economic conditions and cultural heritages. The Islamic norms encountered entirely new situations, and the resultant economic patterns were influenced by both pre-Islamic conditions and the new Islamic ethos. Determining the relative strength of these influences is crucial.

The expansion of the Islamic world and the diversification of its economy led to the development of new institutions and practices. There was significant growth in internal and international trade, the emergence of new handicrafts, and changes in land tenure systems. Concurrently, juridical literature emerged, evaluating and analyzing these new practices and institutions in the context of Shari’ah. Exegetical and philosophical literature, as well as treatises on political philosophy and the art of governance, also addressed these issues. Topics such as taxation, public expenditure, borrowing by the ruler, price control, trade regulation, labor relations, wages, and land tenure and irrigation received attention from jurists and scholars.

A detailed examination of this extensive material reveals how Muslim thinkers responded to changing circumstances while striving for conformity with Islamic norms. It also sheds light on their understanding of economic systems, enriching the histories of both Islamic thought and economic thought.

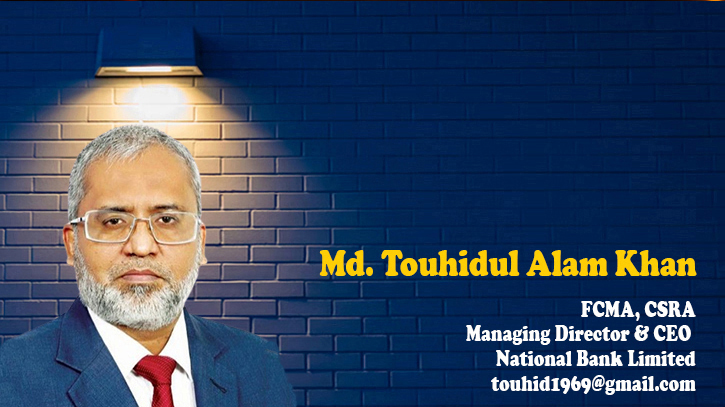

The author is the Managing Director & CEO of National Bank Limited. He is a fellow member of the Institute of Cost & Management Accountants of Bangladesh (ICMAB) and the first Certified Sustainability Reporting Assurer (CSRA) in Bangladesh. He is also a post-graduate diploma from the Institute of Islamic Banking & Insurance (IIBI), United Kingdom.

Messenger/Fameema