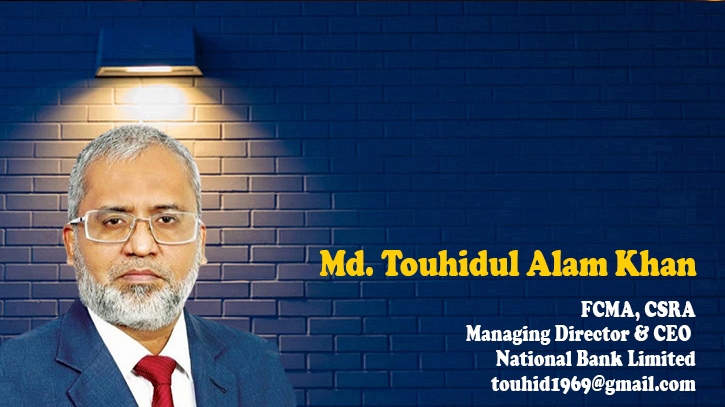

Photo : Messenger

At the crux of an Islamic financial lifestyle lies a fundamental ethos of simplicity, as opposed to the culture of consumerism and materialism prevalent in today's world. This emphasis on modesty and contentment resonates deeply with the Quran's teachings and the Prophet Muhammad's exemplary behavior (PBUH), highlighting the intrinsic value of philanthropy and selflessness in financial matters.

A pivotal component of this lifestyle is the dual emphasis on income sustenance and wealth management. By upholding these principles, individuals and communities can fortify themselves against economic turmoil, fostering a sense of solidarity and cooperation in facing financial challenges.

Fusing philanthropy with prudent financial practices forms the bedrock of a financial ecosystem grounded in sustainability and fairness. Islamic finance o ers a fertile ground for innovation, with the potential to develop instruments and mechanisms that promote collaboration, support, and resilience in the face of adversity. Through the cultivation of cooperative financial models, communities can forge bonds of mutual assistance, transcending barriers of social and economic inequality to cultivate a culture of inclusivity and collective prosperity.

Islamic financial institutions play a pivotal role in championing these values, not only by fostering financial access and equity but also by enhancing their own resilience through the implementation of robust compensation frameworks. By aligning their operations with principles of ethical finance and equitable wealth distribution, these institutions can become flagbearers of financial empowerment, nurturing a climate of shared prosperity and social cohesion within society.

By adopting an Islamic financial lifestyle, individuals and societies stand to gain a plethora of benefits, ranging from financial stability and inclusivity to ethical wealth management and community resilience.

This transformative shift towards a holistic Islamic financial paradigm not only underscores the timeless wisdom of Islamic teachings but also lays the groundwork for a more just, compassionate, and sustainable socio-economic order, wherein financial practices are imbued with the values of equity, compassion, and social responsibility. In conclusion, embracing an Islamic financial lifestyle emerges as a profound testament to the enduring relevance of Islamic principles in the modern era.

By intertwining simplicity, philanthropy, and prudent financial management, individuals and communities can chart a path towards financial stability, inclusivity, and resil-ience. This paradigm shift not only highlights the timelessness of Islamic teachings but also paves the way for a more equitable, compassionate, and sustainable socio-economic order.

Messenger/Fameema