Photo : Messenger

Islamic economics, with its distinctive identity dimension, stands alongside capitalism and socialism as a system that recognizes individual and social identity as fundamental rights.

The crux of this economic philosophy aligns with capitalism, primarily through the acknowledgment of the individual's right to property ownership. However, the nuanced distinction lies in the approach to regulations, with Islam introducing restrictions grounded in a moral code.

In the realm of Islamic economics, a unique framework emerges, shaped by a set of do’s (Halal) and don’ts (Haram). Early Islamic economists have extensively explored the feasibility of constructing an economic system around this moral code. Their endeavors were not merely theoretical; they sought to identify synergies between Islamic economic principles and the tenets of capitalism. To fully appreciate the discipline of Islamic economics, one must understand it as a pursuit toward establishing a distinctive Islamic economic identity.

One key aspect of Islamic economics is the recognition of individual and social identities as basic rights. This acknowledgment resonates with broader societal values, providing a framework that emphasizes economic transactions and ethical considerations. Unlike capitalism, where regulations often serve as the sole safeguard of property rights, Islamic economics integrates a moral compass into the fabric of economic activities.

The core principles of Islamic economics extend beyond profit and loss; they encompass ethical conduct, social justice, and the welfare of the community. The moral code embedded in this economic system ensures that wealth accumulation aligns with principles of fairness and equity.

While capitalism and socialism primarily focus on economic outcomes, Islamic economics places equal importance on how wealth is acquired and distributed. In understanding the professional value addition of Islamic economics, it is important to recognize its potential impact on societal attitudes. Those who hold antagonistic views towards Islamic economics, particularly its extension into banking and finance, may find that their sentiments warrant a closer examination. The lens of Islamophobia might be inadvertently shaping their perspective, hindering a nuanced understanding of the economic system grounded in Islamic principles.

Islamic banking and finance, as an extension of Islamic economics, often face skepticism in the broader financial landscape. However, professionals in the field assert that these systems not only adhere to religious principles but also bring unique advantages. Sharia-compliant financial instruments prioritize ethical investments, risk-sharing, and avoiding exploitative practices.

Embracing these principles can be seen as a strategic move toward sustainable and responsible financial practices, providing a professional value addition that transcends mere economic considerations.

In conclusion, the exploration of Islamic economics goes beyond theoretical frameworks. It delves into the practicalities of constructing an economic system that harmonizes individual rights with a moral code. The professional value addition lies not only in economic outcomes but also in fostering a system where ethical considerations are integral to financial practices.

Those skeptical of Islamic economics may find that their attitudes are colored by preconceived notions, urging a reconsideration that goes beyond economic dogmas. Embracing the distinctive identity of Islamic economics could pave the way for a more inclusive and ethically grounded

economic landscape.

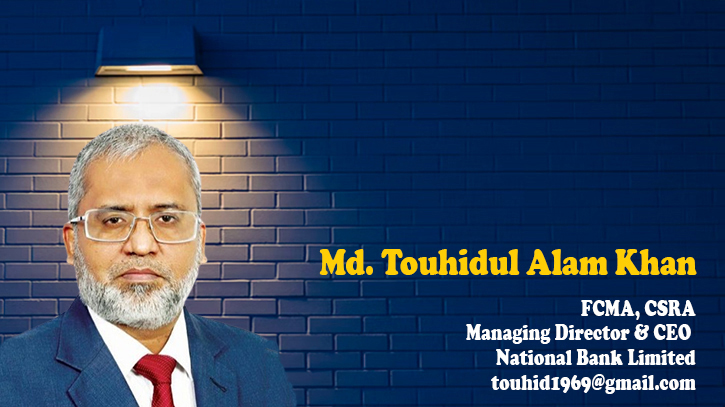

The author is the Managing Director & CEO of National Bank Limited. He is a fellow member of the Institute of Cost & Management Accountants of Bangladesh (ICMAB) and the first Certified Sustainability Reporting Assurer (CSRA) in Bangladesh. He is also a post-graduate diploma from the Institute of Islamic Banking & Insurance (IIBI), United Kingdom.

Messenger/Fameema