Photo : Messenger

Ijarah financing, a prominent method in Islamic banking, enables clients to utilize bank-owned assets or properties in exchange for rent, making it an approved form of financing in Islamic law. This financial tool has gained significant momentum, particularly in the global market, with a remarkable increase from $1.35 trillion in 2021 to $1.53 trillion in 2022, boasting a yearly compound growth rate of 12.9%.

ICD's Dominance in Islamic leasing

The Islamic Corporation for the Development of the Private Sector (ICD), a subsidiary of the Islamic Development Bank, stands out as a major player in the Islamic leasing industry. Holding a substantial stake in 13 leasing companies across multiple countries, ICD has made strategic moves to expand its Ijarah financing products, forming partnerships with entities like Uzbek Leasing International in 2022 to attract a broader clientele.

Sukuk Ijarah: Expanding horizons

Several countries, including Brunei, Bahrain, Turkey, and Indonesia, have become frequent issuers of Sukuk Ijarah. Sukuk, resembling a lease agreement, allows assets financed through Ijarah to serve various purposes, such as vehicles, homes, buildings, industrial facilities, or equipment. Notably, corporate organizations have increasingly turned to Sukuk Ijarah for financing over the past year.

Etihad's sustainable Ijarah financing

Etihad Airways raised $1.2 billion through the first sustainability-linked loan in the aviation sector, aligning with its environmental, social, and governance (ESG) initiatives. This innovative approach is beginning to influence operating leases, including Ijarah arrangements.

A new era for Ijarah contracts

An aircraft lessor introduced a sustainability-linked operating lease, tied to the lessee's ESG rating. This model encourages improved ESG performance and commitment to sustainability through a two-way step-up and step-down rent mechanism, signifying a crucial development in the leasing sector. The adoption of similar practices in Ijarah contracts can further encourage environmental stewardship.

Challenges and opportunities

The introduction of sustainability-linked Ijarah agreements holds great potential but requires awareness and understanding within the wider Islamic finance community. Addressing concerns related to 'floating' rent, which some scholars view as potentially void due to uncertainty, and finding mutually agreed-upon benchmarks are vital steps in this direction.

Diverse perspectives on Ijarah

Shariah boards in different countries hold varied views on Ijarah structures. Greater alignment and adoption of innovative financing techniques can expedite the realization of goals in leading Islamic finance centers, such as the Qatar Financial Centre's aspiration to become a regional hub for aircraft leasing and ESG investments.

The role of Islamic finance in aviation

The global aviation sector has the potential to contribute significantly to the United Nations' Sustainable Development Goals. Islamic finance, through innovations in Ijarah contracts, can facilitate the growth of Shariah-compliant aircraft leasing.

A bright future for Ijarah financing

The global finance lease market is on an upward trajectory, driven by increasing demand in sectors like healthcare, construction, and telecommunications. While challenges such as fluctuating interest rates and inflation persist, Ijarah financing continues to offer consumers benefits like low monthly payments, long-term flexibility, optimal tax advantages, and hassle-free lease maintenance, ensuring a positive outlook for the industry's future.

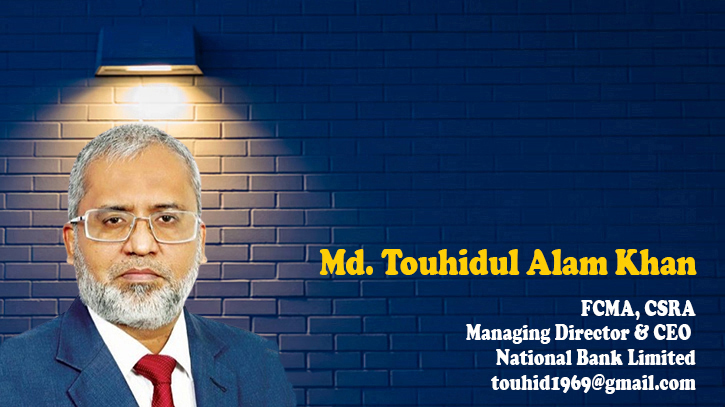

The author is the Managing Director & CEO of National Bank Limited. He is a fellow member of the Institute of Cost & Management Accountants of Bangladesh (ICMAB) and the first Certified Sustainability Reporting Assurer (CSRA) in Bangladesh. He is also a post-graduate diploma from the Institute of Islamic Banking & Insurance (IIBI), United Kingdom.

Messenger/Fameema