Photo : Collected

Islamic banking, rooted in the principles of Sharia law, has gained considerable traction worldwide as an ethical alternative to conventional banking. Unlike traditional banks that generate profits primarily through interest (riba), Islamic banks operate on principles that emphasize fairness, risk-sharing, and the avoidance of exploitative practices. This article will explore various Islamic banking products, the fundamental processes involved in Islamic financing, and the key differences between profit-and-loss sharing and interest.

Islamic deposit products

Islamic banks offer several types of deposit products that adhere to Sharia principles. The most common products include:

Mudarabah (Profit-sharing deposits): This is a partnership where the customer (rab al-mal) provides capital, and the bank (mudarib) manages the investment. Profits generated from the investment are shared based on a pre-agreed ratio, while losses are borne by the capital provider unless due to negligence by the bank.

Musharakah (Joint venture deposits): In this structure, both the bank and the depositor contribute capital and share profits and losses based on their respective contributions. This model fosters collaboration and shared responsibility, aligning with Islamic values.

Wadiah (Safe custody): Under wadiah, depositors place funds in the bank for safekeeping. The bank may use these funds for investment but is obligated to return the full amount on demand. The bank may offer a reward or incentive for handling the deposits, although it is not an obligatory return.

Islamic lending procedures

Islamic banks offer various financing options that are compliant with Sharia law and avoid interest-based lending. Key financing products include:

Murabaha (Cost-Plus Financing): This is a sales contract where the bank purchases an asset and sells it to the customer at a markup. The customer pays the bank in installments, and the markup constitutes the bank's profit, making it compliant with Sharia.

Ijarah (Leasing): In this model, the bank buys an asset and leases it to the customer for a specified period. The customer pays rent, and at the end of the lease term, they often have the option to purchase the asset at an agreed-upon price.

Istisna (Manufacturing Contract): This contract is used for financing the construction of projects or manufacturing goods that are not yet available. The bank finances the project and receives payment over time upon completion, ensuring mutual benefit and risk-sharing.

Bai' Salam (Forward Sale): This is a contract where the buyer pays in advance for goods to be delivered later, typically used for agricultural products. This creates cash flow for the producer while ensuring the buyer receives the goods as per the agreement.

Profit and loss sharing vs. interest

One of the fundamental distinctions between Islamic finance and conventional banking is the concept of profit-and-loss sharing as opposed to interest-bearing loans.

In conventional banking, interest represents a cost of borrowing, where the financial institution earns profits solely through the accrued interest regardless of the borrower's success or failure. This system can lead to financial inequalities, as customers may end up overburdened by debt, especially during economic downturns.

Conversely, Islamic banking promotes risk-sharing, whereby profits and losses are shared among parties. This means that if a business venture is successful, both the borrower and the bank benefit from the profits. However, if there are losses, they are also shared, which encourages responsible lending and ethical business practices. The relationship is collaborative rather than transactional, fostering a sense of community and mutual benefit.

Conclusion

Islamic banking offers a diverse range of financial products designed to comply with Sharia law while promoting ethical standards and social justice. Islamic deposit products, such as Mudarabah and Musharakah, allow depositors to engage in profit-sharing, while financing options like Murabaha and Ijarah emphasize risk-sharing and ethical transactions. The fundamental principle of avoiding riba highlights the commitment of Islamic banks to foster a financial ecosystem that benefits all stakeholders.

As Islamic banking continues to expand globally, its principles of equity, justice, and community-oriented financial practices can provide valuable alternatives to conventional financial systems, addressing modern economic challenges in a manner consistent with Islamic beliefs. With an increasing number of individuals and businesses seeking ethical financial solutions, the significance of Islamic banking products and systems is more relevant than ever.

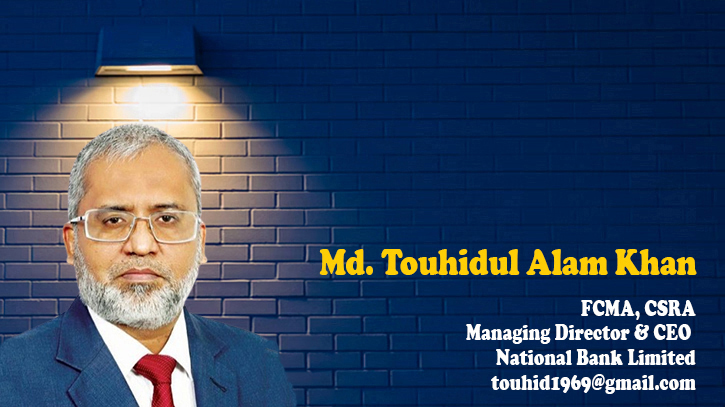

The author is the Managing Director & CEO of National Bank Limited. He is a fellow member of the Institute of Cost & Management Accountants of Bangladesh (ICMAB) and the first Certified Sustainability Reporting Assurer (CSRA) in Bangladesh. He is also a post-graduate diploma from the Institute of Islamic Banking & Insurance (IIBI), United Kingdom.